Results December 2020

MAPFRE’s consolidated revenue in 2020 amounted to 25.4 billion euros, equivalent to a 10.7 percent decrease, and the attributable result stood at 527 million euros, which represents a 13.6 percent fall with respect to the previous year. Excluding write-offs of goodwill and portfolio acquisition expenses in 2019 and 2020, the attributable result would stand at 658 million euros, representing a fall of only 2.5 percent.

Revenue December 2020

The Group’s consolidated revenue in 2020 reached 25.4 billion euros, with a decrease of 10.7 percent, mainly due to the fall in written premiums and lower financial income. The depreciation of the main currencies on our business has also played an important role in the decline, as at constant exchange rates revenue would have only fallen 4.6 percent.

Premiums December 2020

Premiums from direct insurance and accepted reinsurance reached 20.5 billion euros, with a decrease of 11.1 percent, due in part to the effects on new business of the confinement of the population from COVID-19, the strong depreciation of the main currencies, as well as the challenging context for the sale of Life-Savings products. At constant exchange rates, premiums would have only fallen 4.1 percent.

Non-Life premiums went down 8.3 percent, marked primarily by lower issuing in the Auto and General P&C lines, from the effect in the latter segment of the PEMEX policy that was underwritten in 2019. Written Auto premiums fell 15.6 percent, primarily as a result of lower issuing in Brazil, the United States, Italy, Spain and Turkey.

By Non-Life business type, Auto is the most important line, with over 5.6 billion euros in premiums. General P&C holds second place, with almost 5.6 billion euros, and Health and Accident is in third place with 1.5 billion euros in premiums.

Life premiums fell 20.3 percent. Of these, Life-Protection fell 12.5 percent, primarily from the currency effect in Brazil. Life-Savings premiums fell 30.5 percent, primarily from the fall in issuing in Spain in a complicated economic environment for the sale of these products.

Combined ratio December 2020

The Group’s combined ratio stood at 94.8 percent at the close of December, improving 2.9 percentage points and affected by the direct impacts from COVID-19, NatCat events and large man-made losses, which have been partially offset by a strong fall in frequency, especially in Auto and Health lines, as well as by the profitability measures implemented across main markets. The combined ratio of the insurance units stood at 92.9 percent, improving 3.6 percentage points

Net result December 2020

The accumulated attributable result to December 2020 reached 527 million euros, falling 13.6 percent, affected by the earthquakes in Puerto Rico, write-offs of goodwill and portfolio acquisition expenses, as well as by the impact of COVID-19 related claims. Lower frequency in Non-Life lines, especially Auto and Health, has offset COVID-19 related claims and the fall in the financial result. The attributable result of insurance entities amounted to 791 million euros, which represents a 2 percent decrease compared to the previous year.

Balance sheet

Balance sheet to December 2020

Total assets reached 69.2 billion euros at December 31, 2020 and fell 4.6 percent compared to the close of the previous year. These changes include the relevant depreciation of the main currencies in Latin America, the US dollar and the Turkish lira, as well as goodwill write-offs.

The Group’s shareholders’ equity has been primarily impacted by the aforementioned strong currency depreciation, as well as by the effects of the COVID-19 crisis.

Assets Under Management

Solvency II

The Solvency II ratio for MAPFRE Group stood at 180.2 percent at September 2020, which is a three percentage point improvement compared to March, when the markets were hardest hit by COVID-19, and a three point reduction compared to June, primarily as a result of the interim dividend against 2020 results, paid on December 22, for the amount of 154 million euros.

The ratio maintained great solidity and stability, backed by high levels of diversification and strict investment and ALM policies.

- High quality capital base: 86% of eligible own funds are Tier 1.

- “Fully loaded” Solvency II ratio: 167.2% (excluding impact of transitional measures on technical provisions and equity).

Billion euros

Strategic Plan 2019-2021

Based on the transformation we need as a company, we are articulating our strategy around three pillars: client orientation, excellence in technical and operational management and culture and talent. The transformation will be present in everything that we do, it will be transversal and it will act as an authentic accelerator across the entire organization.

Client orientation

We are 100-percent client-oriented, and place the client at the center of everything we do so that we can continue to be your trusted insurance company. With the client orientation pillar, we are working to understand your needs and offer you value propositions that are innovative and tailored to each client profile.

Excellence in technical and operational management

We consider excellence in technical and operational management to be a fundamental goal, and key to achieving adequate profitability in the market.

Culture and talent

We believe that it is essential to be able to count on the people and culture of MAPFRE as the bedrock of our whole business. Our people’s effort and commitment drives transformation and helps us to anticipate change by leveraging progress in the digital age. Equal opportunities, diversity and labor inclusion are the transversal principles at the center of our strategy.

Relevant events

S&P recognizes MAPFRE as a leader in sustainability

February 2021

MAPFRE has once again been named one of the world’s leading companies in the area of sustainability by being included, for the second year running, in the Sustainability Yearbook 2021 — a prestigious annual publication by S&P Global that ranks the most socially responsible companies.

MAPFRE included in 2021 Bloomberg Gender-Equality Index

January 2021

The 2021 Bloomberg Gender-Equality Index brings transparency to gender-related practices and policies at publicly listed companies increasing the disclosure of environmental, social and governance (ESG) data available to investors.

MAPFRE raises its stake in Abante to 20 percent

January 2021

Abante and MAPFRE strengthened their strategic alliance to further advance the creation of the most competitive independent platform for financial advice and product distribution in the Spanish market.

MAPFRE and Abante raise 300 million for its infrastructure fund on the back of strong investor interest

January 2021

MAPFRE and Abante have closed its first vehicle to invest in infrastructure with 300 million euros just three months after the fundraising began, 50 percent more than the 200 million initially envisaged.

MAPFRE launches Programa Horizonte Inversión, an actively managed Unit Linked savings insurance product

January 2021

MAPFRE has developed Programa Horizonte Inversión, a product composed of various fund portfolios, which adapts to the risk profile of each client, as well as the time horizon for which they are planning and maintaining their savings.

MAPFRE, number seven in the ranking of most responsible companies and best corporate governance in Spain

January 2021

MAPFRE is seventh on the list of most responsible companies and best corporate governance in Spain, according to Merco. Additionally, the company continues to lead the ranking as the most valued insurance company in this study.

MAPFRE Economics expects a 6.1 percent increase in the Spanish GDP in 2021

January 2021

MAPFRE Economics, MAPFRE’s Economic Research area, believes that the global economy will return to normal by the middle of the third quarter of the year and that, overall, what was lost in the crisis will be recovered by mid-2022.

MAPFRE and Iberdrola join forces

January 2021

MAPFRE and Iberdrola have reached an agreement by means of which the insurance company’s sales network in Spain will offer personalized and 100 percent renewable products from the power company. It is the first alliance of its kind in the country between an insurance company and a utilities company.

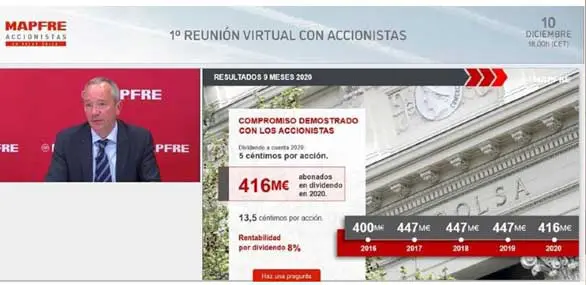

MAPFRE holds its first virtual meeting with more than 200 individual shareholders

December 2020

MAPFRE held its first virtual meeting with non-institutional shareholders to inform them of the latest results for the first nine months of the year, and give them the chance to ask questions about the group’s business.

MAPFRE AM is the first Spanish fund management company to receive the “Label SRI”

December 2020

MAPFRE AM has been granted the “Label ISR“, the most prestigious certification for sustainable investments created and supported by the French Ministry of Finance in recognition of its commitment to Socially Responsible Investment (SRI).

MAPFRE is once again included in the Dow Jones Sustainability World Index

November 2020

MAPFRE has once again been included for the third consecutive year in the Dow Jones Sustainability World Index (DJSI), one of the most significant global barometers for measuring the performance of companies in terms of sustainability and corporate social responsibility.

Standard & Poor’s maintains MAPFRE’s rating with a stable outlook

October 2020

MAPFRE AM Good Governance tops its category

October 2020

MAPFRE launches CUPÓN ACTIVO, a new Unit Linked tied to the Eurostoxx Select Dividend 30 index

October 2020

MAPFRE is strengthening its Life-Savings insurance product range with the launch of CUPÓN ACTIVO, a new single premium Unit Linked with a duration of just under 4 years, tied to the Eurostoxx Select Dividend 30 index and with guarantee at maturity of 90% of the capital.

Dividends and Shareholders

MAPFRE continues creating value for its shareholders

On December 22, the interim dividend for 2020 results of 0.0505 euros gross per share was paid, after having proportionately applied the amount corresponding to treasury stock to the remaining shares.

The dividend to be proposed to the Annual General Meeting as the final dividend for 2020 is 0.075 euros gross per share. As such, the total dividend against 2020 results reaches 0.125 euros gross per share.