Results June 2020

Revenue june 2020

The Group’s consolidated revenue in the second quarter of 2020 reached 13.3 billion euros, with a decrease of 11.8 percent, mainly due to the fall in written premiums and lower financial income. At constant exchange rates, revenue would have only fallen 7.6 percent.

Premiums june 2020

Premiums from direct insurance and accepted reinsurance reached 11.0 billion euros, with a decrease of 12.3 percent, due in part to the effects on new business of the confinement of the population from COVID-19, and to the strong depreciation of the main currencies in LATAM countries and in Turkey. At constant exchange rates, and eliminating the effect of premiums from the PEMEX policy that was underwritten in 2019, premiums would have only fallen 4.3 percent.

Non-Life premiums went down 9.7 percent, marked primarily by lower issuing in the Auto and General P&C lines, from the effect of PEMEX policy. Written Auto premiums fell 18.6 percent, primarily as a result of lower issuing in Brazil, the United States, Italy, Spain and Turkey.

By Non-Life business type, General P&C is the most important line, with 3.1 billion euros in premiums. Auto holds second place, with over 2.8 billion euros, and Health and Accident is in third place with 1.1 billion euros in premiums.

Life premiums fell 21.4 percent. Of these, Life-Protection fell 11.1 percent, primarily from the decline in this business and the currency effect in Brazil in the first half. Life-Savings premiums fell 33.5 percent, primarily from the fall in issuing in Spain and Malta, in a complicated economic environment for the sale of these products.

Combined ratio june 2020

Net result june 2020

Balance sheet

Balance sheet to june 2020

Total assets reached 70.2 billion euros at June 30, 2020 and fell 3.2 percent compared to the close of the previous year. These changes include the decrease in financial investments and in technical provisions, due to the deterioration of the financial markets, as well as the relevant depreciation of the main currencies in LATAM and the Turkish lira in the first half.

The Group’s shareholders’ equity has been primarily impacted by two effects from the COVID-19 crisis. On the one hand, the fall in financial markets, and on the other, the aforementioned strong currency depreciation.

Assets under management

Solvency II

The Solvency II ratio for MAPFRE Group stood at 177 percent at March 2020, compared to 187 percent at the close of December 2019. Despite the sharp fall in stock markets and financial investments, the ratio maintained great solidity and stability, backed by high levels of diversification and strict investment and ALM policies.

High quality capital base: 86% of eligible own funds are Tier 1.

“Fully loaded” Solvency II ratio: 164% (excluding impact of transitional measures on technical provisions and equity).

Strategic Plan 2019-2021

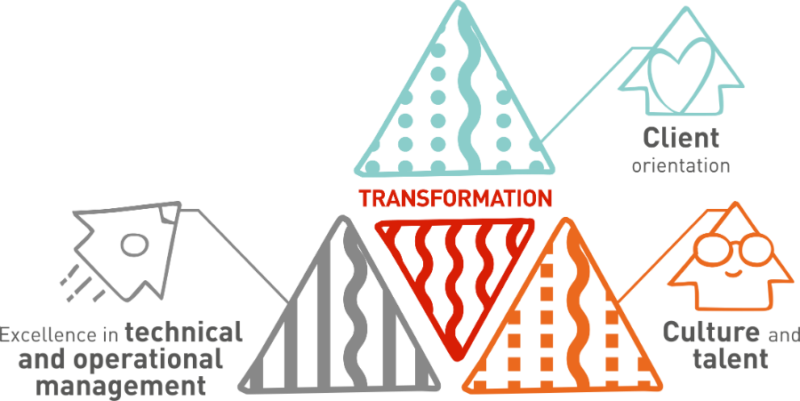

Based on the transformation we need as a company, we are articulating our strategy around three pillars: client orientation, excellence in technical and operational management and culture and talent. The transformation will be present in everything that we do, it will be transversal and it will act as an authentic accelerator across the entire organization.

Client orientation

We are 100-percent client-oriented, and place the client at the center of everything we do so that we can continue to be your trusted insurance company. With the client orientation pillar, we are working to understand your needs and offer you value propositions that are innovative and tailored to each client profile.

Excellence in technical and operational management

We consider excellence in technical and operational management to be a fundamental goal, and key to achieving adequate profitability in the market.

Culture and talent

We believe that it is essential to be able to count on the people and culture of MAPFRE as the bedrock of our whole business. Our people’s effort and commitment drives transformation and helps us to anticipate change by leveraging progress in the digital age. Equal opportunities, diversity and labor inclusion are the transversal principles at the center of our strategy.

Relevant events

MAPFRE launches RENTA DIVIDENDO EUROPA, a new Unit Linked tied to the EuroStoxx 50

July 2020

MAPFRE strengthens its offer of Life Savings insurance products with the launch of RENTA DIVIDENDO EUROPA, a new unit linked tied to the performance of a stock portfolio with high quarterly dividend yield, listed on the European EuroStoxx50 index.

Santander and MAPFRE to jointly distribute Non-Life insurance in Portugal

July 2020

Through the Santander network in Portugal, the bank will be the exclusive distributor of MAPFRE’s automobile, SME multirisk and third-party liability insurance.

MAPFRE AM and GSI launch a social impact fund with a first goal of 50 million to finance companies

July 2020

MAPFRE AM and Global Social Impact Investments SGIIC (GSI) are joining forces to provide financing to companies with high social impact on both frontier and emerging markets.

MAPFRE renews its family insurance FAMILIFE and allows two people to be insured on the same policy

June 2020

MAPFRE launches an improved version of FAMILIFE, its renewable annual individual protection insurance, which provides coverage for both members of the couple on one policy, in addition to also protecting their family, in the case of their children’s death, disability or serious illness.

MAPFRE is included in the « Hyundai Insurance» program

June 2020

MAPFRE has designed specific coverage for Hyundai clients, in order to offer them the insurance product most adapted to their needs. This is an exclusive program full of benefits, which reinforces Hyundai’s commitment to its clients and its value proposal.

MAPFRE commits to private equity with an investment of up to 250 million euros

June 2020

MAPFRE has decided to take an important step in alternative investment, specifically in private equity, and together with Abante and Altamar, it has launched a fund of funds in which the insurance group is committing equity totaling 250 million euros.

Santander MAPFRE Seguros begins operations in Auto with its first product for cars and motorcycles

June 2020

This is the second product for the entity, after the launch of a comprehensive insurance product for shops, entrepreneurs and SMEs this past February, and it is included in Banco Santander’s global product offer for individuals.

MAPFRE includes new services in its insurance product for electric and hybrid cars

June 2020

MAPFRE’s loyalty program, MAPFRE teCuidamos, makes an assessment service available to its clients in order to answer any questions they have about their electric car (current or future). MAPFRE continues to promote sustainable mobility with this.

MAPFRE’s range of sustainable funds attracts more than 60 million euros in spite of market volatility

June 2020

MAPFRE AM has four funds that meet environmental, social and governance criteria, and these products have performed better than benchmark indices during these months of volatility

MAPFRE is one of the most socially committed companies acting against COVID-19

May 2020

MAPFRE is among the 20 companies that are showing the greatest levels of commitment and social responsibility in light of the situation the country is experiencing as a consequence of the pandemic deriving from the coronavirus and leads the insurance sector ranking, according to the extraordinary ranking prepared by Merco.

Fitch maintains MAPFRE’s insurer financial strength rating

April 2020

The Fitch agency has decided to maintain MAPFRE’s financial strength credit rating at A+, with a stable outlook, following its assessment of the potential impact of the coronavirus pandemic on the company

MAPFRE mobilizes over 200 million euros for the fight against coronavirus

April 2020

MAPFRE continues to mobilize resources to protect the health of its employees, collaborators and clients in all countries where it operates; to assist economic recovery and job retention, especially for the self-employed, SMEs and its providers; and to provide resources, especially healthcare equipment, to the wider society to help overcome the effects of this pandemic.

MAPFRE contributes to the industry fund aimed at protecting health care professionals against COVID-19

April 2020

MAPFRE has allocated 5.7 million euros to the industry fund set up by insurance companies to protect health care personnel in the fight against COVID-19 in Spain.

Dividends and Shareholders

MAPFRE continues creating value for its shareholders

On June 25, the final dividend of 0.0858 euros gross per share was paid, after having proportionately applied the amount corresponding to treasury stock to the remaining shares.

The cash dividend paid against 2019 results adjusted for treasury stock reached 0.146 euros gross per share.