Results June 2021

MAPFRE’s consolidated revenue in the first half of 2021 amounted to 14.1 billion euros, equivalent to a 6.1 percent increase, and the attributable result stood at 364 million euros, which represents a 34.5 percent rise with respect to the previous year.

Revenue June 2021

Premiums June 2021

Non-Life premiums grew 6.7 percent, primarily from improved issuing in the General P&C and Health lines, which went up 20.7 percent and 5.3 percent, respectively, in the half year, thanks to the positive performance of General P&C in Mexico, Spain, Brazil and Colombia, and of Health and Accident in Spain and Mexico. On the other hand, lower issuing in the Auto line (-4.7 percent) comes primarily from the United States, Italy, Turkey and Brazil.

By Non-Life business type, General P&C is the most important line, with close to 3.7 billion euros in premiums. Auto holds second place, with over 2.7 billion euros. Health and Accident is in third place with 1.1 billion euros.

Life insurance premiums grew 4.3 percent thanks to improved Life-Savings business, which was supported by higher sales of Unit-Linked products to cover product maturities in the period.

Combined ratio June 2021

Net result June 2021

Balance sheet

Balance sheet to June 2021

Total assets reached almost 70.9 billion euros at June 2021 and grew 2.5 percent compared to the close of the previous year.

The Group’s shareholders’ equity has remained relatively stable on the year, and reflects a decrease in net unrealized gains on the available for sale portfolio as a result of rising rates, while conversion differences had a positive impact during the year, mainly due to the appreciation of the US dollar and strong performance of the Brazilian real.

Assets Under Management

Solvency II

The Solvency II ratio for MAPFRE Group stood at 201 percent with figures at March 2021, compared to 192.9 percent at the close of December 2020, including transitional measures and at the mid-point of our range. The improvement during the year is due to higher risk-free rates in Turkey and Latin America. Eligible Own Funds reached 9.4 billion euros in the same period.

The ratio maintained great solidity and stability, backed by high levels of diversification and strict investment and ALM policies.

- High quality capital base: 88% of eligible own funds are Tier 1.

- “Fully loaded” Solvency II ratio: 187.8% (excluding impact of transitional measures on technical provisions and equity).

Billion euros.

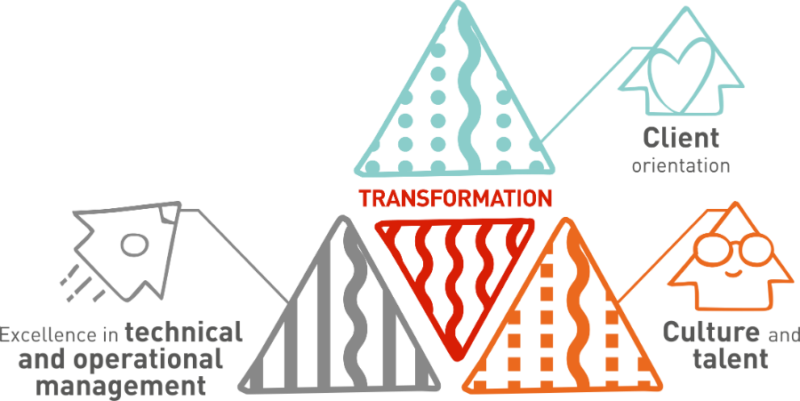

Strategic Plan 2019-2021

Client orientation

Excellence in technical and operational management

Culture and talent

Relevant events

MAPFRE launches Activo Multifondos II, a new individual savings product

July 2021

MAPFRE has launched Activo Multifondos II, a unit linked Insurance product that is totally flexible and can be taken out as single or regular premium, and that always guarantees 80 percent of the maximum value reached.

MAPFRE remains the sixth-largest European Non-Life insurance company in Europe

June 2021

MAPFRE is honored at the El Economista Awards as the share with the most-improved recommendation

June 2021

Fernando Mata, MAPFRE’s CFO and member of the board, received the award for “Share with most-improved recommendation” during the 7th edition of the Valor a Fondo awards from the El Economista newspaper.

MAPFRE AM launches new website

June 2021

MAPFRE AM, MAPFRE’s asset manager, has just launched a new website (www.mapfream.com), which is focused on the company’s commitment to sustainable finance. The website will allow clients to view all the strategies applied by the manager in relation to ESG criteria, as well as more traditional fixed income and equity products adapted to each risk profile

MAPFRE launches EVOLUCIÓN SELECT TOTAL

May 2021

MAPFRE has launched the new unit linked EVOLUCIÓN SELECT TOTAL, a new individual savings product, with returns linked to the performance of the EuroStoxx Select Dividend 30 index, and 90 percent of the amount invested guaranteed to maturity.

MAPFRE AM team awarded international ESG analyst certification

May 2021

MAPFRE’s asset management professionals have received the prestigious international EFFAS Certified ESG Analyst (CESGA) certification from the European Federation of Financial Analysts Societies, which assesses the set of skills needed to achieve an efficient rating, measurement and integration of ESG criteria into investment analysis.

MAPFRE Economics expects a 6% rebound in the global economy

April 2021

MAPFRE Economics has updated its forecasts for the global economy. After 2020, a year which saw the worst economic contraction since the Second World War, MAPFRE Economics expects to see a 6% rebound this fiscal year, up 0.8% on the estimate made in the last quarter, largely due to the deployment of fiscal and monetary stimulus plans

MAPFRE will sell SANTANDER products in the insurer’s 3,000 points of sale

April 2021

Banco Santander and MAPFRE have reinforced the framework of the strategic commercial alliance between the two companies that has been in place for the last two years. They have reached a new agreement that will allow the insurer to offer the bank’s products and services through its commercial network in Spain, the largest in Spanish insurance with close to 3,000 branches throughout the whole of the national territory.

Iberdrola and MAPFRE join forces in a strategic alliance to invest in renewable energy in Spain

April 2021

They have set up a pioneering co-investment vehicle to achieve their goals, through 230 MW of green projects. MAPFRE is the majority shareholder in the vehicle with an 80 percent stake, while Iberdrola holds the remaining 20 percent and is responsible for developing, building and maintaining the farms.

Dividends and Shareholders

MAPFRE continues creating value for its shareholders

On May 24, 2021, the final dividend of 0.0757 euros gross per share was paid, after having proportionately applied the amount corresponding to treasury stock to the remaining shares.