Results

MAPFRE’s consolidated revenue in the first nine months of 2021 amounted to 19.8 billion euros, equivalent to a 3.8 percent increase, and the attributable result stood at 524 million euros, which represents a 16.4 percent rise with respect to the same period of the previous year.

Revenue September 2021

Premiums September 2021

Premiums from direct insurance and accepted reinsurance reached over 16.6 billion euros, with a 7 percent increase, primarily due to the previously mentioned policy in Mexico which provides a larger premium volume and compensates the reduction caused by the fall in exchange rates to the same degree. At constant exchange rates, premiums would have grown 10.3 percent.

Non-Life premiums grew 6.8 percent, primarily from improved issuing in the General P&C and Health lines, which at September went up 19.7 percent and 5.7 percent, respectively, thanks to the positive performance of General P&C in Brazil, Spain, Mexico and Colombia, and of Health and Accident in Spain and Mexico. On the other hand, lower issuing in the Auto line (-4.8 percent) comes primarily from the United States, Italy and Turkey.

By Non-Life business type, General P&C is the most important line, with over 5.1 billion euros in premiums. Auto holds second place, with over 4.0 billion euros. Health and Accident is in third place with over 1.3 billion euros.

Life insurance premiums grew 7.4 percent thanks to improved Life-Savings business, which was supported by higher sales of Unit-Linked products, as well as some relevant group policies in Spain.

Combined ratio September 2021

Net result September 2021

The accumulated attributable result to September 2021 reached 524 million euros, rising 16.4 percent, with IBERIA and MAPFRE RE being the largest contributors to the Group’s results.

Balance sheet

Balance sheet to September 2021

Total assets reached over 70.8 billion euros at September 2021 and grew 2.4 percent compared to the close of the previous year.

The Group’s shareholders’ equity has remained relatively stable on the year, and reflects a decrease in net unrealized gains on the available for sale portfolio, while conversion differences had a positive impact during the year, mainly due to the appreciation of the US dollar and the stability of the Brazilian real.

Assets Under Management

Solvency II

The Solvency II ratio for MAPFRE Group stood at 194.5 percent with figures at June 2021, compared to 192.9 percent at the close of December 2020, including transitional measures. This ratio sits comfortably near the midpoint of our range and is aligned with our risk appetite.

The ratio maintained great solidity and stability, backed by high levels of diversification and strict investment and ALM policies.

- High quality capital base: 87% of eligible own funds are Tier 1.

- “Fully loaded” Solvency II ratio: 181.6% (excluding impact of transitional measures on technical provisions and equity).

192.9%

194.5%

Billion euros.

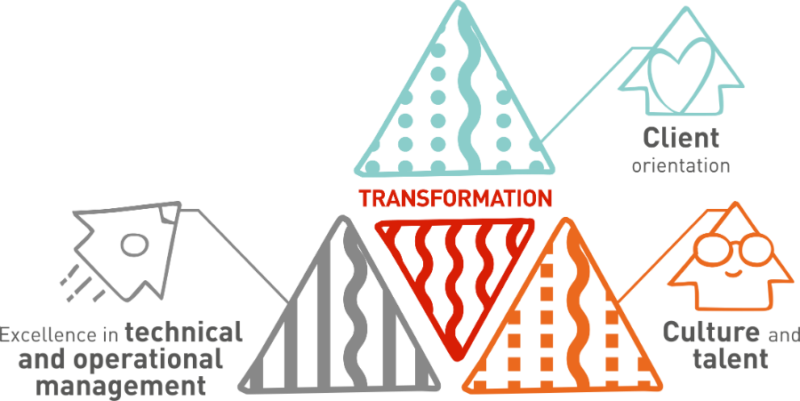

Strategic Plan 2019-2021

Client orientation

Excellence in technical and operational management

Culture and talent

Relevant events

MAPFRE, in the top 10 Ibex Companies providing shareholders with the highest quality information

October 2021

MAPFRE holds its third virtual shareholder event

October 2021

MAPFRE, among top three Ibex companies in dividend yield this year

September 2021

Of the 35 companies included on the Ibex 35, MAPFRE comes in second place in the ranking prepared by El Economista of 2021 expected dividend yield.

Santander|MAPFRE launches “Gama ECO”

September 2021

Santander|MAPFRE has launched the auto insurance product “Gama ECO”, a new line of policies specifically designed for electric and plug-in hybrid cars, with the aim of covering the insurance needs of Banco Santander clients who choose this kind of car.

MAPFRE launches a stock option plan for employee

September 2021

MAPFRE launches “Multifondos Compromiso ESG”

September 2021

MAPFRE Insurance and AAA Washington form jointly-owned insurance company

August 2021

Fitch confirms MAPFRE’s issuer rating

July 2021

Standard & Poor’s maintains MAPFRE’s ratings with a stable outlook

July 2021

The credit rating agency Standard & Poor’s published its decision to maintain MAPFRE’s issuer credit rating at “A-” with a stable outlook, that of its senior debt at “A-” and that of its subordinated debt in “BBB”.

MAPFRE score in FTSE4Good index improves for social commitment and corporate governance

July 2021

MAPFRE Economics updates its economic expectations

July 2021

MAPFRE launches “Activo Multifondos II”, a new individual savings product

July 2021

MAPFRE has launched “Activo Multifondos II”, a unit linked Insurance product that is totally flexible and can be taken out as single or regular premium, and that always guarantees 80 percent of the maximum value reached.

Dividends and Shareholders

MAPFRE continues creating value for its shareholders

At its meeting in October, the Board of Directors agreed to pay an interim dividend against 2021 results of 0.0606 euros gross per share for all outstanding shares, after having applied the amount corresponding to treasury stock proportionately to the remaining shares. The expected payment date is November 30, 2021.

On May 24, 2021, the final dividend of 0.0757 euros gross per share was paid, after having proportionately applied the amount corresponding to treasury stock to the remaining shares.

Share Performance

MAPFRE – IBEX 35 – Stoxx Insurance

Share price evolution: December 31, 2020 – September 30, 2021