Socially responsible investment

Home > Sustainability > Business >

Our investment is socially responsible (SRI), with a view to building a more sustainable world.

In 2017, we signed up to the United Nations Principles for Responsible Investment (PRI), meaning that we are designing new investment products for our customers that satisfy these principles and comply with ESG criteria.

This course of action is compatible with our purpose and obligation to protect our customers’ savings and investments. In order to do this, we apply prudential criteria for investment and seek long-term value creation.

Integrating ESG aspects into investment processes

We made a series of public investment commitments aligned with our Sustainability Plan 2024-2026. Change is possible when we are all playing our part.

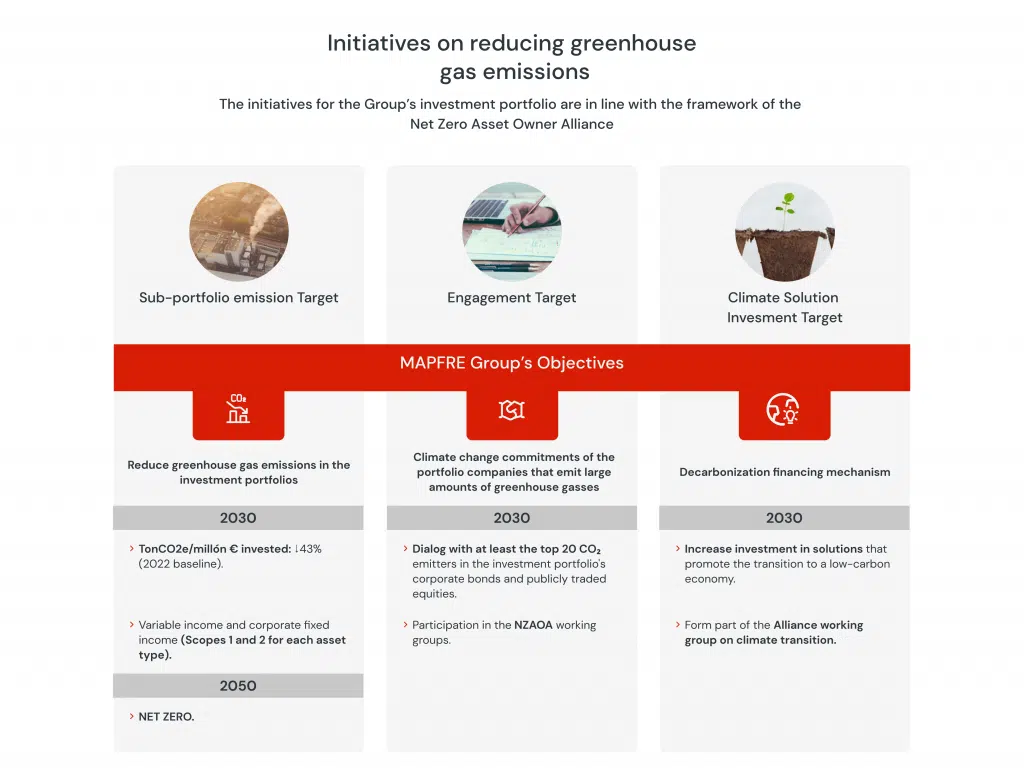

Our commitment to decarbonization

Our socially responsible funds