Results

MAPFRE’s consolidated revenue in the third quarter of 2019 reached 21.6 billion euros, while the attributable result amounted to 463 million euros, impacted by the review of the ASSISTANCE business.

Revenue September 2019

The Group’s consolidated revenue reached 21.6 billion euros, with an increase of 6.5 percent, mainly due to the rise in premium issuing, greater financial income and revenue from non-insurance entities and other.

Premiums September 2019

Premiums from direct insurance and accepted reinsurance reached 17.6 billion euros, with an increase of 2.5 percent, primarily due to positive development in countries like Mexico, Peru and the Dominican Republic.

Non-Life premiums grew 4.1 percent, marked primarily by the effect of issuing the multi-year PEMEX policy in Mexico, which was renewed in June. Life premiums grew 0.9 percent, of which Life-Protection increased 11.3 percent primarily from the positive development of this business in Brazil (+18.6 percent), whereas Life-Savings decreased 7.1 percent, mainly from the fall of issuing in Spain and Malta, in a complicated economic environment for the sale of these products.

By Non-Life business type, Auto is the most important line, with almost 5.1 billion euros in premiums. General P&C holds second place, also with over 4.8 billion euros, and Health and Accident is in third place with 1.1 billion euros in premiums.

Combined ratio September 2019

The Group’s combined ratio improved by 1.7 percentage points and stood at 96.4% at the close of September. The excellent development of the combined ratio is based on the fantastic behavior in the insurance units, especially in LATAM and NORTH AMERICA, thanks to the measures implemented within the framework of the profitable growth strategy and the strict risk underwriting and selection approach. The combined ratios of IBERIA and the reinsurance unit remain at excellent levels.

Net result September 2019

The attributable result to September 2019 reached 463 million euros, a decrease of 12.5 percent, primarily due to the goodwill writedown and provision for business restructuring expenses at MAPFRE ASISTENCIA. Excluding this extraordinary effect, the result would have grown 2.0 percent compared to the previous year.

Balance sheet

Balance sheet to September 2019

Total assets reached 74.3 billion euros at September 30, 2019 and grew 10.5 percent compared to the close of the previous year. These changes include increases in financial investments and in technical provisions, due to financial market movements and the growth from insurance activity.

The Increase in shareholders’ equity also reflects the improvement in the market value of financial assets available for sale, and the positive development of currency conversion differences, primarily from the appreciation of the US dollar, helping to offset the fall in the Brazilian real.

Assets Under Management

Solvency II

The Solvency II ratio for MAPFRE Group stood at 198 percent at June 30, 2019, compared to 189.5 percent at the close of December 2018. The ratio maintained great solidity and stability, backed by high levels of diversification and strict investment and ALM policies.

- High quality capital base: 87% of eligible own funds are Tier 1.

- “Fully loaded” Solvency II ratio: 182.8% (excluding impact of transitional measures on technical provisions and equity).

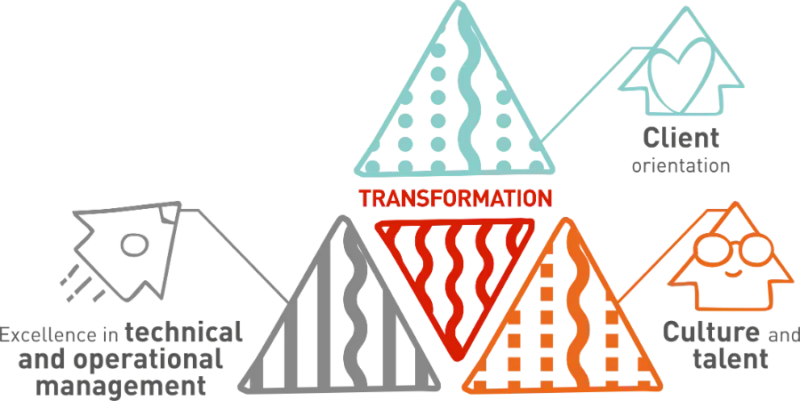

Strategic Plan 2019-2021

Client orientation

Our team is 100% client oriented. We are committed to a competitive model, which puts clients at the center of everything we do, with the aim of offering an optimal experience at every moment of contact with MAPFRE. We want to know, understand and enhance customer loyalty; increase productivity in all our channels and innovate in products, services and experiences for our clients.

Excellence in technical and operational management

We work to improve our efficiency, adapting our structure to offer an excellent service, with a global, flexible and open technology that enables us to increase our competitiveness.

Culture and talent

Strengthening the commitment of everyone working at MAPFRE, we wish to continue adapting to changes with new skills that allow us to face future challenges. We continue working to become a benchmark for sustainability. MAPFRE is a group committed to sustainable development and, especially, with the fight against climate change.

Relevant events

MAPFRE launches DIVIDENDO EUROPA, a Unit Linked tied to the EuroStoxx50 Index

September 2019

MAPFRE reinforces its Life-Savings insurance product offer with the launch of DIVIDENDO EUROPA, a new Unit Linked tied to the performance of a portfolio of shares with high dividend yields, listed on the European index, EuroStoxx50.

MAPFRE is one of the largest shareholders of Puy du Fou Spain

September 2019

This investment by MAPFRE is within the framework of the company’s interest in progressively increasing alternative investments with potential yields for the Group, in order to gradually diversify the balance sheet in a low interest rate environment.

Abante and MAPFRE sign an agreement to offer their clients quality asset management and advisory services

September 2019

Abante and MAPFRE have signed a strategic alliance to create the most competitive independent platform for financial advisory services and product distribution in the Spanish market. The insurance group will take a 10 percent stake in Abante through a capital increase, and will retain the option to acquire a further 10 percent, up to a maximum of 20 percent, within a period of three years.

Fitch confirms MAPFRE’s rating and highlights the company’s solid capitalization and strong revenue generation

September 2019

Fitch confirms as A+, with outlook stable, the insurer financial strength credit rating for the MAPFRE Group’s operating companies: MAPFRE ESPAÑA, MAPFRE VIDA, MAPFRE RE and MAPFRE ASISTENCIA. Similarly, the agency has reaffirmed MAPFRE’s issuer rating as ‘A-‘, with outlook stable, the same as that of the Kingdom of Spain.

MAPFRE Gestión Patrimonial surpasses 500 million in two and a half years

September 2019

MAPFRE GESTIÓN PATRIMONIAL, the MAPFRE company offering financial investment solutions for clients to capitalize their savings, has surpassed 500 million euros in assets under management in its first 30 months of operations.

MAPFRE to pay a dividend of 0.06 euros gross per share

September 2019

The Board of Directors of MAPFRE has ratified the payment of an interim dividend against the 2019 results of 0.06 euros gross per share. This dividend will be paid out on December 23, 2019.

MAPFRE’s clients have benefitted from discounts on 100,000 movie tickets

September 2019

MAPFRE TeCuidamos, the insurer’s client loyalty plan, offers its members savings and discounts to help with day-to-day savings. Members of MAPFRE’s loyalty plan, and their families, have been able to save in their day-to-day thanks to the agreement the insurer signed almost a year ago with Cinesa, and have been able to enjoy new movie releases at a very good price.

MAPFRE TeCuidamos offers its members discounts for shopping in Ikea

September 2019

MAPFRE’s free client loyalty plan has joined forces wtih IKEA to offer its TeCuidamos members the possibility of renovating their homes while saving on their insurance.

Dividends and Shareholders

MAPFRE continues creating value for its shareholders

At its meeting in September, the Board of Directors agreed to pay an interim dividend against 2019 results of 0.06 euros gross per share for all outstanding shares. The amount corresponding to treasury stock will be applied proportionately to the remaining shares. The expected payment date is December 23, 2019.