ECONOMY| 03.05.2022

The geopolitical earthquake opens new scenarios for the global economy

The conflict between Russia and Ukraine, starting with the Russian invasion on February 24, has immediately transformed the prices of raw materials, worsening the historical upturn that had been registered previously, mainly on the energy side, petroleum and food derivatives, and increasing the risk of economic disruption. The new geopolitical determinant, therefore, implies greater risk to production capacity an elevated inflation risk.

This factor, added to the list of risks that are determining the global economy, has also served as a catalyst to risk aversion, “with generalized corrections on the variable income markets, an extension of the movement of credit differentials, and certain refuge in bonds and strong currencies,” affirm MAPFRE Economics experts in the last Panorama 2022 report: Second Quarter Perspectives.

When the war started, the VIX (the main indicator of volatility on the markets) showed the intensity of the shock to the markets, although, as the conflict has become more deeply embedded, the uncertainty has lost weight, “giving rise to a more stable situation, but not exempt from the risk of new events,” explains the Studies Service.

The conflict reached a moment in which the economic policies were on the exit ramp, “from the generalized adaptable environment during the pandemic crisis, toward a more hardening approach.” In this sense, and in relation to disruptions in raw materials, the dossier analyzes that, “it is foreseeable that business margins will start to be affected and, secondly, a reverberation on the end consumer in an additional attempt to transfer costs, which would result in a second round of higher prices and expectations of higher and more long-lasting inflation.”

Given this dynamic, economic policy-makers are in a delicate situation which may lead to a systemic risk event that worsens the forecast scenario. Thus is the situation that the new geopolitical component has created up to three possible scenarios during the last MAPFRE Economics study.

- Baseline scenario

In this scenario, the expert forecasts anticipate, at least for now, a minimum impact on the side of the pandemic, “considering that we have reached robust collective immunity, the maintenance of selective and low-impact restrictions, and a process of transitioning from the pandemic to the endemic phase, aimed at not damaging economic activity.”

With respect to the geopolitical component, the core concept is based on moderate impact on economic growth under the assumption of “(i) a conflict of limited time, (ii) sanctions consisting of those already established, which would persist beyond 2022 (the Russian sanctions will not disappear even with a ceasefire), and (iii) a direct effect on trade and the prices of raw materials.”

Under these forecasts, the prices of oil and gas would remain above $100 per barrel according to Brent for the entire year (against $85 from the previous report), anticipating a pathway to normalization “not exempt from underlying volatility”.

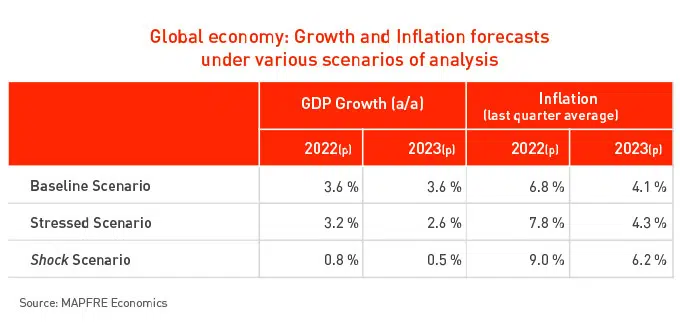

On the side of inflation, and with respect to the action of the central banks, the price hike would remain more persistent throughout 2022, “giving way in early 2023 to a progressive reversion toward the long-term goal of the central banks, which would culminate in 2024” (the price level for this year, at 6.8%, and 4.1% for next year). In this sense, the central banks would maintain the intention to raise interest rates toward the neutral rate in 2022 and 2023, where GDP growth would be placed at 3.6% in both years.

- Stressed scenario

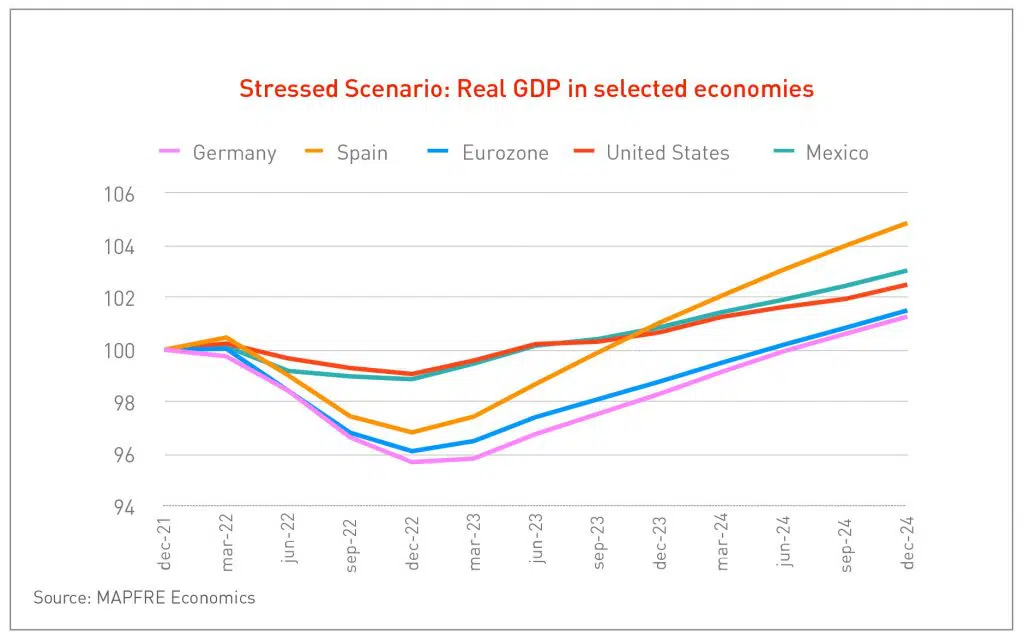

In contrast, the MAPFRE Studies Service considers a second, more pessimistic scenario, which would be defined by two main benchmarks: “(i) A conflict that extends beyond 2022, but which does not assume the involvement of more international actors (NATO and/or China) in the conflict, and (ii) the risk of greater sanctions or measures that would include specific measures on gas and oil by the West.”

The impact on activity in this case, according to the report, would become extremely unfavorable, “with latent stagflationary implications, mainly for Europe that would trigger several quarters with negative growth rates.”

Under this context, oil and gas prices would not stabilize until after 2024, with Brent over $110 throughout 2022, and the implications on consumption would invoke a further decline in disposable income.

Consequently, the inflation rates would respond to the hike in a more prolonged manner throughout 2023, “eroding consumption in the face of a deeper loss of buyer power of disposable incomes in real terms and sapping the activity of sectors with less price fixing capacity,” the experts estimate. According to this forecast, they consider “global economic growth of 3.2% and 2.6% in 2022 and 2023, respectively, with an inflationary prognosis (average of the last quarter of the year) of 7.8% and 4.3% in each of these years.”

- Shock scenario

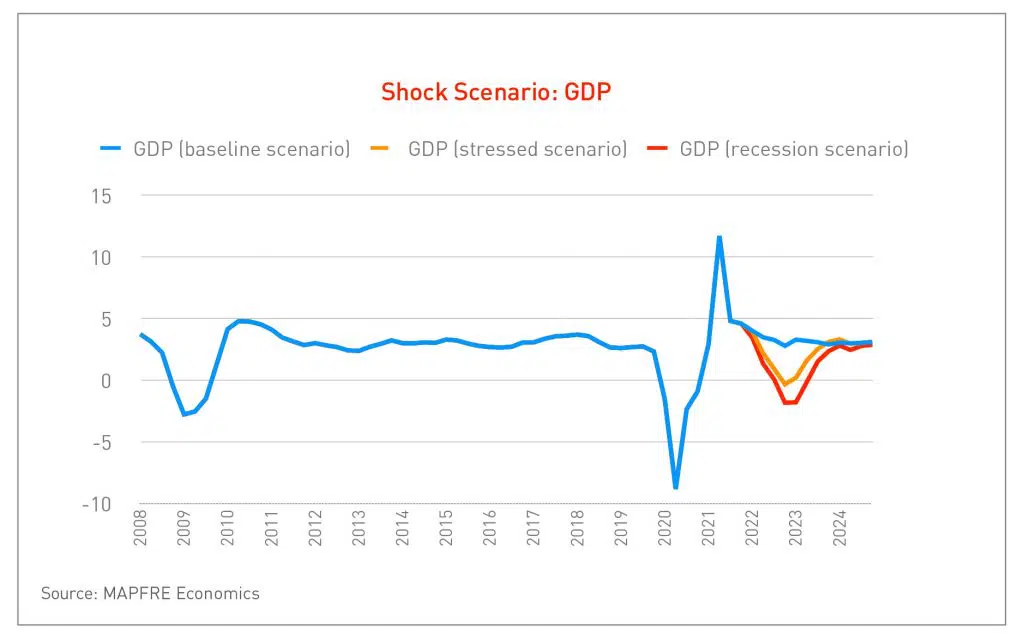

This third and new scenario, which is least probable and of greatest impact, could be caused, according to the report, by “(i) an aggravated conflict in which NATO attaches to the military dynamic, (ii) greater involvement in the conflict by China and other actors (which would trigger a global trade shock), (iii) a severe disruption of supply chains, combined with a raw materials crisis, or (iv) a transmission of contagion in the financial channel (Asian Dragon crisis) with reversion of global flows that would trigger a recession at the end of this year.”

With these variables on the table, oil prices would reach $150 a barrel in 2022, $100 in 2023, and over $80 in the long term, “given the inability of actors like Saudi Arabia, Iran, or Venezuela to compensate for Russian production,” the Studies Service acknowledges.

The economic activity in this shock scenario would suffer abruptly, resulting in a recession with high inflation rates and a growing perception of deterioration in real terms: the GDP growth forecast would barely reach 0.8% for 2022, and 0.5% for 2023, with inflation of 9.0% and 6.2% in each of these years.

This context would lead the markets to an even more compromised situation, “with a negative impact on risk assets,” and with a VIX at levels similar to those during the pandemic or the fall of Lehman Brothers. As a result, MAPFRE Economics determines that the sum of these risks would lead central banks and governments to “a reactive posture, resuming adaptive policies and returning to the Zero Lower Bound interest rates.”

RELATED ARTICLES: