ECONOMY| 23.05.2022

How do interest rates affect household finances?

The upward trend in Euribor that we have been seeing recently is affecting the rise in interest rates, which, in turn, affects mortgages and, consequently, our economy. If you are about to buy a home or you already have a mortgage, read on to find an explanation of the key concepts you need to know and how they affect your pocketbook.

If you already have a mixed or variable interest rate mortgage, you may already be much more familiar with these terms and concepts and, in general, with the impact of interest rates. However, they also have other effects on our economy. Knowing interest rates can not only help you with mortgages, but it will also help you better plan any loans or other financial decisions you may have to make.

What are interest rates?

In this article we will start by explaining this concept, which will allow us to understand financial dynamics: Interest rates. In the same way that you pay to buy a cell phone or to be able to access a phone operator’s services, money itself also has a price. This is a price that is indicated by the interest rate you pay in order to borrow it, which is usually a percentage of the capital lent to you. To this you need to account for the margin that institutions usually apply.

The easiest interest rates to identify are those on mortgages and loans. For example, when you sign a mortgage, the price of this loan will be set specifically by the interest rate, and the higher it is, the more expensive it will be to obtain the amount of money necessary to cover the purchase.

Those who currently have a mortgage fear that the current situation could make their loans more expensive. Likewise, those who are preparing to invest in real estate are keeping an eye on what the banks are doing because the deals they make could change depending on the moves made by monetary institutions such as the European Central Bank (ECB), which, in this case, is the regulator of the official interest rate in the Eurozone, i.e., the “price of money.”

Mortgage interest rates: fixed, variable or mixed

As we have already mentioned, there are different interest rates. Below, we will explain the differences between fixed, variable and mixed interest rates, so that you know how to distinguish between them before going to a bank.

The majority of mortgages taken out in Spain are variable interest mortgages, although there are two other types: fixed and mixed. The latter is recommended in highly specific cases.

We will begin by discussing fixed interest. This is when a common fixed rate is used that allows for stable interest in the long term. In short, if you borrow 500 euros and the rate is 3%, the interest on the capital loaned will always be 15 euros for the entire period. This type of interest rate is usually somewhat higher than the variable interest rate because it involves a higher risk for the bank.

Variable interest is the type of interest found in the vast majority of mortgages, and unlike fixed interest, it usually varies throughout the period of the loan. It means that the loan rate will vary over time in step with its reference rate, the Euribor, which we will discuss later.

A mixed-rate mortgage is one that combines fixed interest and variable interest. As its name indicates, during the initial years of the term, the interest applied is fixed and, therefore, the installments you have to pay will always be the same. For the remaining term, the interest rate becomes variable, and its value will depend on whether the Euribor rises or falls.

These types of mortgages are attractive if the Euribor is on a downward trend or if it stabilizes at negative values for a long period of time (as has happened in recent years, until the beginning of 2022). The main problem associated with these products is that it is impossible to predict whether the Euribor will go up or down in 10 years or more. So, this option is not the alternative for those who prefer to pay stable installments with no surprises in the future.

What determines interest rates?

The central bank of each territory is the institution that sets interest rates in that area. In Spain, the European Central Bank (ECB) sets the official price of money, as it does for all Eurozone countries, while the Bank of England does the same in the United Kingdom and the Federal Reserve in the United States.

Consequently, the ECB’s rates set the price at which money is bought and sold in the Eurozone. These rates are key for most financial products, such as loans or deposits. When interest rates are low, the return on deposits will be limited and if rates rise, the return will increase. The same goes for loans and mortgages. If the interest rate is low, the cost of financing will also tend to be low. In the case of mortgages, the reason is that the Euribor rate is parallel to interest rates, because they are correlated.

And why are they related to Euribor?

To understand how they are correlated, we need to understand how the Euribor works. The Euribor index is calculated on the basis of the bid prices of interbank loans among the main European banking institutions with the highest credit quality.

So, quite simply: if the ECB interest rate is the price at which the ECB lends money to banks and Euribor is the price at which banks lend it to each other, it is easy to understand why these two are closely related. Normally, the Euribor is above the ECB rates when it is believed that these rates will rise and lower when they are expected to fall or remain stable.

What is the relationship between inflation and interest rates?

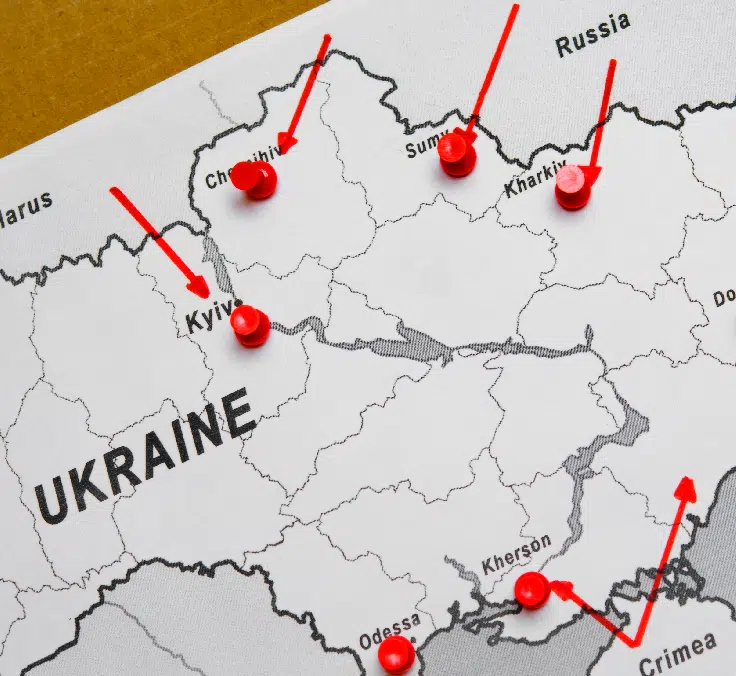

The objective of the central bank, and of everyone in general, is usually to achieve moderate inflation. This is how the economy is made to grow: by stimulating consumption and facilitating the payment of debts. Until now, in order to maintain this situation, the ECB has kept interest rates quite low. However, one of the consequences of Russia’s invasion of Ukraine is an increase in inflation, as we emphasized in our last article on how to save in a context of rising inflation.

With the current geopolitical outlook, this begs the question of whether the escalating inflation could in turn affect interest rates. This would have a direct impact on both current and future mortgages, but it would also affect other financial products.

When interest rates rise, inflation usually falls. In a nutshell, this is because monetary policy and interest rate hikes are used as a way to control inflation and curb price increases. Indeed, central banks have already triggered a sharp shift toward more aggressive policies, leading to the first upward movements and the gradual withdrawal of liquidity from the markets.

A decrease in interest rates penalizes savings and encourages investment, which favors people who want to take out loans or mortgages, as well as those who already have them and are on variable interest rates. The opposite situation, one of rising interest rates, benefits savers and lenders, i.e., those who seek savings rather than investment. This is a time when it is better to opt for government bonds, lend money to business or acquire savings products with fixed remuneration.

Therefore, the rise in interest rates affects the way in which the actors behave. They will give it a second thought when it comes to borrowing, although borrowing is essential for the functioning of the economy, since we need it to acquire raw materials, to set up businesses, and so on.

How do changes in interest rates affect our economy?

As we mentioned earlier, the conflict in Ukraine has many consequences and among them are economic ones. World economies are preparing for these consequences, and given the rising inflation, it is natural to ask how this rise will affect your pocketbook.

The U.S. Federal Reserve approved the first interest rate hike since 2018 a few weeks ago, with the aim of curbing inflation. Inflation and the generalized rise in prices have become one of people’s main concerns. The CPI, the consumer price index, rose to 7.4% in February, its highest rate since 1989.

If you start with the already delicate situation of the European economy, which is still recovering from the coronavirus, and you add proximity to the conflict and energy dependence on Russia, then you have a much more sensitive situation than that of the United States. Despite this backdrop, the President of the ECB has stated that an interest rate hike is getting closer and closer. The main consequences that we will be able to see include:

- More expensive loans: the most obvious consequence of higher interest rates is more expensive loans. In other words, we will have to pay more for the same amount of money, as we have explained above with the examples of mortgages.

- Easing inflation: as mentioned above, the point of raising interest rates is to control inflation. The ECB’s target inflation rate is 2% in the medium term. If we consider the first point, the increase in the cost of loans means that banks make access to credit more difficult, which discourages consumption and increases inflation.

- A decrease in job creation: although rate hikes seek to stabilize the economy, they also often lead to a slowdown in growth. If the economy does not grow and access to credit is tighter, it may lead to a drop in job creation and an increase in unemployment.

- Fomenting and encouraging savings: all of the above points tend to lead consumers to save more money; during the pandemic, household savings soared, as many people decided, in the face of uncertainty, to keep their money. In this environment of uncertainty, if you also prefer to stimulate savings, in our last article we explained some ways to prevent your money from losing value.

The situation leads us to the conclusion that, in addition to the widespread increase in the cost of products and services, such as electricity or gasoline, there will also be an increase in the cost of borrowed money, i.e., loans, mortgages or credit cards. The importance of interest rates in the household economy is obvious, so it is important to watch out for any changes in the market and to stay informed so you can make better financial decisions.

RELATED ARTICLES: