INNOVATION | 29.12.2022

Grappling with the metaverse and its impact on insurance

According to a recent survey by the ICEA, only 4% of insurance companies in Spain have a budget assigned to the metaverse. Experts agree that there will be no solid projects in this new virtual reality until 2026. MAPFRE España believes that these new environments “are very relevant and of the utmost interest.”

“Fashion protects itself from counterfeits in the metaverse.” This headline, which appeared last November in a major newspaper, warned of how high-fashion companies had run into an initial problem when they presented their collections on the runway in this new virtual reality. With the metaverse still in its infancy, clothing brands have detected counterfeits of their products, and their legal experts are working to expand records of their pieces and uniquely identify the owners of the digital assets (digital clothing) that will be worn by the avatars (identity of a person in that digital environment).

It will take years for the metaverse to become a widely used commercial and interactive space, but few people doubt that these new universes will become part of global business. According to Morgan Stanley, one of the most important investment management companies in the world, in 2030, the metaverse will accrue 10% of luxury sales (over 50 billion euros).

The metaverse is a virtual, three-dimensional ecosystem—virtual reality headsets will need to be used in the beginning— where users (individuals, companies, or other organizations) will interact with each other. Through avatars and an immersive experience, we will work, play, buy, learn, go to cultural or sporting events, meet up with family members and friends, etc.

The insurance sector in the metaverse

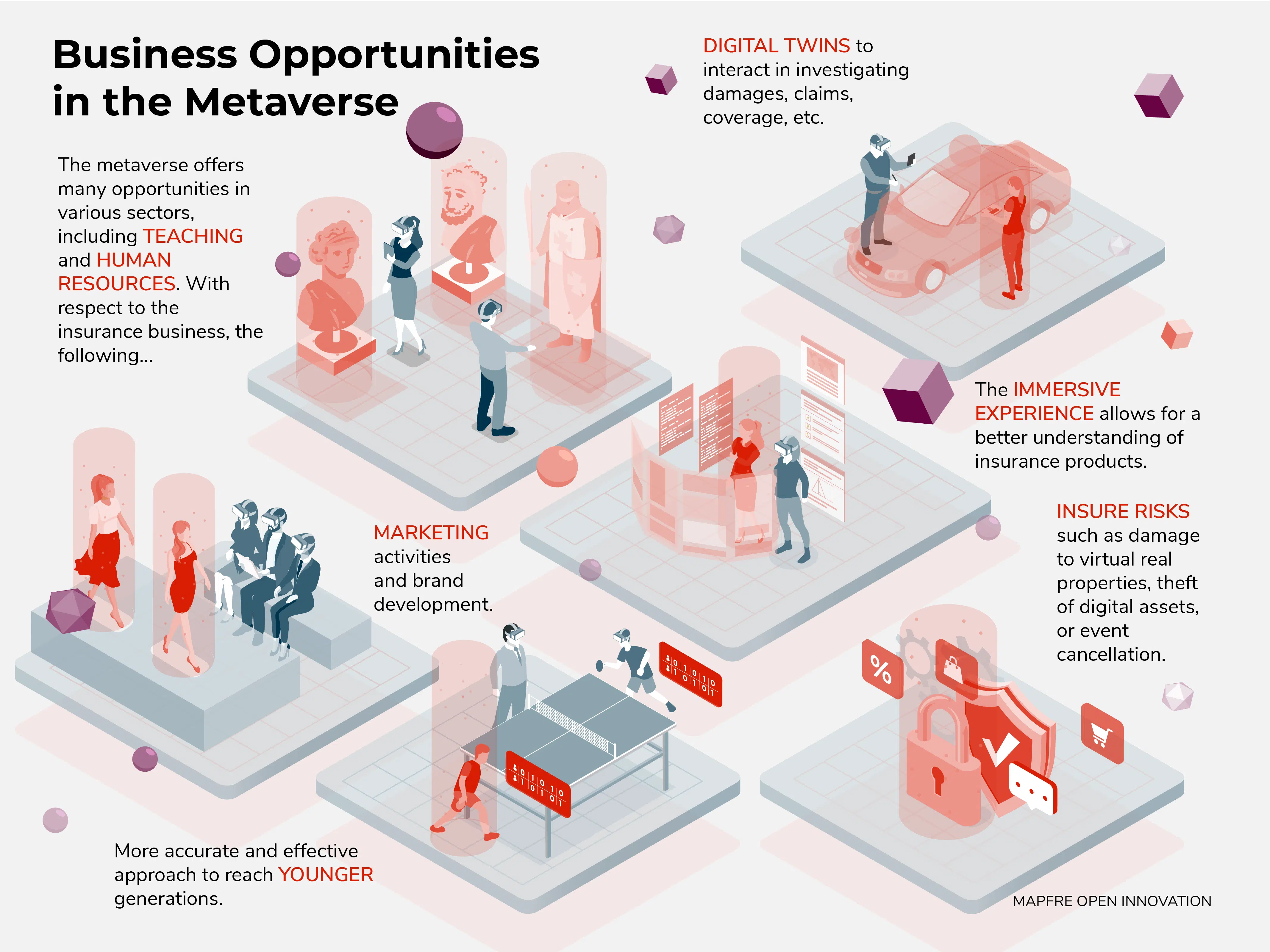

Videogames and fashion seem to be taking the lead in these initial stages, but checks, studies, and tests are being carried out across all economic sectors to position themselves in the new reality. What will happen with insurance companies? What will their opportunities be? Will there be a virtual insurance ecosystem?

Last October, the ICEA, the insurance sector’s statistics and research service in Spain, presented the report Insurance Metaverse: new realities, new opportunities, where most experts in the sector confirmed that insurance companies are reflecting on the metaverse’s possibilities, and they acknowledged “the current immaturity of these new virtual environments,” which hinders the advancement of their use. The companies that participated estimate that advancements in this virtual reality will be seen from 2026 onward.

According to the report, which was sponsored by Minsait, less than 10% of companies have a budget assigned to the metaverse, 42% are currently defining this line item, and only 3.8% have said funds.

Defining objectives in the new environment

One of the most enlightening details from the report is that more than 70% of companies in the sector do not have a defined strategy on how to operate in these virtual universes. That’s why, as highlighted in the ICEA study, the first obstacle is to define the objectives of having a presence in the metaverse. Securing brand positioning or advertising, interacting to enhance customer loyalty and access new segments, attracting workforce talent, and promoting the development of new products are some of the strategies being proposed in the innovation departments of insurance companies.

Another would also be to create workspaces, “virtual locations that would generate opportunities to carry out various kinds of activities,” and advisory and insurance sales offices.

New insurance products could be targeted to digital assets like NFTs (non-fungible tokens), cryptocurrency, and assets related to home, health, and third-party liability.

This is where more serious questions arise. Insuring these kinds of digital assets against theft or damage, for example, will depend on clear regulations and the security of the metaverse. “The truth is that in principle, due to the technology being used (blockchain), hacking or stealing a digital asset is more complicated, but insurers do not currently see specific legislation on digital rights and intellectual property in the virtual reality. It’s true that being able to operate globally opens the door to opportunities, but if we look at this current moment, data protection legislation is not the same in the European Union as in China or the USA,” Sabina Martín Martínez, from ICEA’s research department, explained to MAPFRE.

Among the risks arising from becoming involved in these universes, most companies that participated in the study highlighted the risks related to data regulation and achieving a safe virtual environment.

Uncertainty about the impact on insurance companies

In the working groups preceding the report, “we were surprised that professionals from Spanish insurance companies have quite a good knowledge of the implications, risks, and possibilities of the metaverse, especially in the innovation profiles.” Fernando Granado, Innovation expert at MAPFRE España, took part in that working group: “Along with other colleagues in insurance innovation, we started to take a look at what the metaverse could contribute and change in our sector. Today, no one knows the concrete impact it will have, as only time will tell, but taking part in this kind of work helps us start to build that future together, always focusing on the customer.”

New segments and user experience

In terms of using the metaverse to attract new customer segments, the clearest objective is advertising and brand positioning. “How they enter into this new environment and how they achieve greater visibility will be the short-term objectives. Technologically, how to do it is the main challenge. Currently, there are not many concrete undertakings because the sector is in the planning phase, but we cannot rule out that insurance companies, for example, may be able to give their brand visibility by being present at events, such as a concert, to target a specific profile,” the ICEA researcher explained. In the medium term, they can also create a virtual office with advisors and other employees to answer questions or handle claims.

Another concern is how many metaverses will end up being developed, and how many will have a greater segment of users where insurance companies can position themselves. “Not knowing whether a company-user inter-relationship is allowed, as well as the lack of specific regulations, is slowing down the development of projects. A reliable, safe, and defined framework needs to be established in order to start getting involved,” Martín Martínez commented.

Although people are mainly talking about Meta, the metaverse being created by Mark Zuckerberg, Facebook cofounder, various metaverses will more than likely coexist. Companies like Apple, Google, Epic Games, and Microsoft are also developing similar infrastructures. Even insurance companies are expected to have their own virtual ecosystems.

In terms of user experience, the experts consulted foresee important changes. Talking in person, on the phone, or by email is not the same as chatting through an avatar in a conference room in the metaverse. “The environment will modify the experience,” the ICEA researcher explained, “but we don’t know how or how much. There are people who aren’t comfortable in a face-to-face interaction or a video call, but are comfortable speaking using an avatar as their identity.”

Juan Cumbrado: “It’s a relevant topic, and one of utmost interest”

Juan Cumbrado, Innovation manager at MAPFRE España, maintains that the metaverse “is a topic of utmost interest for several reasons. Its increasing significance in society and in companies is relevant, and for us as well. The first thing we’re doing is studying what these environments mean in order to understand their possibilities.”

In the area of human resources, MAPFRE España has already facilitated talks with employees and created spaces to cultivate digital talent and outreach. “In addition to people in the Innovation department, who would be spearheading this topic, the employees themselves have content they can consult to get informed. In parallel to this learning phase, we’re preparing internal reports on any trend that affects the business,” Cumbrado assured.

Beyond the ability to maintain a space where people can interact virtually, “we are in an exploratory phase, researching what business model can be applied in the metaverse. From there, we will need to deploy lines of work on projects with people, customers, and employees in mind,” the Innovation supervisor specified.

In 2023, MAPFRE will begin testing concepts arising from that initial exploration. “Just like the Metropolitan Museum of Art in New York provides an immersive experience in a work of art, imagine the possibilities that we have in this educational area, how we can have this experience in health topics, when the devices (virtual reality headsets) become popular,” Cumbrado stated.

The risks, according to PwC

Last July, international auditing firm PwC published the report The potential impact of the metaverse on insurance companies to define the implications of this “new economic sphere” that the metaverse represents in the insurance business. “In this future economy, digital data representing land, buildings, and other virtual properties will be considered a regular part of an individual’s economic assets, which will then lead to the need to insure said assets,” the PwC experts explained. The report also said: “Insurance companies will also be able to add NFTs and cryptoassets to their own investment portfolios.”

PwC highlights the following risks that accompany these new universes and that may impact insurance companies:

Attack on the metaverse. User data can be stolen or lost as a result of digital piracy, which harms the customer’s value in this new environment. Malicious use of avatars can also cause abuse and reputational damage.

Litigation on account of trademark rights and intellectual property. There has already been litigation relating to the violation of trademark rights and intellectual property from NFT transactions.

Data loss. There is a risk that avatars, NFT data, and other digital assets may be lost due to metaverse platform provider failures. This service provider faces the risk of having to compensate customers for economic damage.

User negligence. As participants have to wear virtual reality glasses to have an authentic immersive experience, it is possible for them to injure themselves or others. Also, if a user involuntarily filters confidential data during their immersion, they may be liable for damages. In both cases, insurance companies can create specific insurance products.

RELATED ARTICLES: