INNOVATION| 26.07.2023

Climate change and cybercrime: among the most severe global risks

When it comes to addressing the most severe global risks, the insurance industry has an essential role to play. Insurtech startups are looking for new approaches to help confront these challenges, which include everything from climate change mitigation and natural resource crises to geoeconomic confrontation and cybercrime.

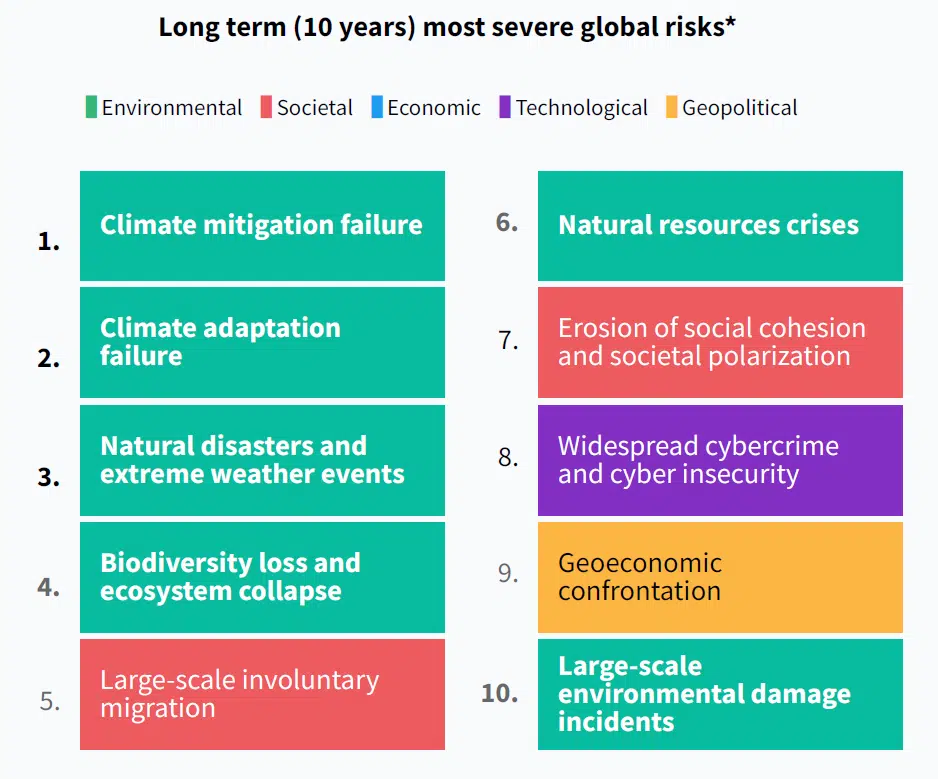

The most severe long-term global risks (10 years or more) can be grouped into five main categories: Environmental, Social, Economic, Technological, and Geopolitical. According to the third edition of the report entitled “The State of Global Insurtech”, produced by Dealroom.co, Mundi Ventures, MAPFRE, NN Group, and Generali, there are currently 10 major risks that every company, organization, and society should be taking into account:

- Environmental: climate change mitigation failure, climate change adaptation failure, natural disasters and extreme weather events, biodiversity loss and ecosystem collapse, natural resources crises, and large-scale environmental damage incidents.

- Social: large-scale involuntary migration, erosion of social cohesion, and societal polarization.

- Technological: widespread cybercrime and cyber insecurity.

- Geopolitical: geoeconomic confrontation.

The insurance industry has an important role to play in terms of confronting these risks, and this includes the insurtech companies that are creating business models focused on new ways of addressing them.

Figure 1: Top 10 emerging global risks. Source: “The State of Global Insurtech” report.

Environmental risks on the rise

A large-scale increase in the frequency and severity of natural disasters, as a result of climate change, has now become a reality. We have already seen how the physical risks presented by extreme weather events have led to the destruction of homes and businesses.

We are also now seeing how increasing concentrations of greenhouse gases in the atmosphere are causing changes to regional and global temperature and rainfall patterns, and to other climate-related variables, all of which is driving changes in consumption habits (for example, increasing use of solar panels on homes and commercial buildings).

The carbon market in particular is set to grow massively, heightening the need for high-quality projects that can bring trust to that market. According to BNEF’s scenario modelling mentioned in that report, the voluntary carbon market could grow 7.5x in the most conservative scenario and up to 70x in the most ambitious “carbon removal” focused scenario.

As explained by Miguel Ángel Rodríguez Cobos, Global Head of Innovation at MAPFRE, “climate change simultaneously presents risks and opportunities for insurance companies and reinsurers, everything from reviewing our financial investments and acting on our portfolio of insured risks, to assisting companies and individuals with their needs for prevention, adaptation, and resilience. There are also other aspects such as regulatory compliance (for example, the TFCD framework) and the need to design new products and services. This is a challenge that we are all actively working on, in order to contribute value to our business and to society.”

Startups like Descartes and Raincoat have become leaders in parametric insurance (where indemnification is based on a previously established, index-based trigger), with a clear orientation towards protection from climate change and adaptation to its effects. For example, Raincoat is offering insurance products designed with the aim of giving people economic liquidity immediately after a natural disaster has occurred.

Cyber insurance: a key part of the cybersecurity ecosystem

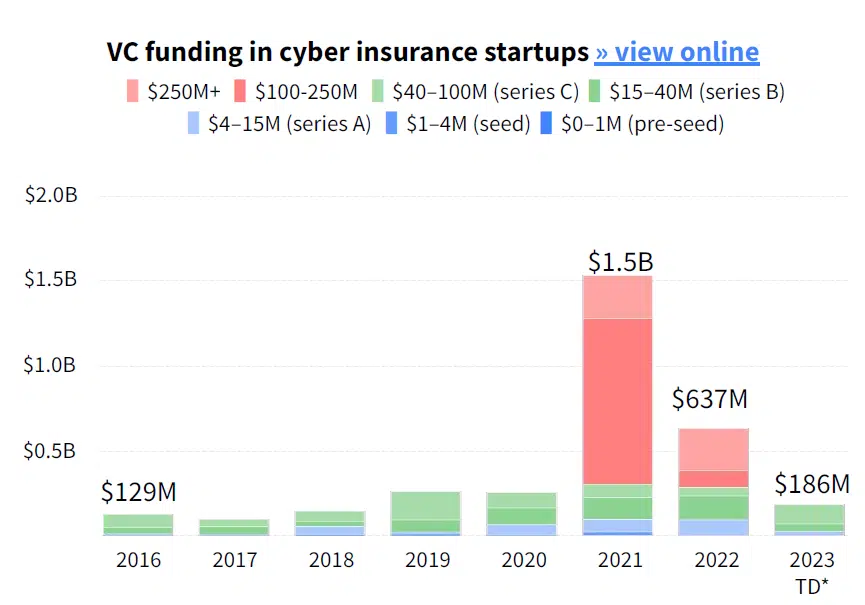

Cyber insurance is becoming a fundamental element of the global cybersecurity ecosystem. However, according to the report “The State of Global Insurtech”, cyber insurance has attracted just 4.5% of the $72 billion in cybersecurity investments since 2016.

Funding for this type of insurance grew 10x from 2016 to its peak in 2021, driven by the pandemic and the rise in remote work and online education, reaching over $1.5 billion in venture capital funding. Funding has slowed down since then, but 2023 is already higher than 2016‑2018 with more than half of the year still remaining.

Figure 2: Funding for cyber insurance startups. Source: “The State of Global Insurtech” report.

Some of the areas that are seeing the sharpest rise in investment include supply chain vulnerabilities, security for remote connections and sensitive data, attacks on IoT devices and digital assets such as cryptocurrency wallets, the metaverse, and cyberwarfare. Within this context, it is expected that marketing of cyber insurance products will continue to increase, especially through new channels or packages.

“More than 60% of European SMBs received an attempt of a cyber-attack last year, whilst penetration of cyberinsurance is still below 20% in the space,” explained Lluis Viñas, Investment Director at Mundi Ventures. “Although people tend to believe that cyber-attacks only target large corporations, SMBs accounted for nearly half of the cyber breaches last year. Still, many owners and managers in the SMB space find it hard to understand cyber insurance and gauge the real risk they are facing, resulting in a penetration of cyber insurance across SMBs of 17%. On the other side, beyond the demand for coverage, the capacity providers face a real challenge to follow up with real-time and reliable cyber risk assessments thus finding it hard to keep with market needs and underwriting massive volumes. These challenges, among others, set the ground for a massive opportunity for insurtech companies targeting to positively transform the space, especially in improving underwriting or reaching and distributing cyber insurance for SMBs at scale,” he added.

One of the players in this insurtech ecosystem is Cyberwrite, which is a company dedicated to supporting insurance companies and reinsurers when underwriting cyber risk, especially for SMEs. Specifically, this startup offers a cyber risk assessment for each company, mapping out its need for a policy with various coverage levels. It also presents financial estimates for recommendations on how to improve any weak points detected, while also producing a consolidated overview of the portfolio of insured risk (scalable up to tens of thousands of companies).