ECONOMY | 11.07.2023

These are the two scenarios for the global economy in the coming months

MAPFRE Economics always calculates two scenarios, which makes even more sense at present when there are more and more exogenous factors that can influence economic performance. The latest factor is the conflict in the Middle East, which may have more or less an impact on global GDP depending on how it evolves.

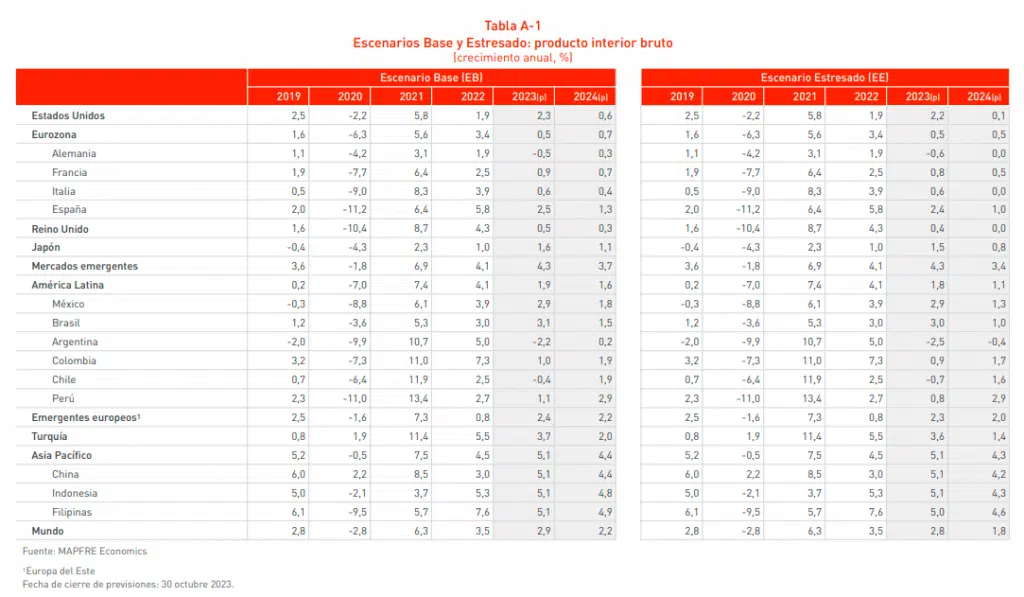

In its baseline scenario, the growth forecast for the global economy is 2.9% for this year and 2.2% for next year, with inflation of 6.6% in 2023 and 6.1% in 2024.

The stressed growth forecast anticipates slightly lower growth for this year, at 2.8%, and 1.8% growth next year. Inflation is also higher under this scenario, with a forecast of 6.8% for both 2023 and 2024.

Baseline scenario

For the purposes of the base scenario considered in this report, growth below potential will be maintained for the remainder of 2023 and the beginning of 2024. A cyclical slowdown will occur later than suggested in previous reports and will become more abrupt next year.

Projected inflation also anticipates a slower, more gradual return, but subject to more sustainable rates that allow for the gradual recovery of real wages. Nevertheless, the exhaustion of the main pillars supporting demand will continue to have a negative impact while also limiting the inflation catalysts.

As a result, monetary policy will remain at current levels, at least until the second half of 2024 in developed countries, and will gradually relax in emerging countries. Meanwhile, it will take into account the internal dynamics of the balance between economic activity and prices.

More specifically, the current interest rates for both the United States Federal Reserve and the European Central Bank remain, at least through the first half of 2024. After that, the first reductions should begin, but with prolonged maintenance of positive real interest rates.

Given the new global environment, oil price forecasts are revised, increasing to an average of $87 per barrel, giving way to a fourth quarter with a peak of $101 per barrel by the end of the year. In turn, a simulation of a higher long-term trajectory returns an average that remains above $90 per barrel in 2024 and a later convergence in the medium term.

This assumption results in a more pronounced period of stagflation in 2024, but with more significant implications for economic activity than for price dynamics. The changes also lead to an increase in gas prices, but in a more contained manner during the shock and an earlier return to pre-conflict levels.

Stressed scenario

The stressed scenario (risk scenario) considered for the purposes of the report assumes a more pronounced and sustained oil price shock for most of 2024, due to worsening tensions in the Middle East. This supply shock translates into a more rigorous stagflation outlook, with implications both for economic activity and price dynamics. More specifically, and although the effects are practically nil for the remainder of 2023, the erosion of activity translates into a 3 tenths of a percentage point reduction in growth for 2024.

In terms of inflation, the impact adds two tenths to the 2024 annual average and seven tenths to the 2024 average (around one percentage point over a 12-month period). The oil price shock assumes that oil prices will peak at $115 per barrel between the end of the fourth quarter and the beginning of the first quarter of 2024, with prices stagnating at around $100 per barrel for the remainder of the projection horizon.

In this stressed scenario, fiscal policy remains on neutral ground and neglects to re-activate fiscal backstops, albeit subject to tighter financial conditions. Monetary policy remains in a more prolonged tightening environment, with an additional interest rate hike by the US Federal Reserve (Fed), but not by the European Central Bank (ECB). Meanwhile, monetary easing is delayed until the end of 2024 and early 2025.

In the case of monetary policies in emerging markets, this scenario does not include an additional hardening line, but it does subscribe to a more time-consuming easing process, which is postponed by one quarter. The change in conditions leads to implied volatility that raises the VIX to levels above 40, and the annual average close to 35.

The inference results in a correction of risk assets: global equities contract by 20% in their aggregate index; fixed income starts with a 10% correction in the 10-year duration; a stronger dollar against other currencies (1.05 against the EUR) remains appreciated in the short and medium terms (1.07 in 2024 and 1.1 in 2025). The latter amplifies the effect of liquidity withdrawal and a flight-to-quality scenario that affects emerging currencies facing outflows similar to previous shocks, but much more selective.

Lastly, credit spreads widen in the range of 100 to 200 basis points, depending on the credit quality scale.

RELATED ARTICLES: