ECONOMY| 28.09.2023

Why financial education is important to us at MAPFRE

October 2nd marks the celebration of Financial Education Day, an initiative promoted by the Bank of Spain, the Spanish National Securities and Exchange Commission (CNMV), and the Spanish Ministry of Economic Affairs and Digital Transformation. This initiative is dedicated to “enhancing the financial literacy of citizens by equipping them with essential knowledge and tools to manage their finances in a responsible and well‑informed way.”

With that objective at the forefront, MAPFRE is dedicated to advancing financial education as a critical tool that can substantially contribution to the 2030 Agenda. It not only facilitates responsible financial decision-making but also plays a pivotal role in promoting knowledge in these areas.

As highlighted by the CNMV, “financial education empowers people to improve their understanding of financial concepts and products, guard against fraud, make informed decisions based on their own circumstances and needs, and avoid unfavorable situations stemming from excessive debt or unsuitable risk positions.”

Improving our financial literacy empowers us to make better choices in the present, with a ripple effect of positive outcomes for the future. That is why we encourage financial and insurance education and awareness among all our stakeholder groups.

As part of the 2022-2024 Sustainability Plan, under the banner of #PlayingOurPart, MAPFRE is committed to promoting financial education and culture within society. The objective is to encourage saving, improve investment decisions, boost pensions, and improve quality of life.

Our commitment to financial education is nothing new, tracing back to nearly the founding of the company when we began training employees on insurance products. Moreover, MAPFRE’s 2019‑2021 Sustainability Plan already included a section on financial education, with the intent of giving it greater emphasis.

Our proposals for Financial Education Day 2023

How can financial education have an impact on a country’s economy?

Each country’s economic stability clearly depends upon many factors, both domestic and foreign, and one of those factors is a country’s citizens and their behavior. Financial education gives people more independence, so they can make their own decisions, and this will also have an impact on their country.

For example, when people are able to make well-informed financial decisions, they are less likely to take on more debt than they can repay. That, in turn, helps reduce the number of unpaid debts, late payments, and the types of financial crises that can exist at the individual and systemic levels.

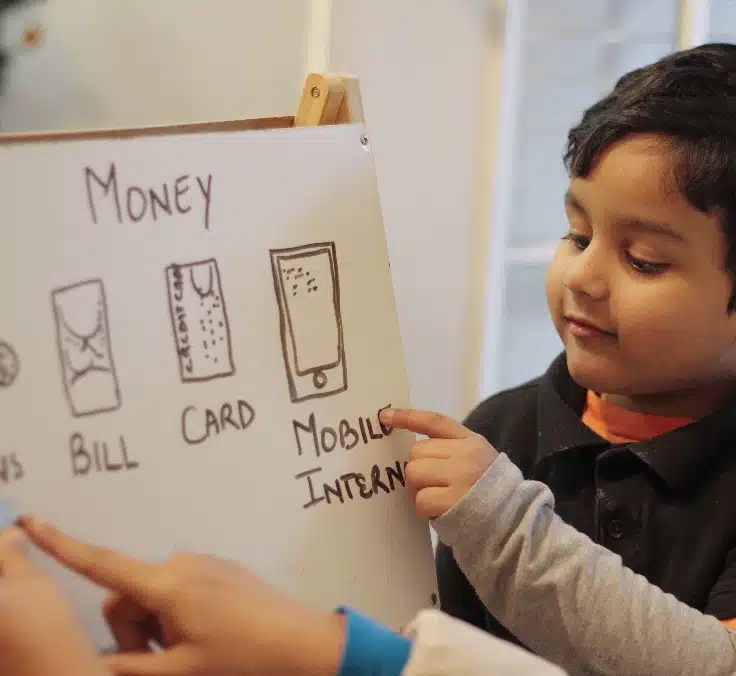

The importance of giving kids an early start with their financial education

Education is one of the most important aspects of any child’s development. However, both at home and at school, the focus is placed on helping kids understand the importance of subjects such as interpersonal relationships, language, and health, which are all topics they need to learn about. But are they also being taught about the value of money?

Talking to kids about money, and explaining its usefulness, is an essential way to help ensure that they will feel comfortable discussing the topic of money in the future, rather than seeing it as taboo. Learning how to save is one of the easiest lessons to teach, and in fact, this can be done almost without realizing it.

The most obvious example is when a child is given a piggy bank, along with a savings target that will allow them to buy something they really want. This will give kids the motivation to build up their own savings, while also learning how to manage their money. It will also help them understand that getting the things we want requires effort and responsibility.

RELATED ARTICLES: