INNOVATION| 31.08.2023

Blockchain in insurance: risks and opportunities

In recent years, decentralized finance (DeFi) and blockchain have become very valuable tools in all kinds of sectors for their potential to be applied in a number of processes, improving data efficiency and transparency and reducing costs.

The finance sector has already experimented with these technologies, the best known application of which is cryptocurrencies, although they are also used in other areas such as international transfers or fraud prevention.

Its impact on the insurance industry is less well known, but it could change the way insurers operate, according to the report “Assessing the Potential of Decentralized Finance and Blockchain Technology in Insurance,” edited by The Geneva Association and published recently.

DeFi, referred to as decentralized insurance in its application to this sector, enables risk-sharing arrangements based on a blockchain without an intermediary. The report gives the example of peer-to-peer insurance that uses tokens for premium and claim payments and operates on a public blockchain, such as Ethereum. This would be known as tokenized insurance, and it allows users to make transactions directly with each other, without an intermediary.

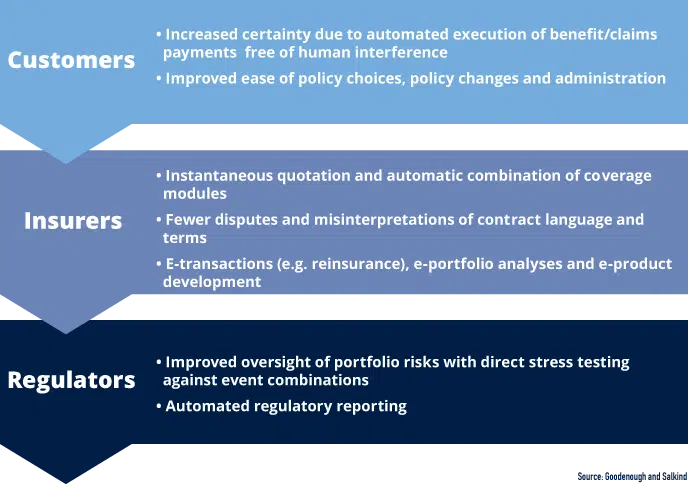

The benefits of blockchain include the application of smart contracts, which automate the settlement of claims without the need for human interference, among other things. For example, in the case of health insurance, blockchain connects patients, hospitals and insurers, sharing medical information without revealing identity and improving trust between parties.

Combined, both technologies have the potential to reduce administrative costs and streamline processes by eliminating intermediaries; increase transparency by enabling transparent and immutable records; and improve accessibility and inclusiveness by covering previously inaccessible communities.

“Decentralized finance (DeFi) and blockchain are ushering in a new era of more seamless customer experience and claims management. By facilitating inclusive insurance solutions, they can play a transformative role in empowering underserved communities,” explains Jad Ariss, managing director of The Geneva Association.

Transformation is not without risks

Both technologies could become an integral part of the insurance value chain, becoming a resource, platform and ecosystem for new business models and creating new opportunities for the sector.

However, the report concludes that these benefits for the insurance industry have not yet materialized, and DeFi and blockchain are not risk-free either. The immaturity of the ecosystem, the lack of academic literature and scalability issues are among the main obstacles to widespread adoption, as well as regulatory risk and data protection concerns.

These technologies are also closely linked to cryptocurrencies and have been affected by the crash that this market has experienced over the last year. This has affected both the number of patents and the financing of new projects by venture capital funds, which peaked in the first quarter of 2022, followed by three other quarters with hardly any deals.

Thus, insurers and reinsurers “must carefully weigh the short-term cost of investing in technology against the long-term potential of DeFi and blockchain,” the report says. “They should analyze the pros and cons and continue to test the waters with pilot projects because of the potential of DeFi insurance to disintermediate and transform traditional business models, and the new revenues generated by the provision of enhanced services.”

MAPFRE also experiments with blockchain

Insurers are no strangers to the technological transformation being experienced, and many have already taken a first step to implement DeFi and blockchain in their processes.

Specifically, MAPFRE España participates in three initiatives related to the research and promotion of blockchain solutions, such as Alastria, a multi-sectorial association that promotes the digital economy through the development of decentralized registration technologies with blockchain. It is based on the methodology of the virtuous spiral of innovation, growing with the collaboration of the private sector, public authorities and the academic world.

The insurance company is also present in Digitalis, a platform involving large Spanish companies that applies blockchain technology to the verification of providers’ documentation. The objective is to make the relationship between corporations and their providers more agile, efficient and secure, looking to create a unique digital identity for these companies.

Tirea CYGNUS, for its part, is a pioneering initiative that seeks to become a benchmark in our sector and lay the foundations for future blockchain applications for insurance companies. It is articulated through an open ecosystem of sectoral collaboration in which the aim is to accommodate all insurance companies interested in this technology. The first initiative for managing coinsurance with blockchain has the main benefit of improving the efficiency of the processes associated with this complex product.

MAPFRE RE participated in a global blockchain initiative together with other insurance and reinsurance companies, B3i, which brought together large insurers and reinsurers from five continents to explore the potential of distributed ledger blockchain technology in our sector. The companies built a platform to address critical industry needs by growing their network and developing partnerships with other initiatives around the world.

You can read the full report here.

RELATED ARTICLES: