ECONOMY| 18.01.2022

It’s time for finance to back the green economy

Joseph E. Stiglitz probably needs no introduction, but just in case, we’ll remind our readers that this American economist and professor has received awards that include the Nobel Prize in Economics for his analyses of markets with asymmetric information. A month ago, in an op-ed piece on finance and the climate crisis in Spanish daily newspaper El País, he said things like, “The world has finally awakened to the existential imperative of guaranteeing a rapid transition to a green economy. Finance will play a fundamental role in that process,” statements that opened his discourse.

In Stiglitz’s view, although he sees positive developments, investments in the fossil fuel industry continue to be financed. These are long-term investments that fuel the environmental crisis. And, in the current context of the fight against climate change, they are bound to stagnate, causing losses for investors. In his article, Stiglitz warns of the economic risks of transitioning too slowly to carbon neutrality, which could lead to sudden changes in financial asset prices. The economic crisis is going to require tremendous economic and social changes, he added, concluding: “We have no choice but to change the way we consume, produce and invest.”

The financial sector cannot be left behind

Environmentalist Bill McKibben, in an interesting newsletter on climate change and the environment, commented a few months ago that certain industry sectors, such as automobile manufacturing, have already started to “discover the climate future.” Consumers have no problem buying electric cars if the product meets their expectations. That said, this sector is well aware that legislation on polluting gas emissions (especially in the European Union) is going to be increasingly tough, leaving little room for the reversal of its decisions.U

McKibben seems to share Stiglitz’s view, stating that the banking sector is operating a double standard, with the aim, he believes, of obtaining economic gains from both the fossil fuel industry and the “renewable future” that we are gradually headed towards. And he explains that President Joe Biden himself has warned that financial institutions’ inability to measure the risks of a necessary transition can put both companies’ competitiveness and household savings at risk.

One risk that we are exposed to now is the fact that green-economy goals are unclear or too timid. Or we could even talk about greenwashing, as some companies take only cosmetic measures, for the sole purpose of satisfying the user/customer, that have no clear benefit to the environment. McKibben cites the example of a German bank, Deutsche Bank, which takes weak energy-saving measures while directly collaborating with an oil and gas group.

ESG criteria or what a small investor can do

An investor is also a saver. What can individuals do if they want to invest their savings in financial products that won’t end up having a negative impact on the environment or on society?

First of all, let’s talk about ESG criteria. This acronym stands for Environmental, Social and Governance. These criteria are linked to concepts such as social responsibility and sustainability, so companies that are committed to combating climate change and to improving people’s quality of life aim to follow them in the three aspects they address. The criteria for good corporate governance, perhaps the most difficult to understand in layman’s terms, would be those that consider everyone who might be affected every time a business decision is made.

ESG criteria are also used to ensure that a project or an investment is aligned with and committed to social and environmental responsibility. This brings us to another term: sustainable finance, or finance that aims to have a positive impact on the environment and society while obtaining financial yields. If you invest in a financial product with an ESG commitment, you are making a socially responsible investment. But words are not enough, because they need to be backed by companies and projects that follow the Principles for Responsible Investment (PRI) of the United Nations.

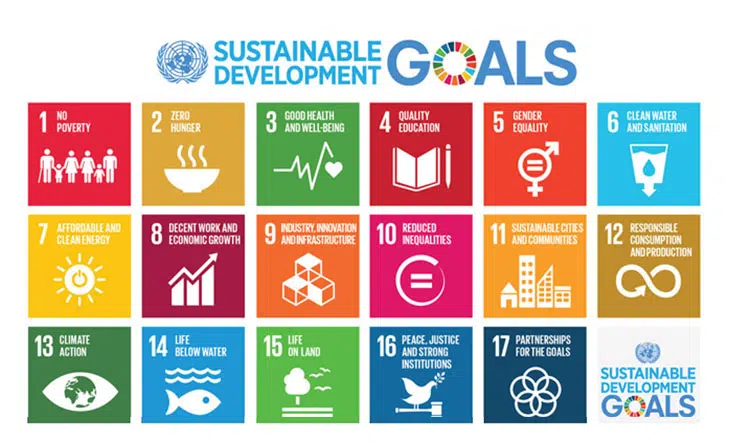

In 2017, United Nations Secretary-General António Guterres said: “The green economy is the economy of the future.” And at this point, more than an option, it has become the only viable path for the economy, society and the planet. If we are talking exclusively about finance and the business world, ESG criteria mark the way, but on a much more expansive scale, we have the 17 Sustainable Development Objectives, part of UN Agenda 2030. This is a commitment for all.