Guaranteed funds vs. deposits: which is the best option for savers?

Various types of assets fall into this “drawer,” from treasury bills to bank deposits. Traditionally, these options were favored by more conservative investors before rates dropped to 0%; a situation that forced them to look for riskier options that offered better returns.

Treasury bills have seen a significant rise in their returns —rising above 3% after the falls recorded in 2022 across all fixed income— and have made headlines due to the long lines of investors at the doors of the Bank of Spain.

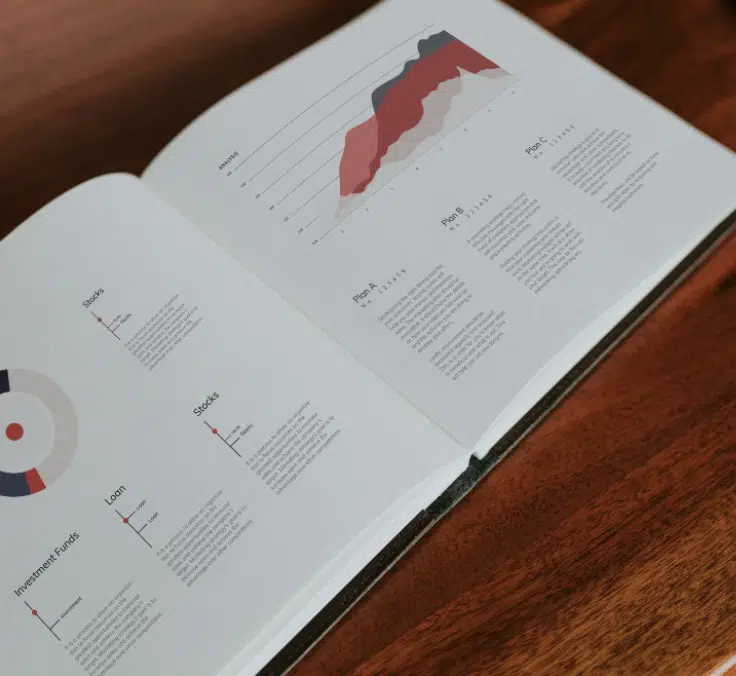

Alberto Matellán, chief economist at MAPFRE Inversión, explains that direct investment in treasury bills may not be suitable for all investors and instead recommends another product: guaranteed funds. According to information appearing on the website of Spain’s National Securities and Exchange Commission (CNMV), these are products that, as a minimum, guarantee that all or some part of the initial investment made will still be maintained on a specific future date. The website also points out that these products do not guarantee a specific yield at all times, only on their maturity date.

“With rates where they are and with good fixed-income managers, it will soon be possible to find guaranteed products with the same or even higher yields than treasury bills,” he adds.

Eduardo Ripollés, director of institutional sales at MAPFRE AM, notes that investors’ entry into guaranteed funds has been “very fast” since the interest rate hikes began. This is confirmed by Inverco’s figures: February saw inflows of 647 million euros, bringing the total since the start of the year to almost 944 million.

These vehicles invest mainly in treasury bills and bonds, thus offering greater diversification than direct investment in these assets. In addition, portfolios may also include some corporate bonds and even index-linked bonds, establishing a profile that may be an ideal option for more conservative savers.

Ripollés recalls that another of the advantages of guaranteed funds is the ability to transfer without incurring a tax penalty. “Investors have the option of transferring between funds without a tax penalty, which helps with tax planning and gives them the option to defer payment of capital gains or losses if they so wish,” he stresses.

Deposits: far from offering good returns

They were particularly profitable during the financial crisis. When wholesale funding slowed down, banks had to turn to their customers for liquidity, which caused deposit remuneration to rise to levels of 5% in some cases.

But now, the situation is much different. Institutions now have plenty of liquidity, which makes it unnecessary to increase the profitability of deposits. As a result, remuneration in Spain remains at fairly low levels with a few exceptions in the case of smaller banks. According to recent data from the European Central Bank (ECB), Spanish institutions paid an average interest rate of 0.69% on two-year deposits in January, compared with an average of 1.2% in the eurozone and more than 1.8% in Italy and the Netherlands.

In a recent speech, the governor of the Bank of Spain, Pablo Hernández de Cos, explained that the pass-through of the hike in interest rates is slower than in other periods, especially in the case of deposits.

“The trend across Europe’s main economies broadly follows this lagging pattern of previous episodes, although, in the case of Spain, the pass-through during 2022 was below average, particularly in the case of deposits. The unique starting point of this episode —with market rates below zero— and the excess liquidity accumulated by deposit institutions are likely contributing to this phenomenon,” said De Cos.

Thus, the profitability offered by banks for deposits is expected to remain low in the immediate future, which means that they are not the best option for savers wishing to invest.

RELATED ARTICLES: