CORPORATE|01.24.2024

MAPFRE Economics forecasts that the global economy will grow 2.3% in 2024 and 2.6% in 2025

- Economic growth will continue to weaken in 2024, far from the potential and average figures of the past few decades

- Geopolitical crises and other key risks are expected to persist in 2024

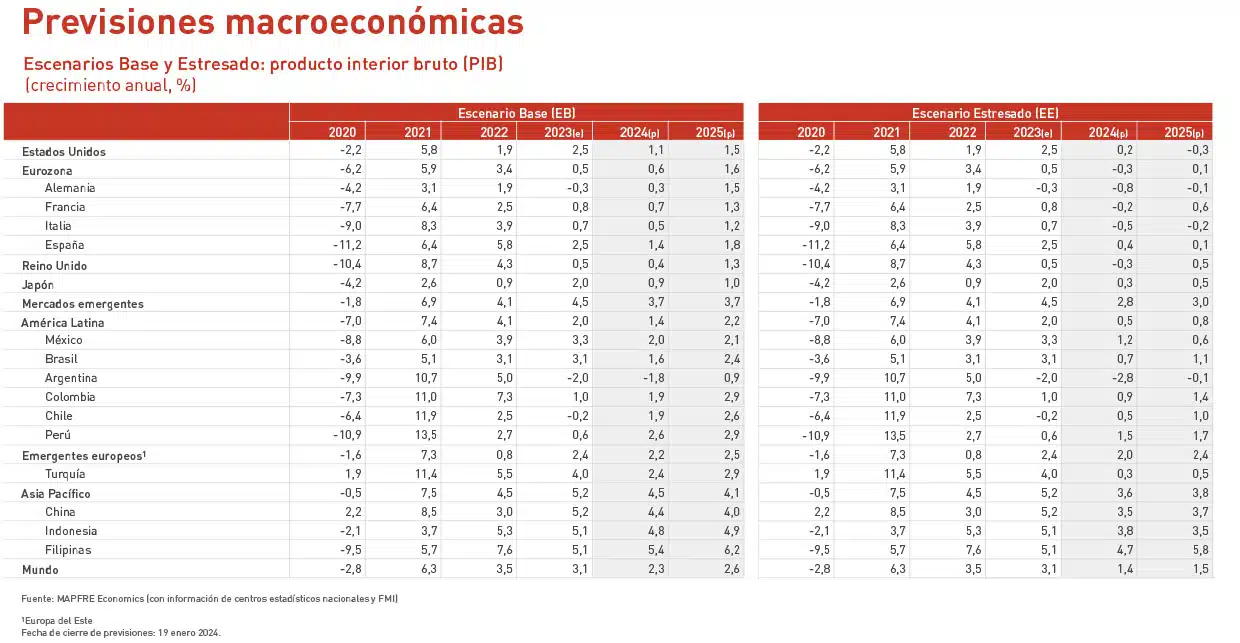

Economic growth will continue to weaken in 2024 due to high inflation and the money tightening measures implemented to control it. With this in mind, MAPFRE Economics, MAPFRE’s research arm, forecasts that the GDP of the world economy will grow 2.3% this year, followed by a modest recovery in 2025 of 2.6%. Despite that upturn, growth will remain far from the potential and average growth figures of the past few decades. These are the predictions highlighted in the “Economic and Industry Outlook 2024”, prepared by MAPFRE Economic Research and published by Fundación MAPFRE.

Inflation will continue its downward trend and is expected to reach 4.4% by the end of 2024, falling further to 3.3% in the following year. This slowdown in price increases, together with weakened growth, paints a less stagflationary picture than previous editions of the report, as the risk balance, which the central banks have been able to stabilize and control more.

Geopolitical crises and other key risks are expected to persist in 2024. The complexity and interconnectedness of supply chains, along with tail risks, which weren’t an issue in 2023, could reemerge and test the resilience of world trade in the wake of the global economic shifts instigated by the recent conflict in the Middle East and developments in the Red Sea.

Looking at things from a geographic standpoint, the United States’ contribution to global growth will decrease this year, though developed economies will continue to play a bigger role than emerging economies in this area. Thus, this world power is expected to grow 1.1% this year and 1.5% in 2025, and higher inflation hasn’t been ruled out, due to slowing demand and less reliance on supply-side constraints. Stagnation will continue to be the order of the day for the Eurozone, with the forecast signaling that it will continue suffering from insufficient economic activity and a lack of clear engines of growth, though it could start to gradually recover at the end of the year or the beginning of 2025. MAPFRE Economics expects its GDP to grow by 0.6% in 2024 and 1.6% the following year.

Asia is in a less than ideal situation when it comes to inflation, but it will still be compatible with “acceptable” growth rates, and the region will continue to be the main buffer of global growth, with an anticipated rate of 4.5% for this year and 4.1% for the following year. Latin America will be affected by less foreign demand, which will be reflected in this year’s growth, an expected 1.4% for 2024 and 2.2% for 2025.

Impact on the insurance industry

The insurance industry will continue to notice the impact of financial tightening, which leads MAPFRE Economics to anticipate a decrease in Non-Life insurance underwriting in the wake of the cyclical slowdown, with an average increase of 5% between 2024 and 2025 worldwide compared to the 7.1% expected for 2023. The performance of the Life savings business will depend on both economic activity and how the interest rate environment goes, with this line of business expected to benefit from sufficiently high rates to generate new business, despite the expected cuts. As such, the Life business as a whole should register growth of almost 7%.

In general, MAPFRE’s research arm predicts an improvement in profitability for the sector – which had been impaired in recent years as a result of the rise in inflation – due to the upward revisions of insurance premiums and moderation in the growth of insurance costs. The financial income of insurance companies’ investment portfolios will contribute to this improvement in profitability.

You can read the full report here