ECONOMY| 26.04.2023

From the United States to the Philippines: these are country-level forecasts from MAPFRE Economics

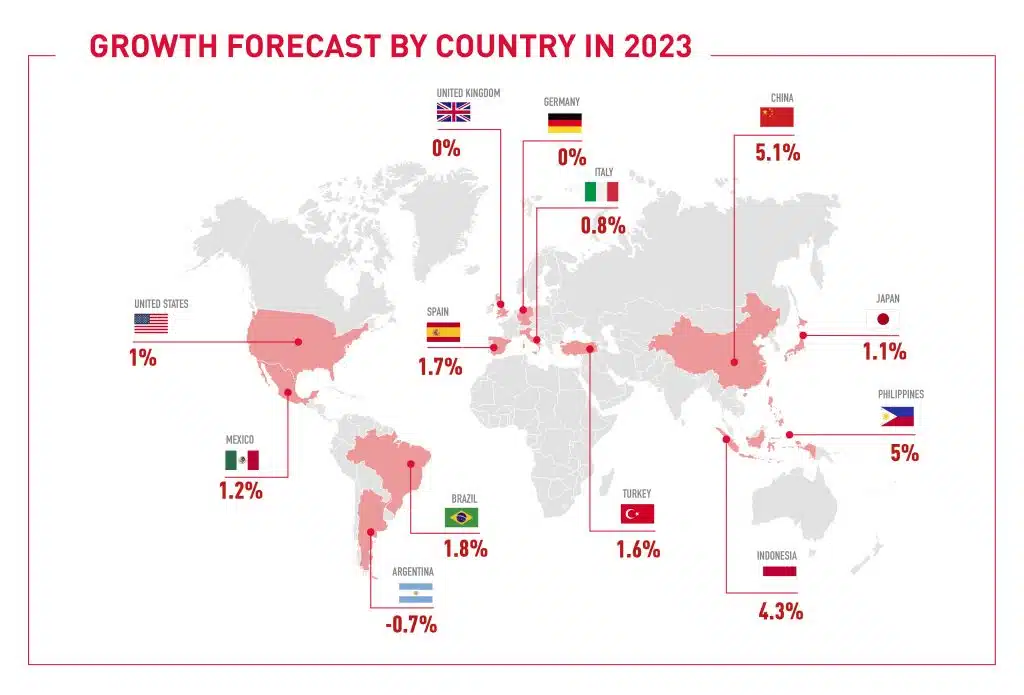

MAPFRE Economics, MAPFRE’s research arm, recently published the report “Economic and Sectoral Outlook 2023: Forecasts for the Second Quarter,” edited by Fundación MAPFRE. This study anticipates an improvement in global growth of 0.7 percentage points, with the forecast for this year standing at 1.7% compared to the 1% forecast at the beginning of the year. However, each country has its own specific circumstances, and there is much variation from one country to another.

These are the country-level forecasts from MAPFRE Economics for 2023:

United States

Despite a 1% growth forecast for the United States, the country is expected to enter recession in the first quarter of 2024. In fact, the slowdown is already beginning to appear in many sectors. Consumption has not slowed further because households are still using their credit capacity and savings accumulated during the pandemic. Nevertheless, tighter financing conditions will manifest themselves in consumption levels in the upcoming quarters, which is precisely the effect pursued by the Federal Reserve (Fed) to contain inflation.

The risks to the US economy now center on concerns around the banking sector, although the Fed and the Treasury have already committed to supplying the necessary liquidity to keep it afloat. Moreover, monetary tightening, by its own transmission mechanism, will see bank lending constrict and will lead to an economic slowdown.

China

During 2023, a return to normal activity is expected alongside a strong boost to consumption due to pent-up demand and accumulated savings, while inflation is well under control. Growth is forecast at 5.1% for 2023 and 4.9% for the following year.

Economic activity is resuming, but China has many uncertainties to handle. The first is geopolitical, as tensions with the United States increase over the Taiwan issue, but it is not the only one. The Belt & Road infrastructure project aims to connect the “Chinese factory” with the rest of the world and reduce dependence on the United States as a market, while, in the economic field, China has not overcome the risks linked to the real estate sector, which, if not well managed, could affect the financial sector.

Germany

MAPFRE Economics anticipates a slowdown in Germany in the coming quarters, especially in consumption, due to the loss of purchasing power and tighter financial conditions. GDP is expected to contract in the second and third quarters, albeit less than expected a few months ago, resulting in a short and shallow recession. Thus, by 2023, Germany is expected to record flat growth, i.e., a 0% increase in GDP.

Inflation remains high, standing at 7.4% in March due to high energy costs, making its industry uncompetitive and tightening financial conditions. Hopes of moderating inflation are fading, as high energy costs drag on and inflation starts to have second round effects (wage increases and generalized price increases across products).

Spain

The growth forecast for Spain stands at 1.7% in 2023 compared to the 1% forecast at the beginning of the year, an improvement driven by moderating energy costs and a return to normalcy for production chains. Spain’s economy is not expected to contract in any quarter thanks to the recovery of net exports and a reasonable consumption performance despite inflation and high financial costs. If this remains true, Spain will exceed its pre-pandemic production level this year.

The study demonstrates that Spain is comparatively better off than other European economies. Inflation, while benefiting from base effects, will not see a more definitive easing until the energy problem is resolved, while higher financial costs could also eventually have an impact on the prices of goods and services.

Italy

MAPFRE Economics has also upgraded the forecast for Italy to 0.8% for 2023, thanks to an improvement in indicators such as industrial production, retail sales, and consumer confidence, among others.

On the risk side, the health of the banking sector will be under the microscope, as will government bond yields. The latter have fallen as they has functioned as a safe haven for money fleeing equities, benefiting government funding costs in the medium term, however, if current levels continue for much longer, renewals will gradually be affected.

United Kingdom

The UK is forecast to enter recession at the start of 2023 due to falls in consumption and government spending, leaving GDP growth flat for the full year. Despite all the uncertainties, the MAPFRE Research Service anticipates a recovery the following year with growth of 1.6%.

Inflation will continue to moderate in the coming quarters, although second-round effects and continued high energy costs are making it difficult for it to drop as fast as anticipated. This is compounded by shortages in some food products due to energy costs, fertilizer costs, and Brexit-related logistical difficulties.

Japan

The forecast for Japan this year projects weak growth of 1.1%, the same as in 2024. The first quarter will be particularly weak, although it will pick up over the course of the year. At the same time, inflation is taking off, reaching 3.3% in February, the highest figure since the early 1980s.

The main short-term risk for the Japanese economy is pressure on the exchange rate given the counter-cyclical monetary policy and the huge monetary expansion of the last 15 years. Additional risks include continued high commodity costs, aggravated by a weak yen, and a slowdown in consumption in the destination countries of its exports.

Turkey

Turkey’s economy has begun decelerating, which will lead to a growth rate of 1.6% in 2023, weaker than in previous years. In 2024, it will grow by 2%. Inflation in Turkey continues to soften, falling to 50.5% in March from a peak of 85.5% in October.

Elsewhere, the impact of the earthquake on output, consumption, employment, and expectations is being assessed by the authorities. While the earthquake is expected to affect economic activity in the short term, it is not expected to have a permanent negative impact on the Turkish economy in the medium term. The stronger than expected contribution of tourism receipts to the current account balance is maintained for 2023.

Mexico

Mexico has met previous growth expectations, and growth is expected to reach 1.2% this year and 1.5% by 2024. Inflation is slowing, albeit more slowly than anticipated.

Among the main short-term risks to the Mexican economy is a possible recession in the United States, which would spill over to Mexico via its exports, both in the automobile sector and in the construction materials sector. The disinflation process is proving slower than expected, and a restrictive monetary policy will continue to affect financing costs, consumption, and investment. Nevertheless, the Mexican economy could benefit from the relocation of US multinationals’ production chains.

Brazil

The Brazilian economy performed much better than expected in 2022, and in 2023, it is expected to grow by 1.8%. The reopening of China and a good agricultural season will provide some support to the performance of the Brazilian economy, although it will be counterbalanced by slowing private and public consumption.

The study identifies several short-term risks for Brazil. For example, it draws attention to the ongoing inflationary pressures globally and the prices of the raw materials that Brazil exports, which could suffer a drop in prices. In addition, the global economy may suffer a more pronounced slowdown than is currently expected, as well as a reintroduction of taxes that had been reduced during the confinements.

Argentina

2023 will continue to be difficult for the Argentine economy. Inflation is expected to reach above 102%, according to the central bank’s survey of expectations, and its currency will continue to depreciate as a result of the growth of the monetary base due to the influx of money from multilateral organizations (IMF and Inter-American Development Bank).

Thus, MAPFRE Economics forecasts a GDP contraction of 0.7%. Drought in the agricultural sector alone is estimated to account for a drop of at least 2.1 percentage points in GDP, which will affect people’s incomes and government tax revenues. This sector is also important in securing the foreign currency needed for the smooth functioning of the rest of the economy.

Indonesia

Economic activity levels are expected to weaken in the coming quarters, due to the absence of fuel subsidies and the effect of inflation, resulting in growth of 4.3% in 2023 and 5.4% the following year. In addition, weaker consumption and exports are also expected.

Risks to the Indonesian economy could come from a global economic slowdown, affecting the prices of its main exports, palm oil and coal. Rising interest rates on external dollar-denominated debt pose a challenge for all emerging countries when attempting to roll over these debt issues, and instability in international funding markets will be a challenge for Indonesia.

Philippines

The Philippine economy will slow down to 5% growth in 2023 and 5.2% the following year, following the 7.6% growth the country experienced in 2022. This weakening is mainly due to inflationary pressures and tighter financial conditions.

Inflation, the most prominent short-term risks to the Philippine economy, appears to be accelerating at present. The terms of trade have been worsening for years, with the price of exports growing less than those of imports. On the positive side, the Philippine economy is recording sustained high economic growth, even if it will slow down somewhat in 2023.

RELATED ARTICLES: