ECONOMY|03.21.2024

Fondmapfre Global: an overview of the largest fund managed by Mapfre AM

When it comes to choosing a mutual fund, equity under management is one of the key considerations. A larger asset volume brings about increased investment diversification, improved capacity to handle redemptions, generally lower fees, and, consequently, higher net returns. And, generally speaking, an endorsement for new investors, who identify this substantial asset with more stability and reliability.

So today we’re going to analyze the mutual fund at MAPFRE AM, MAPFRE’s fund manager with the highest volume of assets: Fondmapfre Global FI. This investment vehicle manages assets worth €267.3 million, according to the latest data available from Morningstar (as of February 28, 2024).

Fondmapfre Global is a fund of funds with a global focus and exposure to fixed income, equities and currencies. For readers who are less versed in finance, this fund of funds is just that: a mutual fund that invests in other mutual funds. This means it can invest in the assets that you want to invest in indirectly, through the best managers and products that are already committed to these assets.

The fund invests a considerable part of its assets in financial collective investment institutions (CIIs) that do not belong to the management group. These institutions are domiciled in OECD countries (mainly in Europe) or listed on an EU Stock Exchange with daily liquidity. Specifically, as indicated in the Key Investor Information Document (KID), the investment in funds will never be less than 50% of the assets, and generally, stands between 75% and 95%. From this percentage, a maximum of 30% is invested in non-harmonized CIIs.

To date in 2024, the management team, made up by Patrick Nielsen, César Gimeno and Nicole Sophie Gomez Adenis, has recorded returns of more than 5%. At 12 months, the fund achieves returns of close to 14% while at 5 years, it achieves annualized returns of more than 8%. As always, it’s worth remembering that past performance doesn’t guarantee future gains, and before investing in a fund, the investor must determine their risk profile and consult with an expert if they can’t make up their mind.

The fund has a medium-high risk profile, with a risk rating of 5 out of 7, according to the Morningstar classification. This rating reflects an investment strategy that, while seeking to maximize returns, also maintains a balanced and calculated approach to risk. The fund’s geographic and sector diversification plays a crucial role in mitigating risk, allowing the fund to navigate global markets with greater stability.

The portfolio has a wide range of assets and no restrictions when it comes to exposure, markets, currency, market capitalization, sectors, credit rating or average duration. At January 31, 2024, equities accounted for a large weight and represented 84.4% of assets, while fixed income exposure represented 7.63% and cash accounted for 7.81%. By regions, the United States accounts for more than half of the portfolio’s exposure, with 55.4% of the total, followed by the Eurozone (12.75%), Japan (9.22%) and Emerging Asia (8.19%).

And as for sectors of activity, the fund invests most of its portfolio in technology, accounting for 23.89% at January 31. In second place were financial services, with 15.81% of the total, then cyclical consumption (13.02%), health (11.4%) and industry (10.68%).

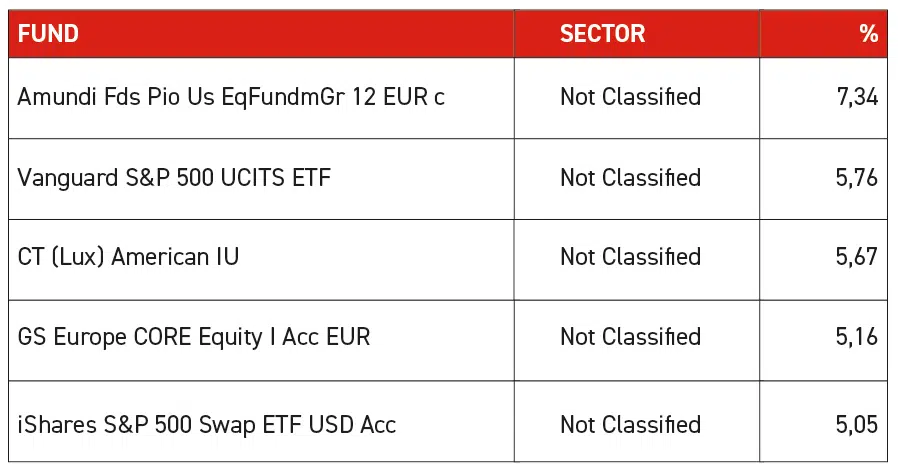

These are the top five positions of Fondmapfre Global FI.