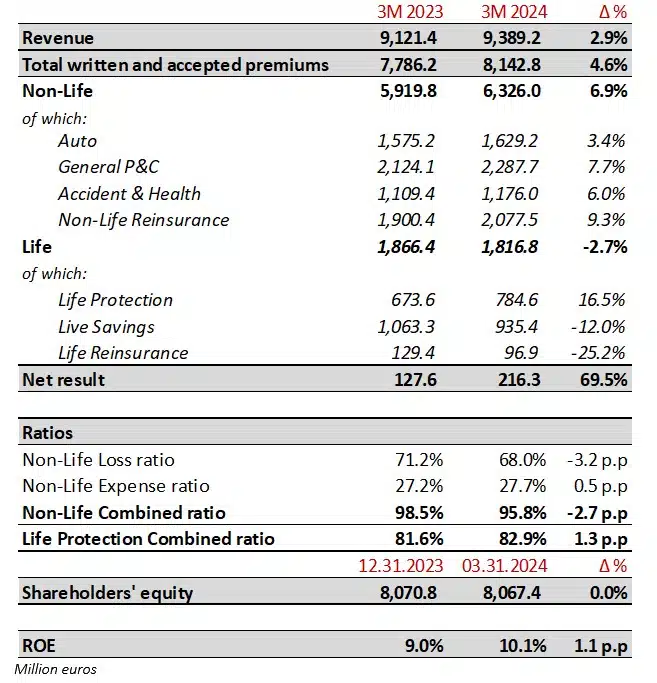

MAPFRE’s net result reaches 216 million euros (+69%) in the first quarter

- The new Strategic Plan strengthens growth in all lines of business and the result improves in most countries.

- Premiums grow 4.6%, surpassing €8.1 billion, while revenue stands at close to €9.4 billion.

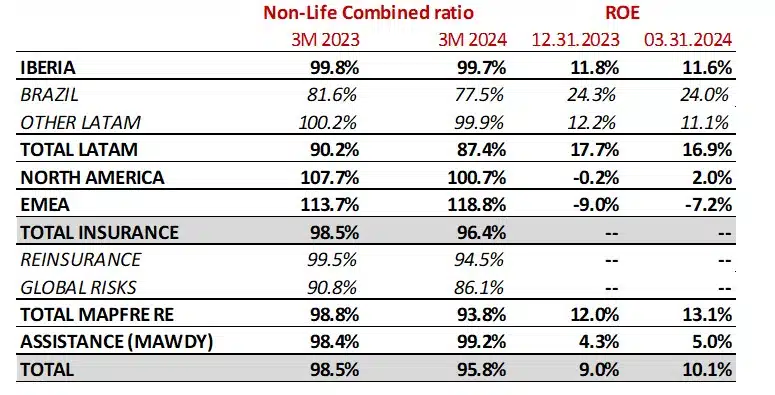

- Significant improvement of 2.7 points in the Non-Life combined ratio (95.8%) and a greater contribution from the financial result.

- The ROE exceeds 10%.

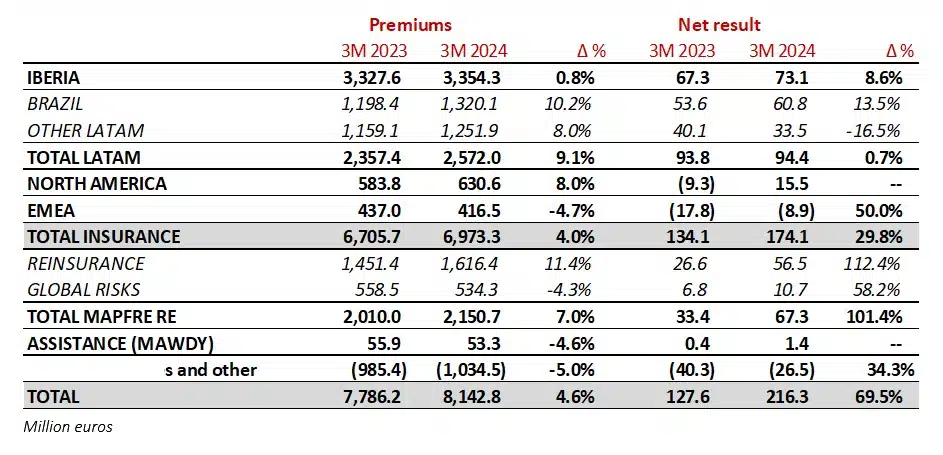

- LATAM, especially BRAZIL, continues to be the growth engine for the Group with a 9.1% increase in premiums and €94 million in earnings.

- IBERIA’s result grows 8.6% and technical improvements continue in Auto, which is the line most affected by inflation.

- NORTH AMERICA posts a relevant improvement in the result thanks to the technical measures implemented.

- MAPFRE RE, which includes the reinsurance and Global Risks businesses, posts solid business growth and doubles its result, reaching €67 million.

- The Solvency ratio stands at 208.2% at the close of 2023, 199.6% without transitionals, according to provisional figures.

- MAPFRE will pay the final dividend against 2023 on May 24th.

“The positive results of the first quarter, with an ROE of over 10%, are proof of the strength of our business model and the first results from the new Strategic Plan. Our geographic diversification continues to contribute solid, profitable growth” says Antonio Huertas, Chairman and CEO of MAPFRE.

*DISCLAIMER: MAPFRE S.A. hereby informs that the figures and ratios in this activity report are presented under the accounting principles in force in each country, homogenized for comparison and aggregation between units and regions. As such, certain adjustments have been applied, the most relevant of which are the following: the elimination of the goodwill amortization in Spain and the elimination of catastrophic reserves in some Latin American countries. In Malta and Portugal, the applicable local accounting is IFRS 17 & 9. MAPFRE Group presents its financial statements under the international accounting standards in force (IFRS 9 and 17) applicable to listed companies on a half-year basis.

- Key figures

- Premiums are up 4.6%, with a slight positive impact from exchange rates (3.8% at constant rates). This advance is supported by the strong growth in General P&C and Life Protection, as well as in Reinsurance, business lines with greater contribution to the result. Auto shows lower growth as a result of the technical measures implemented in this line. Life Savings, although it is down 12% from the extraordinary issuance in 2023, reaches €935 million, doubling 2022 premiums. By region, there is noteworthy growth in IBERIA, LATAM, NORTH AMERICA and MAPFRE RE.

- The net result, which stands at €216 million, is up almost 70%, based on the following developments in the quarter:

- The relevant improvement in Non-Life technical profitability, with an almost 3-percentage point reduction in the combined ratio, from both technical measures in underwriting and tariff adjustments, as well as the absence of relevant Cat events (in 2023, the earthquake in Turkey).

- The growing contribution of financial income, which reaches €195 million in the quarter for the Non-Life business (+30.2%).

- The great stability of the Life Protection business in IBERIA and LATAM.

- The effect of hyperinflation adjustments, with a €24.6 million negative net impact (€10.5 million in 2023), mainly from Argentina.

- A €15 million positive tax impact resulting from declaration of unconstitutionality of Royal Decree-Law 3/2016 regarding the impairment of investees.

- The Non-Life combined ratio improves 2.7 p.p. and stands at 95.8% with the following performance:

- General P&C reaches an excellent combined ratio of 83.5%, (-3.8 p.p.), compensating the high loss experience that persists in other lines affected by inflation.

- The Auto combined ratio improves 1.1 p.p. to 105.3%.

- The Accident & Health combined ratio stands at 102.8% and has deteriorated compared to the previous year (+1 p.p.) also due to an increase in costs.

- The Life Protection combined ratio remains at an excellent level (82.9%), and the financial result continues to have a relevant contribution.

- Shareholders’ equity for the Group reaches nearly €8.1 billion with almost no variation during the quarter.

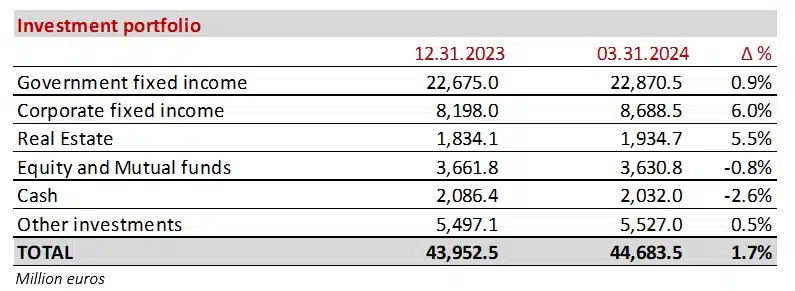

- The investment portfolio is shown below.

IBERIA maintains its solid leading position in the main lines of business with a focus on profitable growth and its result grows more than 8%

- Premiums in IBERIA reach nearly €3.4 billion (+0.8%), with Spain standing out with over €3.2 billion (-0.8%). Premiums in Portugal reach €127 million (+70.7%) driven by the strong growth in Life Savings.

- Non-Life premiums are up 6.4% and reflect the positive development of General P&C (+6.7%), driven by Homeowners and Condominium lines, and Accident & Health (+7.1%).

- In Auto, premiums are up 5% due to the gradual adaptation of tariffs to the inflationary context.

- The Non-Life result and combined ratio continue to be affected by the Auto business. The combined ratio of this line improved slightly (-0.8 p.p.) to 105.7%. Tariffs will continue to be adapted based on the development of expected costs.

- General P&C has a stable combined ratio, which stands at an excellent 93.8% (+1.4 p.p.).

- Life business continues contributing significantly to the result, both in the Savings as well as the Protection segments – the latter had a 67.5% combined ratio (-5.7 p.p.). Life premiums (-10.9%) are affected by the extraordinary issuance in 2023.

- The financial result continues to improve in a favorable environment.

- The net result reaches €73 million, of which Spain contributed €70.7 million and Portugal €2.4 million.

Business in LATAM shows strong growth and continues being the Group’s growth engine and largest contributor to earnings. Premiums grow 9.1% surpassing €2.5 billion, and the result reaches €94 million

BRAZIL consolidates solid growth with a net result of €61 million (+13.5%), reflecting improvements in the technical result and the strong contribution of the financial result

- In Brazil, premiums reach over €1.3 billion (+10.2%), and reflect a slight appreciation of the Brazilian real (+2.6%). In local currency, premium growth is 7.3%, thanks to Agro Insurance and Life Protection.

- The Non-Life combined ratio improves significantly to 77.5%, due to a 5.3 point reduction in the Auto combined ratio, which stands at 101.3% thanks to previously implemented tariff adjustments. The General P&C combined ratio stands at an excellent 69.6%, supported by the Agro business which was not affected by relevant events.

- The Non-Life financial result is in line with recent quarters.

- The Life Protection business also posts a solid combined ratio, standing at 81.6% (+3.8 p.p.).

The rest of LATAM maintains its strong contribution to the Group result

- Premiums are up 8%, while the net result stands at €33.5 million, with relevant contributions from Mexico and Peru. Written premiums grow in local currency, with noteworthy performance in Chile (13%), Dominican Republic (12%) and Peru (12%).

- The combined ratio improves to 99.9% (-0.3 p.p.), with positive developments in General P&C and Auto that offset the performance of the Accident & Health business.

- Life business continues contributing very positively and financial income maintains its upward trend.

- In Mexico, premiums reach €368 million (+10.5%), also driven by peso appreciation (+8%). Both the Auto line as well as Life have experienced strong business growth. The combined ratio stands at 96.9% and the net result at €12.3 million.

- In Peru, premiums reach €203 million, growing 12.1%, with a net result of €12.3 million.

- Hyperinflation adjustments, primarily from Argentina, had a €17.9 million negative impact on results (€8.6 million in 2023).

NORTH AMERICA posts a strong improvement in the result, due to the technical measures implemented

- Premiums reach €631 million (+8%), of which the United States contributed close to €555 million (+5.5%).

- The Non-Life combined ratio has a noteworthy improvement, reaching 100.7% (-7 p.p), thanks to benign weather and significant tariff adjustments implemented last year.

- In General P&C, the combined ratio stands at 96.2% (-35.3 p.p.). The Auto combined ratio also improves substantially, reaching 101.8% (-3.2 p.p.).

- Puerto Rico business volume increases, reaching €76 (+31.2%), with a €4.1 million result.

- The region has a net result of €15.5 million, compared to losses of €9.3 million the previous year.

EMEA improves its result

- Premiums stand at €416 million (-4.7%), reflecting the fall in the Life business in Malta and Auto in Italy.

- In Turkey, the positive performance of financial investments has offset the effect of inflation, leading the country to report profits in the first quarter of 2024. Finally, Malta continues with a recurring contribution to earnings.

- The region posts €8.9 million in losses (compared to €17.8 million in losses in 2023), mainly in Germany and to a lesser extent Italy, as a result of the complicated Auto environment.

MAPFRE RE doubles its result, supported by profitable growth

- MAPFRE RE premiums, which include the reinsurance and Global Risks businesses, are up 7%, reaching nearly €2.2 billion.

- The combined ratio improves significantly in the year to 93.8% (-4.9 p.p.), supported by the recovery of tariffs, especially catastrophic covers. There have been no impacts from relevant Cat claims in the quarter, compared to the same period in 2023 when there was a relevant earthquake in Turkey.

- The financial result continues increasing its contribution, and the net result reaches €67.3 million, up 101.4%.

MAWDY continues to focus on strategic markets for the Group

- Revenue, which includes premiums and service revenue, reaches €130 million, growing 13.5%, and posting net earnings of €1.4 million.

3. The Solvency ratio improves to 208%

- MAPFRE Group will publish its 2023 Solvency and Financial Condition Report (SFCR) on May 20th. The provisional figures place the Solvency II ratio at 208.2% (201.2% in 2022). Without transitional measures for technical provisions, this ratio stands at 199.6% (191.4% in 2022). In both cases, the ratio is within the reference framework established by the Group of 200% +- 25 points.