CORPORATE | 06.04.2020

MAPFRE calculates its Solvency II ratio as 177 percent at the close of the first quarter of the year

It remains within the range set by the company of 25 points above or below 200 percent — twice the capital required by the regulator

MAPFRE has updated the calculation of its Solvency II position as on March 31, 2020, following a request from the General Directorate for Insurance and Pension Funds, and within the framework of the Recommendations on supervisory flexibility regarding the deadline of supervisory reporting and public disclosure – Coronavirus/COVID-19 issued by EIOPA, the European insurance supervisory authority.

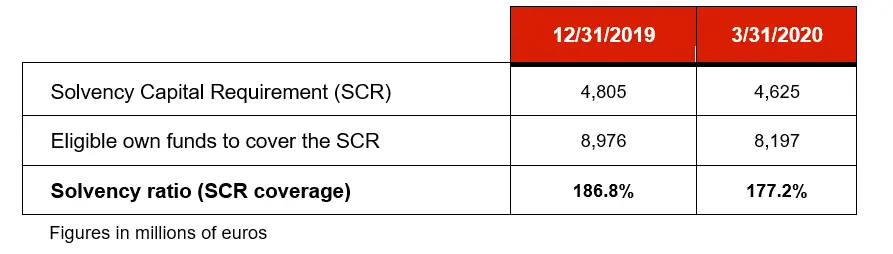

This updating of its solvency position (of which the Supervisor has already been notified) required both the Solvency Capital Requirement (SCR) and eligible own funds to be calculated in the first quarter of 2020 — usually calculated annually and quarterly, respectively. These results are detailed below, along with the results calculated at the close of 2019 for comparison purposes:

The Solvency II ratio has decreased by 9.6 percentage points (pp) and reflects the measures adopted by the Group in March to mitigate the impacts of the COVID-19 crisis and protect its solvency and capital position as a result. MAPFRE’s ratio reduction is among the lowest when compared to the data published by the major European insurance companies. “Against a backdrop of a decrease in the value of financial assets and falls in shareholders’ equity as a result of the collapse of the markets that took place in March, this variation is very satisfactory and reflects the strength and resilience of the company’s balance sheet,” explained Fernando Mata, CFO and member of the Board.

Despite the impact of the crisis, MAPFRE remains within the tolerance range set down by the Board, whereby the lower threshold—the solvency margin—is 175 percent.