CORPORATE | 09.21.2020

MAPFRE’s Solvency II ratio stands at 184% at the close of the first half of the year

It improves seven points compared to the first quarter, and remains within the range set by the company of 25 points above or below 200 percent

MAPFRE has updated its Solvency II position as on June 30, 2020, following the request from the General Directorate for Insurance and Pension Funds, and within the framework of the Statement on Solvency II supervisory reporting in the context of COVID-19 issued by EIOPA, the European insurance supervisory authority.

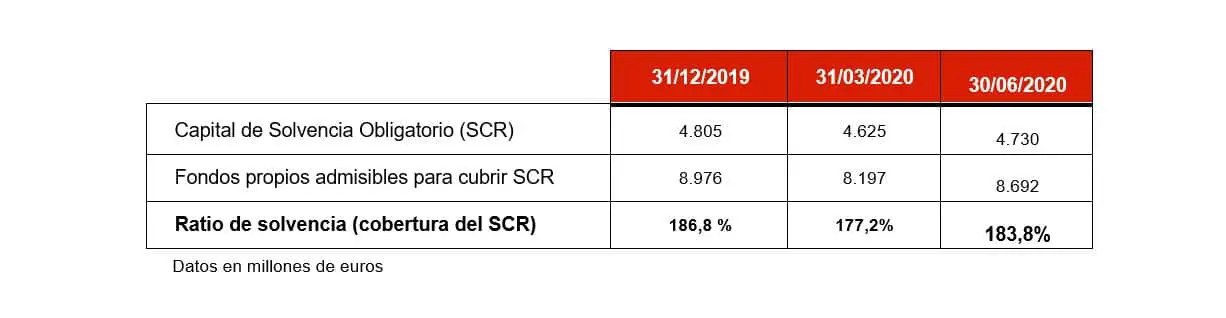

This updating of its solvency position, which has already been reported to the Supervisor, required both Solvency Capital Requirement (SCR) and eligible own funds to be estimated in the first half of 2020 – usually calculated annually and quarterly, respectively. The results are detailed below, along with the results calculated at the close of 2019 and the first quarter for comparison purposes:

The Solvency II ratio has improved by 6.6 percentage points compared to March, and reflects the significant increase in own funds (an increase of almost 500 million euros in the second quarter of the year), as a result of actively managing the investment portfolio in a more favorable environment. “The robustness of the Solvency ratio reflects, once again, the great strength and resilience of the company’s balance sheet,” explained Fernando Mata, CFO and member of the Board.

Despite the impact of the crisis, MAPFRE remains within the tolerance range established by the Board, which sets the lower threshold of the solvency margin at 175 percent.