CORPORATE | 29.04.2021

MAPFRE’s earnings rise 37 percent in the first quarter, to 173 million euros

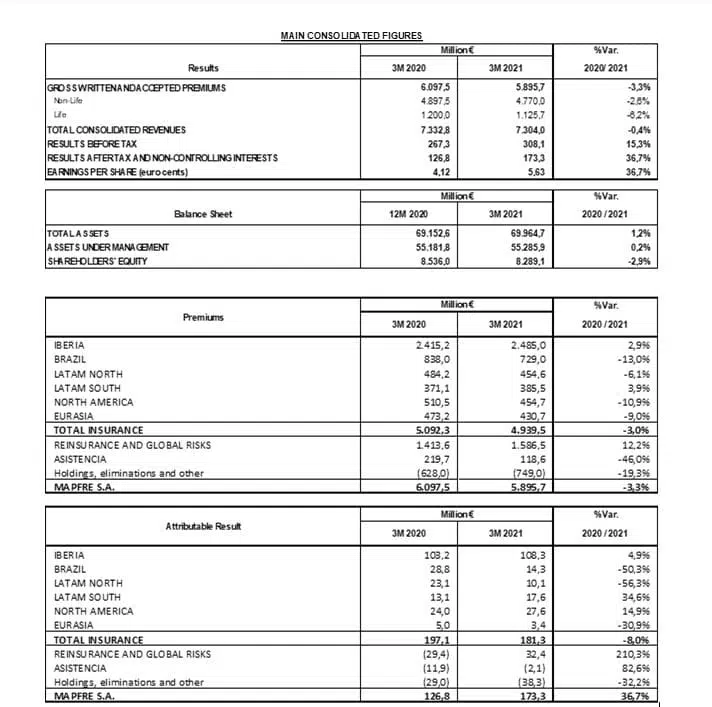

- Group revenue remains stable at more than 7.3 billion euros while premiums total 5.9 billion euros (-3.3 percent), affected by currency depreciation. At constant exchange rates, premiums would have grown by 3.2 percent.

- Business progresses positively in Spain, increasing by 2.9 percent, and profits are up 5.5 percent, with the country remaining the biggest contributor to Group earnings. All LATAM countries closed the quarter with a profit. MAPFRE RE performed well, producing earnings of more than 32 million euros.

- COVID-19 claim costs amount to 109 million euros, of which 77 percent are from LATAM. The net impact of claims relating to Storm Filomena comes to almost 20 million euros, split between MAPFRE RE and MAPFRE in Spain.

- The Solvency II ratio rose to 193 percent as of December.

- The company is bringing forward the payment of the final dividend of 0.075 euros per share by one month, to May 24.

MAPFRE’s attributable earnings in the first quarter of the year were 173 million euros, representing growth of 36.7 percent compared with the same period in the previous year, driven by improved business in Spain, LATAM South and North America, and an upturn in the reinsurance business. This increase is particularly significant given that it comes after dealing with COVID-related claims of more than 109 million euros for the quarter, including more than 34 million euros in Health and 48 million in Life-Protection, almost completely concentrated in Latin America. The fall in loss experience for Automobile and General P&C continued due to lockdown measures and the slowdown in economic activity.

The Group’s total revenue between January and March was 7.3 billion euros

(-0.4 percent), while premiums amounted to 5.9 billion euros, 3.3 percent less than the same period in the previous year. However, at constant exchange rates, premiums would have risen by 3.2 percent.

The combined ratio improved by almost 6 percentage points compared to the same quarter in the previous year (pre-COVID), to stand at 94.3 percent, with a notable reduction in the Automobile line and a lack of significant catastrophic claims (the last major earthquake in Puerto Rico was recorded in 2020).

The Group’s equity at the close of March 2021 stood at 8.3 billion euros and total assets amounted to 69.97 billion euros.

MAPFRE’s investments totaled 44.59 billion euros at the end of March. Of these investments, 51.3 percent are in sovereign fixed income, 18.2 percent are in corporate fixed income, 6.6 percent are in equities, with the remainder being cash and other investments.

The provisional Solvency II ratio stood at 192.9 percent in December of 2020, reflecting the strength and resilience of the balance sheet and active investment management. The final data for fiscal year-end 2020 will be published in May. The solvency ratio was strengthened by extending the application of the internal longevity risk model used in Spain to the entire Group, as was recently authorized by the supervisor.

1. Business performance:

Insurance Unit premiums amounted to 4.94 billion euros at the end of March, a decrease of 3 percent compared to the first three months of the previous year. At constant exchange rates, premiums would have risen 4.2 percent.

Iberia

- In the Iberia Regional Area (Spain and Portugal), premiums grew by 3 percent to 2.49 billion euros, with a result of 108 million euros, up 4.9 percent.

In Spain, premiums stood at 2.45 billion euros, up 2.9 percent, compared to a fall of 0.3 percent in the sector. Earnings grew by 5.5 percent to 107 million euros and the country remains the biggest contributor to Group profits. Premiums for the Automobile business rose to 539 million euros, representing growth of 1.3 percent (compared to a fall of 1.8 percent in the market) with more than 6 million insured vehicles and a combined ratio of 88.1 percent — an improvement of 1.7 percentage points. Verti’s performance is also noteworthy, with premium volume up by 6 percent to more than 21 million euros.

General P&C premiums amounted to 711 million euros, 3.6 percent more than in the same period of the previous year, driven by the increase in Homeowners insurance (+3 percent) and Condominium insurance (+5.5 percent), which grew by 2.6 points more than the market. Finally, Health and Accident premiums exceeded 673 million euros, 8.3 percent more than in the first quarter of last year.

Life was the business most affected by the current uncertainty and the persistence of low interest rates, producing premiums totaling 463 million euros, 1.7 percent less than in the first three months of the previous year.

Pension funds amounted to 5.94 billion euros at the end of March, up 3.2 percent, while mutual funds grew by 5.7 percent to 4.1 billion euros.

Brasil:

- In Brazil, premiums stood at 729 million euros, representing a decrease of 13 percent, hit by the depreciation of the Brazilian real (-23.2 percent). In local currency, growth was 13.3 percent, with positive performance in agriculture and the industrial and transport lines. As such, General P&C contributed 370 million euros, while Life produced 247 million euros, with 112 million coming from Automobile. It is important to highlight the improvement in the combined ratio, which was 88.2 percent, almost 7 percentage points lower than in March last year.

Latam Norte:

- In the LATAM North Regional Area, premiums amounted to 455 million euros (-6.1 percent). These figures were largely determined by the depreciation of the area’s main currencies (-9.1 percent for the Mexican peso and -14.2 percent for the Dominican peso). Mexico contributed 255 million euros to the region (-1.4 percent), while premium volume in the Central America and Dominican Republic subregion amounted to 200 million euros, including 77 million euros from the Dominican Republic, 50 million euros from Panama and 25 million euros from Honduras. The combined ratio for this region stood at 93 percent at the end of March this year.

Latam Sur:

- The LATAM South Regional Area ended the first quarter of the year with premium volume of 386 million euros—up by 3.9 percent—driven by the General P&C line, which grew by more than 15 percent. The performance of Colombia and Chile is noteworthy, with the former seeing a premium increase of 17.9 percent to 103 million euros and the latter growing by 31.4 percent to 63 million euros.

LATAM South’s earnings figure was 34.6 percent better at 18 million euros. Peru remained the biggest contributor, with a profit of 7 million euros, representing growth of 59.9 percent.

The region’s combined ratio fell by 8 percentage points to 89.4 percent, thanks to the decrease in both the loss and expense ratios. It should also be highlighted that the combined ratio of all lines (Automobile, General P&C and Health and Accident) improved significantly.

Norteamérica:

- In the North American Regional Area, premiums amounted to 455 million euros, falling by 10.9 percent compared with March of last year.

Business in the United States contributed 396 million euros in premiums to the Group, down 11.7 percent, as a result of the depreciation of the dollar (-7.6 percent), the downturn in economic activity due to COVID-19 mobility restrictions and the strict technical control measures implemented two years ago in an effort to improve the profitability of the business.

In Puerto Rico, premium volume amounted to 58 million euros

(-5.3 percent, although in local currency it would have been up 3 percent), with a profit of more than 3 million euros recorded for the period to the end of March.

It is important to highlight the performance of the combined ratio in this regional area, which improved by more than 5 percentage points to stand at 96.6 percent.

Eurasia:

- Premiums in the EURASIA Regional Area amounted to 431 million euros at the end of March, 9 percent lower than the same period of the previous year. This decline was mainly the result of the depreciation of the Turkish lira (-24.6 percent).

In Germany, premiums stood at 159 million euros, with growth of 4.4 percent—driven by attractive promotion campaigns and an excellent renewal ratio—and a profit of 2 million euros (+24.5 percent). In Malta, premiums grew by 11.4 percent to 110 million euros, while earnings rose by 58.9 percent to 2 million euros. Finally, business in Turkey exceeded 80 million euros (-22.6 percent), with a profit of 2 million euros (-62.2 percent).

MAPFRE RE

- In MAPFRE RE, which includes the reinsurance and major risks businesses, premiums increased by 12.2 percent in the first quarter of the year to just under 1.59 billion euros, with earnings of more than 32 million euros, and the combined ratio improved by more than 14 percentage points, taking it to 95.1 percent.

The reinsurance business closed the first quarter of the year with premium volume of 1.21 billion euros, up 14 percent, due to improved conditions in some lines, and earnings of 25 million euros, compared with losses of 22 million euros in March 2020.

In addition, premiums in the Global Risks business rose 6.8 percent to 373 million euros, while its profit figure was 8 million euros, compared to a negative result of 8 million euros in the first quarter of the previous year.

ASISTENCIA

Finally, revenue totaled 136 million euros at the Asistencia unit, 45.5 percent less than between January and March 2020, strongly impacted by the reduction in the volume of the travel insurance business. The negative result (2 million euros) was also significantly affected by pandemic-related travel insurance losses, mainly in the UK and Australia.

2. Dividend

The Board of Directors has agreed that payment of the final dividend for the 2020 fiscal year (of 0.075 euros gross per share), approved by the Annual General Meeting, will be paid on May 24. As a result, the total dividend for 2020 will have amounted to 0.125 euros per share, with the Group set to pay its shareholders a total of 385 million, charged to earnings.

The Alternative Performance Measures (APMs) used in the report, which refer to financial measures not defined or specified in the applicable financial reporting framework, along with their definition and method of calculation, can be found on our website at the following address: https://www.mapfre.com/en/financial-information/