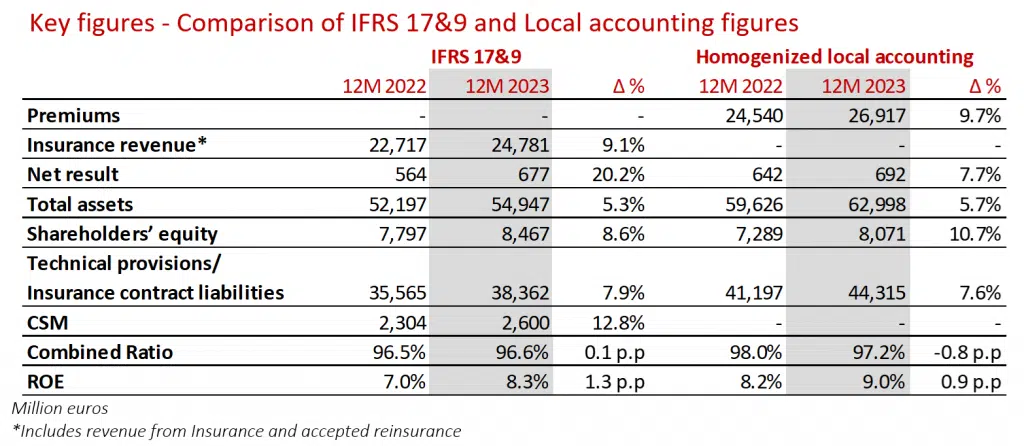

MAPFRE’s net result reaches €692 million (+7.7%) and the adjusted ROE is nearly 10%

- The net result would have stood at €767 million (+19.4%), without the €75 million goodwill writedown in the United States.

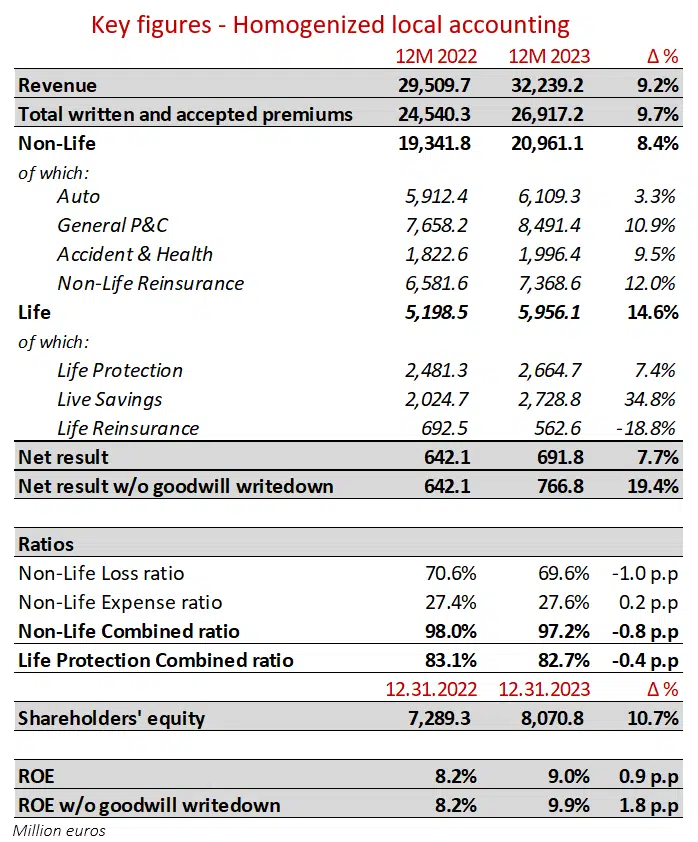

- Premiums are up 9.7%, reaching nearly €27 billion, the highest figure in the company’s history, while revenue grew 9.2%, reaching over €32.2 billion.

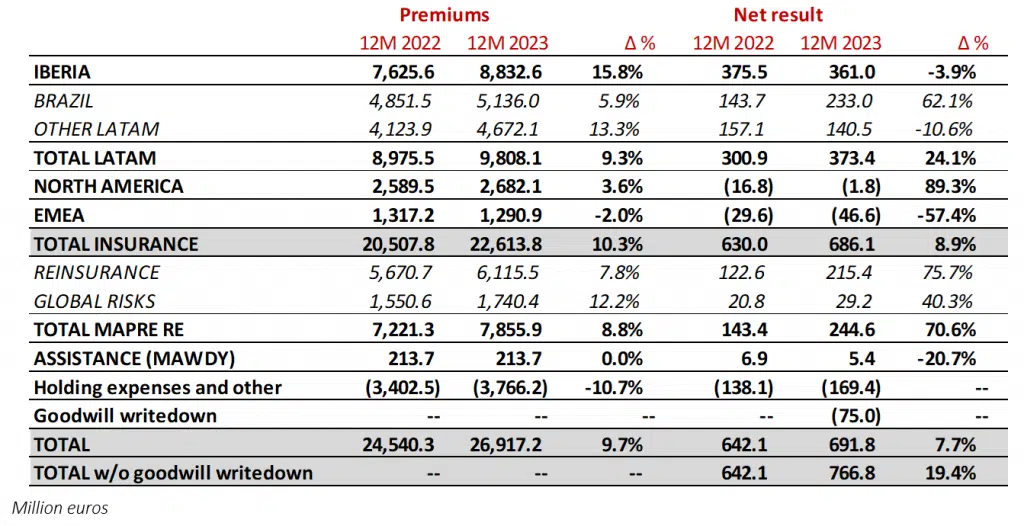

- IBERIA is the unit with the highest premium growth, with an increase of 15.8%.

- LATAM, where net results soared to €373 million, up 24%., is the main contributor to earnings.

- MAPFRE RE increases its contribution to earnings, reaching €245 million (+71%), with solid business growth.

- The ROE stands at 9.9% excluding goodwill writedown in the United States (9% without excluding this impact)

- Shareholders’ equity grew over 10%

- The Board of Directors has agreed to propose to the AGM a final dividend against 2023 of 9 cents per share, 5.9% higher than the previous year.

- Under the new IFRS 17&9 international accounting standards, net income rose 20.2% (€677 million), the ROE stood at 8.3% and shareholders’ equity reached €8.5 billion. The most relevant data are presented herein.

“In 2023, we hit records in terms of premiums, and this strong growth is already translating into profitability, with the adjusted ROE close to 10%. MAPFRE is overcoming the challenges of the current context and continues advancing its business transformation. Furthermore, we reaffirm the commitment to our shareholders with a final dividend of 9 cents, proof of the strength of the Group’s results and financial position”, says Antonio Huertas, Chairman and CEO of MAPFRE.

*DISCLAIMER: MAPFRE S.A. hereby informs that, unless otherwise indicated, the figures and ratios in this activity report are presented under the accounting principles in force in each country, homogenized for comparison and aggregation between units and regions. As such, certain adjustments have been applied, the most relevant of which are the following: the elimination of the goodwill amortization in Spain and the elimination of catastrophic reserves in some Latin American countries. In Malta and Portugal, the local accounting applied is IFRS 17 & 9.

- IFRS ACCOUNTING

- MAPFRE S.A. is reporting its 2023 annual accounts under the new accounting standards, with relatively stable figures. In 2023, the Group has applied the standards IFRS 17 regarding Insurance Contracts and IFRS 9 regarding Financial Instruments in the MAPFRE S.A. consolidated annual accounts submitted to the CNMV today.

- Local accounting reflects the evolution of the different business units under the accounting criteria in force in each country.

- The 9.2% increase in revenue consolidated the trends from recent quarters and reflects both a relevant increase in business volume as well as an improvement in financial income.

- Premiums are up 9.7%, with no relevant impact from exchange rates. This growth reflects a general improvement in business, with an 8.4% increase in Non-Life and a 14.6% increase in Life. IBERIA, LATAM and the Reinsurance business all contribute positively.

- The net result reached €692 million, including the following singular events during the year:

- The occurrence of two relevant catastrophic events – the earthquake in Turkey and Hurricane Otis in Mexico – with a €159-million combined impact. In 2022, there was a drought in the Paraná River basin, with a €113-million impact. Additionally, the higher frequency of weather-related events in Europe led to a €115-million higher net impact than in 2022.

- €46.5-million net revenue as a result of the arbitration from the end of the Bankia alliance.

- €75-million goodwill writedown of insurance operations in the United States. This had no impact on cash generation, solvency, or the Group’s capacity to pay dividends.

- The hyperinflation adjustments in Venezuela, Argentina and Turkey, which had a €47-million negative impact (€41 million in 2022).

- The net result and ROE excluding the impact of this writedown stand at €767 million and 9.9%, respectively.

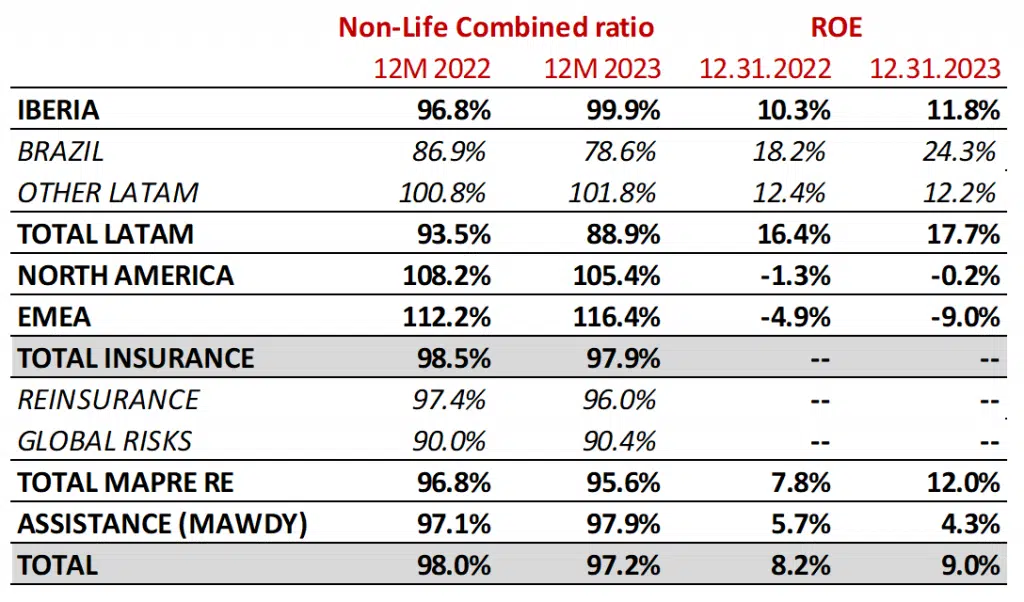

- Regarding Non-Life business, premiums are up over €1.6 billion in the year, with 10.9% growth in General P&C, 9.5% growth in Accident & Health and 3.3% in Auto. The combined ratio stood at 97.2% (-0.8 p.p.), and the volatility and dispersion from previous quarters remain. General P&C maintained a solid combined ratio (87.6%), with a -0.3 p.p. improvement, which compensated the high loss experience that persists in the Auto business. The Auto combined ratio reached 106% (-0.1 p.p.), as a result of inflationary tension. The Accident & Health combined ratio stood at 98.9% and improved compared to the previous year (-1.2 p.p.). The gross financial result, excluding the goodwill writedown, reached €767 million, up almost €160 million, growing 26.2%.

- In the Life business, premiums are up close to €760 million, driven by Life Savings in Spain. The result reflects both good technical performance in all geographies as well as strong financial income, especially in Latin America. The Life Protection combined ratio continues at an excellent level (82.7%), with a 0.4 p.p. improvement in the year. All these factors led to a 12% improvement in the Life technical-financial result.

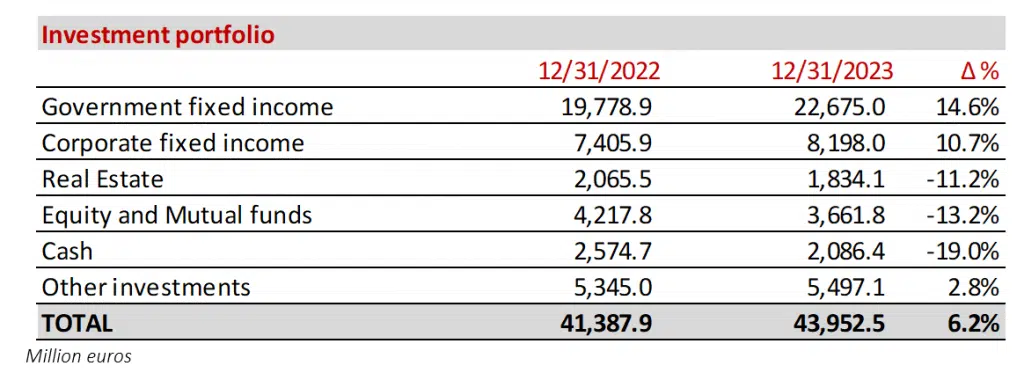

- The investment portfolio is detailed below. Net realized gains had a €91 million impact on the result, in line with the previous year (€100.4 million in 2022).

- Shareholders’ equity for the Group under homogenized local criteria reached nearly €8.1 billion, a €782-million increase (+10.7%). Unrealized gains on the portfolio of financial assets available for sale contributed €566 million in the year, while currency conversion differences were stable.

3. INFORMATION BY REGION AND BUSINESS UNIT (accounting criteria in force in each country)

IBERIA maintains its solid leading position in the main lines of business, growing both in premium volume and number of clients in a complicated context

- Premiums in IBERIA surpass €8.8 billion (+15.8%), with Spain standing out with over €8.5 billion (+15.7%). Premiums in Portugal reached €307 million (+18.8%).

- Life business volume is almost 1.4 times higher than the previous year, reaching nearly €2.7 billion, of which over €2.3 billion correspond to Life Savings (close to €6 billion in 2022).

- Non-Life premiums are up 7.8% and reflect the positive development of General P&C (+9.5%), driven by Commercial lines and Accident & Health (+8.0%).

- In Auto, premiums are up 5.3% due to the gradual adaptation of tariffs to the inflationary context. The portfolio stands at over 6.1 million insured vehicles, with a slight reduction from risk-selection measures.

- The Non-Life result and combined ratio have been affected by the Auto business, which had a combined ratio of 103.6% (+2.6 p.p.). This line is affected by the recovery of mobility to pre-pandemic levels, the high inflation scenario, the Baremo update and a higher occurrence of weather-related claims. Tariffs will continue to be adapted based on the development of expected costs.

- General P&C was also affected by weather-related events, above all the heavy storms in Spain in the second half of the year, which affected Homeowners, Condominiums and Commercial lines. The combined ratio stood at 100.0% (+6.2 p.p.).

- Life business continued contributing significantly to the result, both in the Savings as well as the Protection segment, the latter of which had a 69.1% combined ratio.

- The financial result continues to improve in a more favorable environment, with a €177.9-million gross contribution to the Non-Life result (€117.4 million in 2022).

- The net result stood at €361 million, of which Spain contributed €345.7 million and Portugal €15.4 million. Net realized gains had a €73.5-million impact on the net result (€70.3 million in 2022). The result also includes a €46.5-million net impact from the arbitration for the end of the Bankia alliance (€29.4 and €17.1 million in Life and Non-Life, respectively).

Business in LATAM consolidates the strong trends of recent quarters with over €9.8 billion in premiums and a result of €373 million, the largest contributor to Group earnings.

BRAZIL continues showing strong growth with a result of €233 million (+62.1) thanks to improvements in both the technical and financial result

- In Brazil, premiums reached over €5.1 billion (+5.9%), with the Brazilian real stable. This improvement in written premiums is due above all to the positive development of the Agro Insurance and Life Protection businesses, which grew in euros 7.4% and 5.6%, respectively.

- The Auto business is up 0.9%, and tariffs continue to adapt to inflation. The portfolio of insured vehicles continues going down in the year related to risk-selection measures.

- The Non-Life combined ratio reduced significantly to 78.6%, due to a more than 12-point improvement in the Auto line as a result of tariff increases, reaching 102.5%. The General P&C combined ratio stood at an excellent 69.8%, supported by the Agro business.

- The Non-Life financial result also continues to perform very positively, with a €92.3 million gross contribution (€80.8 million in 2022).

- The Life Protection business also posts a solid combined ratio, standing at 79%. The Life financial result also improved, supported by the high interest rates in the country.

The rest of LATAM continues its strong contribution to the Group result

- Premiums in the region grew 13.3%, while the net result reached €140.5 million, with relevant contributions from Mexico and Peru. Written premiums in local currency grew in all countries, with noteworthy growth in Mexico (28%), Colombia (10%), the Dominican Republic (9%) and Peru (8%).

- The combined ratio rose to 101.8% due to an uptick in General P&C that was partially offset by an improvement in the Auto business.

- The Life business and financial income continued improving and contributing very positively to results.

- In Mexico, premiums reached nearly €1.5 billion, up 43.4%, driven by the issue of a relevant industrial risks policy in the second quarter (contributing 30 points to growth) and the favorable performance of the Mexican peso (+11.8%). Additionally, both the Auto and Life lines had strong growth. The net result reached €44.3 million, improving 43% compared to December 2022. The combined ratio stood at 98.2%, up 1.5 p.p., with improvement in the Auto combined ratio offset by an uptick in other lines.

- In Peru, premiums reached €760 million, growing 7.5%, while the net result reached €38 million, heavily conditioned by the effects from the coastal El Niño which especially affected Non-Life lines.

NORTH AMERICA improving result, supported by tariff updating

- Premiums reached nearly €2.7 billion in December, growing 3.6% in euros, despite the slight depreciation of the dollar (-3.3%). The largest contributor was the United States with close to €2.3 billion and 2.4% growth.

- The Non-Life combined ratio stood at 105.4%, still affected by the inflationary environment, but with a 2.9 p.p. improvement in the year.

- The Auto combined ratio stood at 107.1% (-2.5 p.p.), with better performance during the second half of the year. Loss frequency is stable, and the already-implemented tariff increases in the United States (more than 29% since January 2022) should offset the expected increase in claims costs.

- In General P&C, the combined ratio stood at 100.8%, affected by various weather-related events during the year, as well as the relevant increase in the cost of catastrophic reinsurance protection. In the Homeowners line, the trend of increasing tariffs continues.

- Net realized gains had a €5.2 million impact on the result (€27.7 million in 2022).

- Puerto Rico recorded a 10.8% increase, reaching over €400 million in premiums, with a €27.9 million result.

- Despite the excellent result in Puerto Rico, the region of NORTH AMERICA has recorded losses of €1.8 million.

EMEA

- Premiums reached nearly €1.3 billion, representing a 2% decrease and reflecting the fall in the Life business in Malta.

- The region recorded €47 million in losses, concentrated in Italy and Germany, as a result of the complicated Auto environment and the severe storms in Europe.

- In Turkey, the positive performance of euro-denominated financial investments has offset both the effect of inflation as well as the impact of the earthquake in the first quarter, allowing the country to report profits in 2023. Finally, Malta continues with a recurring contribution to earnings.

MAPFRE RE consolidates its strong growth and increases its contribution to earnings

- MAPFRE RE premiums, which include the Reinsurance and Global Risks business, grew 8.8%, reaching nearly €7.9 billion.

- The Reinsurance business grew 7.8%, while the Global Risks business is up 12.2%.

- The combined ratio improved significantly in the year, reaching 95.6% (-1.2 p.p.), supported by the recovery of tariffs in the reinsurance market, especially catastrophic covers.

- Two relevant cat events – the earthquake in Turkey and Hurricane Otis in Mexico – had a combined impact of €153 million. Other frequency events, including the storms in Europe, were offset by the absence of events in the Atlantic.

- The financial result also grew, with a €128.2-million gross contribution to the Non-Life result (€79.5 million in 2022). Net realized gains had a €12.3 million impact on the result (€2.4 million in 2022).

- The net result reached €244.6 million, up 70.6%.

ASISTENCIA (MAWDY) continues to focus on strategic markets for the Group, with a focus on more digital activity

- Revenue reached €472 million, growing 9.2%, and recording earnings of €5.4 million.

- Agreements of the Board of Directors

- In addition to the proposed increase in the final dividend against 2023, the Board has also approved the appointment of José Miguel Alcolea Cantos as General Counsel and General Manager of the Corporate Legal Affairs Area and Secretary of the Board of Directors of MAPFRE, S.A., as well as member of the Executive Committee, effective April 1. This appointment replaces Ángel Dávila Bermejo, who is retiring after 32 years at MAPFRE in different positions of responsibility.

- Terminology

- Definitions and calculation methodology for financial measures under IFRS 17&9 used in this report are available at the following link:

https://mapfre.com/media/shareholders/2023/2023-12-alternate-performance-measures.pdf

- Definitions and calculation methodology for financial measures under homogenized local accounting used in this report are available at the following link:

https://www.mapfre.com/media/shareholders/2022/2022-03-22-alternate-performance-measures.pdf