SUSTAINABILITY | 04.23.2024

Financial education: keys to better money management

The more you know about finances, the greater your sense of control and self-esteem, empowering you to make more and better decisions. So says Natalia de Santiago (Madrid, 1977), an engineer, finance expert, writer, and entrepreneur who aims to teach us financial habits we can use to live with greater peace of mind. We talked to her about financial education–a neglected topic–and she elaborated on the importance of budget planning, no matter how modest, and encouraged saving and investment, even starting at a young age.

You insist on the need for more financial education to learn to better manage our money and lead a more secure and prosperous life. What steps should we take to achieve this?

You insist on the need for more financial education to learn to better manage our money and lead a more secure and prosperous life. What steps should we take to achieve this?

I'd like to emphasize that we’re talking about a subject that needs to be addressed. We can't afford to ignore it. Just as you look after your health, it is your responsibility to take care of your finances. And if you aren’t taught how to manage your money, you need to learn on your own. There are countless resources available today to help you get started, ranging from podcasts to educational literature. While the information is abundant, you need to take the first steps into this world. You also need to understand that you’ll increasingly have to manage your own finances, particularly given the rising job turnover rates and declining birth rates, which have a direct impact on economic stability. A prime example of this is the growing risk facing the public pension system.

Several reports from governmental institutions like the Bank of Spain or international organizations such as the OECD highlight our society’s limited financial knowledge. What do you think we need to learn most urgently?

In finance, you need access to information to make decisions. We should all have a basic understanding of savings, interest rates, and how inflation impacts our economic situation. It’s very important to realize that time is of the essence in financial matters. Problems tend to worsen with time, so addressing them sooner rather than later minimizes their impact on your finances. As my father used to say, when it comes to finances, it's about taking care of them, not just worrying about them.

At what stage of life do you think we should begin managing our finances? And who should teach us?

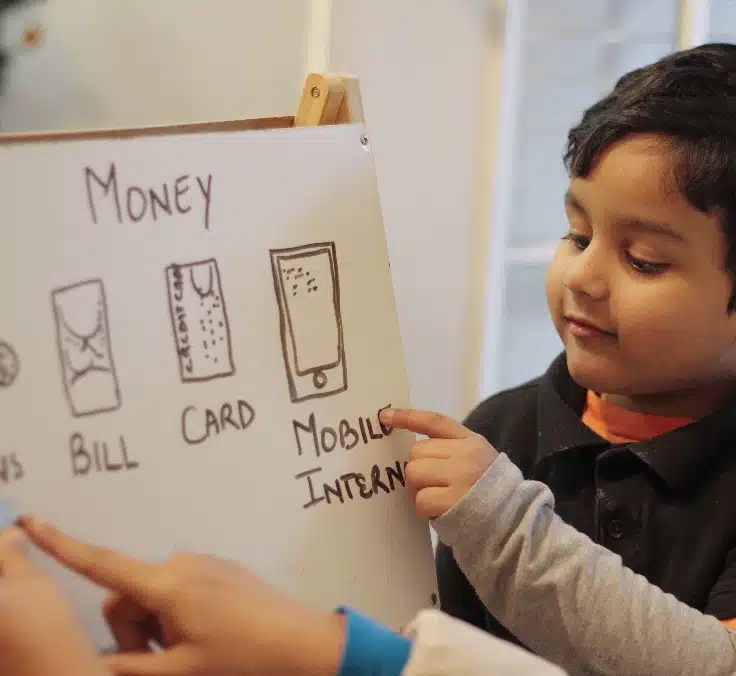

I think it’s important to differentiate between financial knowledge and developing financial habits. The former should ideally start in primary school, gradually becoming more sophisticated as we progress through education, extending into university where financial education should reach an advanced level. Studying economics is not the same as learning about personal finance. Incorporating financial literacy into academic programs is an ongoing challenge, so until it becomes standardized, it falls to parents to instill both the knowledge and the habits at home.

What advice would you give parents to promote healthy financial habits?

I would suggest that the earlier they start promoting these habits, the better equipped their children will be to manage their own finances. This can be initiated through familiar methods such as providing an allowance to teach budgeting or using a piggy bank to encourage saving. I would caution against giving excessively high allowances, as having everything readily available can hinder the development of money management skills. The key is to gradually introduce more sophisticated financial tools to make them increasingly educational. With the increasing complexity of finance due to technology and globalization, staying informed is crucial to avoid falling behind and widening the inequality gap. It’s also important to gradually expose children to the realities of the financial world so they can become familiar with its workings and better prepared for the future.

Natalia de Santiago: “We need to take care of finances, not just worry about them.”

You’ve authored three books: “Invest in Yourself”, “Invest with Little”, and the children’s series “M.O.N.E.Y. Academy”. In them, you emphasize that understanding the subject matter empowers us as people. What do you mean by that?

Some clients hesitate to ask questions when selecting a product, leading them to potentially unsuitable choices and eventual disappointment with the institution. When someone realizes they can grasp financial topics, they feel more in control and engaged in their financial life, boosting their self-esteem. Often, the gap in financial literacy stems from lack of confidence, underscoring the need to apply knowledge to empower yourself in the world of finance.

You maintain that there are fewer female investors and that we are still at a disadvantage. What can we do to reduce this gap?

It’s undeniable that there’s a shortage of female talent in this sector, traditionally led by men, leading to lower female participation and exacerbating gender disparity, consequently contributing to wage inequality. To narrow this gap, we must improve financial education and promote the visibility of female role models. Women have a significant role to play in this sector, and we are fully equipped to excel in it.

You always stress the importance of maintaining an emergency fund and reducing the proportion of fixed expenses. Why?

Having a larger share of fixed expenses reduces flexibility in responding to emergencies. It’s not inherently negative to have fixed expenses, but it becomes problematic when they represent a high proportion of total expenses, as it becomes challenging to quickly reduce these payments in the face of unexpected economic situations. For instance, debts are among the least flexible. So, you need to keep them at a manageable level. Building an emergency fund enables you to maximize peace of mind and provides a buffer for overcoming economic downturns with greater ease.

How do you think large companies like MAPFRE can further contribute to improving society’s financial well-being, making it more efficient and accessible?

It’s important for trusted entities like MAPFRE to continue fostering financial literacy through educational initiatives aimed at improving accessibility and narrowing inequality gaps. By offering a wide range of content, including courses and workshops for both employees and the broader community, we can elevate financial literacy levels. This, in turn, will empower individuals to engage more actively in financial matters and equip them with the necessary knowledge to cultivate healthy saving and investment habits.

RELATED ARTICLES: