FINANCE | 07.14.2022

The potential insurance market in spain is worth 98 billion euros

The industry has demonstrated itself to be highly resilient, with a solvency ratio of 252% in 2021, 11 percentage points higher than in 2020.

MAPFRE Economics, the company’s Economic Research department, has highlighted the recovery of the Spanish insurance market during 2021, with a premium volume coming to 61,831 million, up 5% year on year, with 7.9% growth in the Life segment (+9.1% in Life Savings and +3.4% in the Life Risk) and 3.3% growth in the Non-Life segment. This is reflect in its report “The Spanish Insurance Market in 2021”, which it presents today at 12 pm at the headquarters of Fundación MAPFRE in Madrid and which can be followed online.

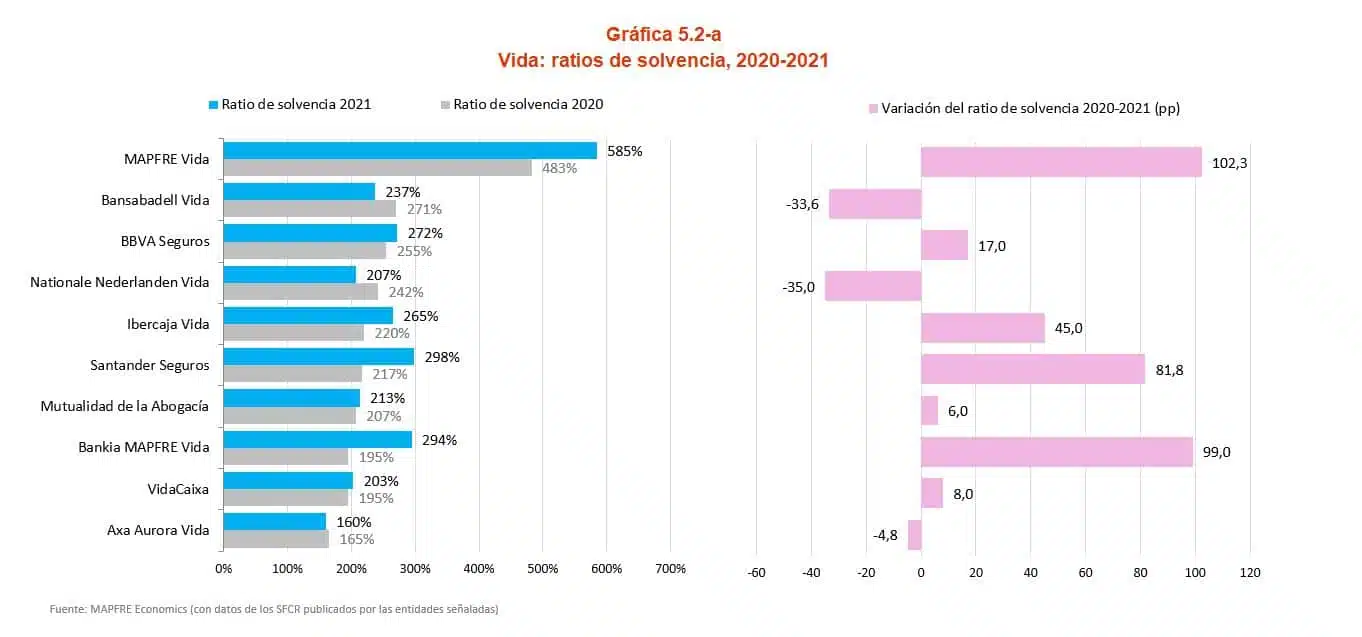

MAPFRE Economics highlights the resilience of the sector during the Covid-19 crisis which defined 2021. The total aggregated solvency ratio of insurers operating on the Spanish market that year came to 252%, 11 percentage points (pp) up on the value registered in 2020 (241%). In this sense, MAPFRE is worth particular note, as, according to its report, MAPFRE Vida still boasts the highest solvency ratio in this market segment, standing at 585% (102.3 pp above 2020).

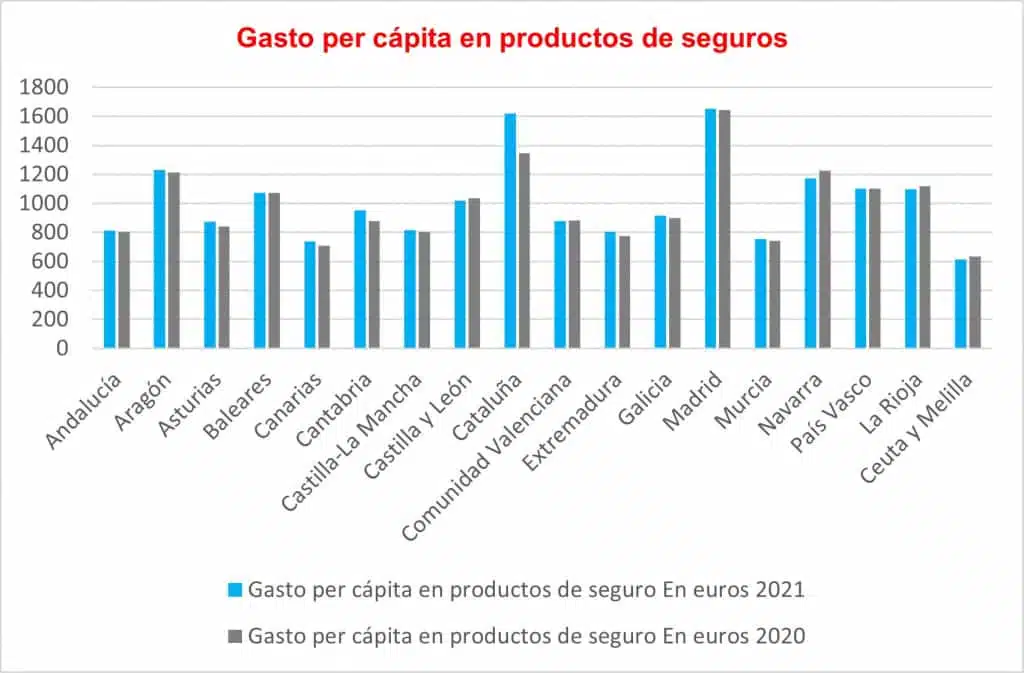

In addition to taking stock of 2021, the report includes a detailed analysis of structural insurance trends, in other words, penetration, density and depth. In the specific case of density (premium per capita), there was a change in trend in 2021, given the upturn in the Life insurance segment after four consecutive years of contractions. In total, Spaniards spent an annual average of 1,303.5 euros on insurance in 2021, up by 60.7 euros year on year, with increases in both market segments.

Below are details of spending per capita, per autonomous community:

For the first time, the report has included an outlook for the business. In this connection, MAPFRE Economic Research has offered reminder that 2022 began with similar dynamism as seen in 2021, with strong growth; nonetheless, there have been three core changes that have affected the global, European and particularly Spanish economic backdrop and that will affect the business’ performance: “A slowdown in economic growth expected for 2022, which will postpone the recovery of pre-pandemic levels of activity further still, a slightly higher inflationary environment before the onset of the conflict in Ukraine and a more restrictive interest-rate environment in the face of monetary normalization and the tightening of credit spreads, in particular in vulnerable countries like Spain”.

Even so, MAPFRE Economics still expects the year to end in the black. For December 2022, it forecasts nominal growth in Life segment premiums of around 2% and, in the long term, expects this to be in the range of 1.9% to 3.3%. In the case of the Non-Life segment, the forecast for 2022 stands at around 2.3%, while the long-term estimate would stand between 1.8% and 2.8%.

Click here to read the full report

To stream presentation of the report beginning at 12 pm, click here