FINANCE | 05.03.2022

MAPFRE Economics reduces the growth forecast for the world economy to 3.6% and predicts oil over $100 through 2023

The Eurozone will be the region most acutely affected by war, both due to the depth of its trade ties and its energy dependence

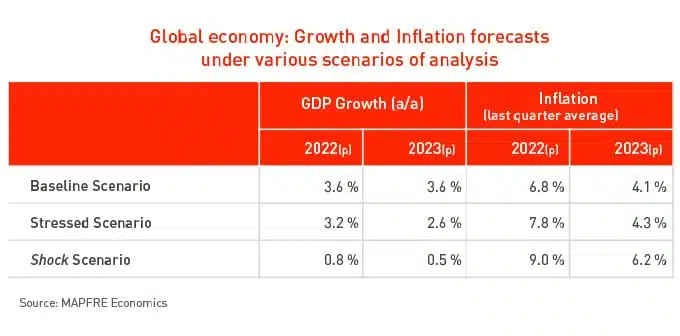

MAPFRE Economics, the MAPFRE Economic Research, reports that, after a first quarter that invited optimism, “the geopolitical situation has deepened the supply shock, which will cause significant global deterioration of activity and increase pressures on prices, with divergences by region.” As included in the report “Economic and Industry Outlook 2022: second quarter perspectives,” published today, economists expect 3.6% growth for 2022, versus 4.8% in the previous quarter, and 3.6% in 2023, with inflation increasing to 6.8% and 4.1% on average in the last quarter of each of the fiscal years.

These are the figures contained in its baseline or central scenario, that is, those with the highest probability. But for this to happen, the impact of the pandemic must be at a minimum, and the geopolitical conflict must be more limited in time, with sanctions consistent with those already in place, which will persist beyond 2022. In this scenario, oil and gas prices will remain over $100 throughout the year. But, given the uncertainty, Economic Research considers, as is common in its reports, a stressed scenario, closer to a stagflation situation, in which there would be an additional cut of 4 tenths in the GDP and an increased inflationary dynamic. In the latter instance, although more likely, now a “shock” scenario is added that includes the risk of recession.

For Spain, in its core scenario, MAPFRE Economics forecasts 4.2% growth this year (versus the 5% it had previously forecast) and 3.0% next year (versus the 4.3% in the previous Outlook report). It points out as a main risk the cost of energy “and a possible expansion of inflation in all categories”. In this sense, the hikes in foodstuffs are evident (6.8% March) and the high prices of fertilizers “will aggravate them”; meanwhile the higher prices in production are surprisingly high (+40.7% in February), due to the costs of electricity and gas, causing an interruption in production in many factories.

In the opinion of the experts, “the energy problem does not have a quick solution, and the intervention in the price, although unconventional, would allow it to adjust to the reality of the mix of Spanish production.” “Caution should be exercised, because failure to arrive at a coherent price could discourage investment, just when it is needed most,” they add. However, they show optimism with the recovery of tourism, and, again, see “the effective utilization of European Union funds to generate dynamism in the Spanish economy” as key.

Economic Research considers the Eurozone to be a region more impacted by the conflict in Ukraine, both due to the level of commercial connection and their energy dependence. “The risk for the economy of the Eurozone is mainly the upturn in inflation, which will reduce disposable income for consumers, and margins for companies, making them more cautious in their investment decisions, which will take its toll on the growth of the economy. The resolution of the energy problem will be key in the coming months, and even years. While inflation will only moderate due to the baseline effect, the vicious cycle of climbing prices has begun, and getting inflationary dynamics back on track will be a difficult task,” they explain. This has led to a drop in the growth forecast from 3.9% to 2.9% for this year, while they maintain 2.7% for 2023.

For the United States (with a GDP growth forecast of 3.2% for 2022, versus the previous 4.0%), they expect a lesser impact from the geopolitical crisis. “Its energy self-sufficiency, the limited trade connection with Russia, and a solid labor market provide greater resilience than anticipated to a clearly deteriorating consumption in real terms,” they indicate.

Finally, although ties are not as close or dependent, emerging markets face a more fragmented impact: positive for those economies that export raw materials like oil and derivatives, metals, and certain foodstuffs, among others, and negative for those emerging economies intensive in manufacturing, that confront these high prices in their production capacity. In the particular case of China (with a new economic growth forecast of 4.8% for 2022, versus the previous 5%) and certain industry-intensive satellites in Asia, both the risk of direct sanctions that may intensify the problem, and the political environment of zero tolerance facing the pandemic, which is causing new lockdowns in cities like Shanghai, Changchun, Jilin, Shenzhen, and Langfang, are added, aggravating the bottlenecks originating in Asia that, given their global relevance, would exacerbate the supply shock and, with it, the risk of stagflation,” MAPFRE Economics indicates.

Impact on the insurance industry

This macroeconomic context of greater uncertainty casts a shadow on the outlook for the insurance industry, whose profitability may be negatively affected by the erosion of inflation in business margins, increasing the pressure on insurance prices at a time when the inflationary process will reduce the buying power of households and make it more difficult to transfer the increased prices in costs this entails.

In terms of Non-Life business volume, auto insurance will continue to suffer from the fall in new vehicle registrations (still far from pre-crisis levels), amplified by supply bottlenecks resulting from the shortage of semiconductors and certain metals such as aluminum, of which Russia is one of the main producers. These disruptions in supply chains continue to weigh down new vehicle registrations, negatively impacting the insurance business in this line of business.

On the positive side, however, in terms of business volume, some lines of business such as health and life risk insurance may benefit from increased sensitivity to the risk of illness and death as a result of the pandemic and war, especially in countries where public health systems are weaker. Other important business segments, such as home multirisk and industrial, also tend to be resilient in these situations.

As for the outlook for life insurance policies in which the policyholder assumes the investment risk, the downturns and high volatility of the stock markets make it difficult to market them. This will force insurance companies to adapt their products to a new environment in which risk-free interest rates and risk premiums on fixed income are rising due to the withdrawal of monetary stimuli. Hence, the Life investment business faces a more complex scenario in which the sovereign and corporate bond market is playing a bigger role.