Inflation! What inflation?

Chief economist of MAPFRE Inversión

Current market narrative states that inflation will be higher. Thus, yield curves steepen, and a reaction from central banks may derail optimism on stocks.

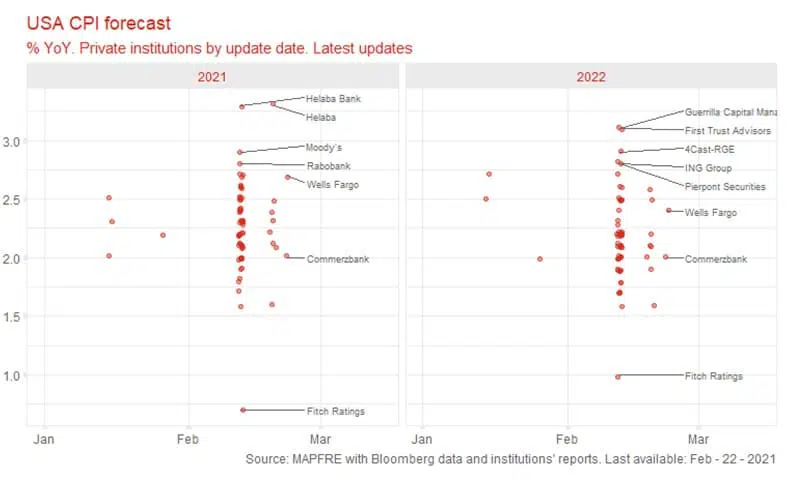

Nowadays no one is forecasting a sustained inflation in the US high enough to trigger a Fed reaction, let alone in Europe. The 5y5y inflation forward is around 2.4%. Among more than 130 private forecasts contributed to Bloomberg in the last two months, only two of them see inflation higher than 3% in 2022, while the bulk of them is between 2% and 2.25%. These figures are far from worrying. Actually, market reaction seems more linked to a normalization of the situation, than to fears of hyperinflation. 2.5% yoy CPI is pretty much in line with historical average, even lower.

Of course there a risk of much higher CPIs over the long term. Admittedly, we are already suffering monetary hyperinflation. But that translating to CPIs in less than two years? It’s not clear at all. Actually, forecasts point to the opposite.