Deciphering the “new normal”: Utilities gain appeal in the face of support for the energy transition

Pablo González, Equity

Manager at MAPFRE AM

Recovering from this crisis will therefore depend not only on the impact that the fiscal and monetary stimuli announced by various governments and financial institutions will have on the economy; the ongoing spread of the virus and the development of medical treatments to combat it will also play a key role in determining when and how the economy will recover.

This recovery process will not be the same for all sectors, just as the initial impact of this crisis affected all sectors differently. Social distancing and limiting the movement of people have been the hallmarks of this crisis, which has dealt a heavy and unexpected blow to businesses that are most exposed to leisure, tourism and transport, as well as the more cyclical sectors (oil and gas, banking, automobiles). However, the effects of this crisis are expected to be transient and are unlikely to lead to a long-lasting change in our way of life. Thus, the “new normal” will be characterized by an acceleration of pre-crisis trends, rather than a permanent disruptive change.

In this sense, digitization and sustainability are two themes that will play an even greater role in this recovery. It’s reasonable to expect that technology companies, in all their forms, and companies exposed to the energy transition will perform well in this recovery period to the extent that: (i) their businesses have a high level of visibility despite the current uncertainty surrounding the virus, and (ii) public investment policies are likely to be leveraged in these sectors to boost economic recovery.

In Europe, the European Commission (EC) recovery plan lays out a combined budget of 1.85 trillion euros for the 2021–2027 period and stipulates that 25 percent of this amount be spent on “green” activities, thus encouraging governments to push for the investment and reforms needed to achieve climate neutrality by 2050, the main goal of the Green Deal. The EC explicitly mentions that “investment in key sectors and technologies, from 5G to artificial intelligence and from clean hydrogen to offshore renewable energy, holds the key to Europe’s future.” Instruments to support companies will encourage their ecological and digital transformation.

In order to achieve climate neutrality by 2050, it will be necessary to decarbonize the different sectors of the economy. The EC estimates that 175–290 billion euros will need to be invested each year over the next three decades to achieve this objective.

Renewable developers will be the main beneficiaries, as the penetration rate of renewable energies in electricity generation is expected to reach 84 percent in 2050 compared to the current level of under 30 percent. There is also a significant opportunity for power grid operators, as for each euro invested in renewables, an estimated 0.5-euro investment is needed in networks. In Spain, for example, the draft of the PNIEC (Plan Nacional Integrado de Energía y Clima — Spanish national integrated energy and climate plan) includes investments totaling 91 billion euros in renewables and 58 billion euros in networks and electrification for the 2021–2030 period. The journey toward decarbonization will also bring other investment opportunities in energy efficiency, electric mobility, batteries and renewable gases.

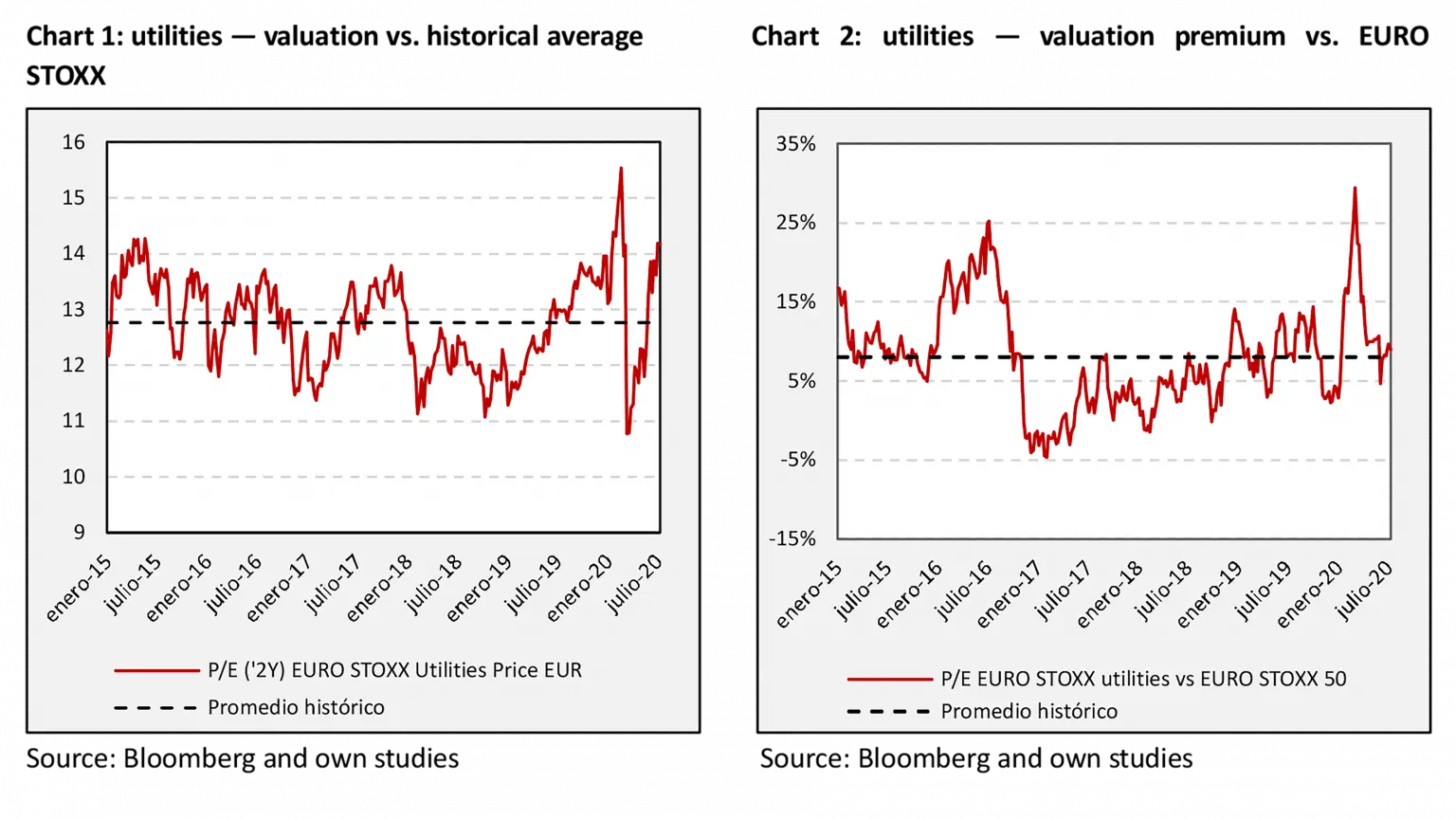

This mega-trend against climate change is likely to trigger a shift in paradigm among investors with respect to the Utilities sector, which is expected to begin being ranked more as a growth sector as companies accelerate their investment plans. In this sense, current valuation levels would remain attractive, staying close to historic levels and with a low premium compared to the rest of the market despite their defensive nature in the face of uncertainty in the present and growth potential in the “new normal.”

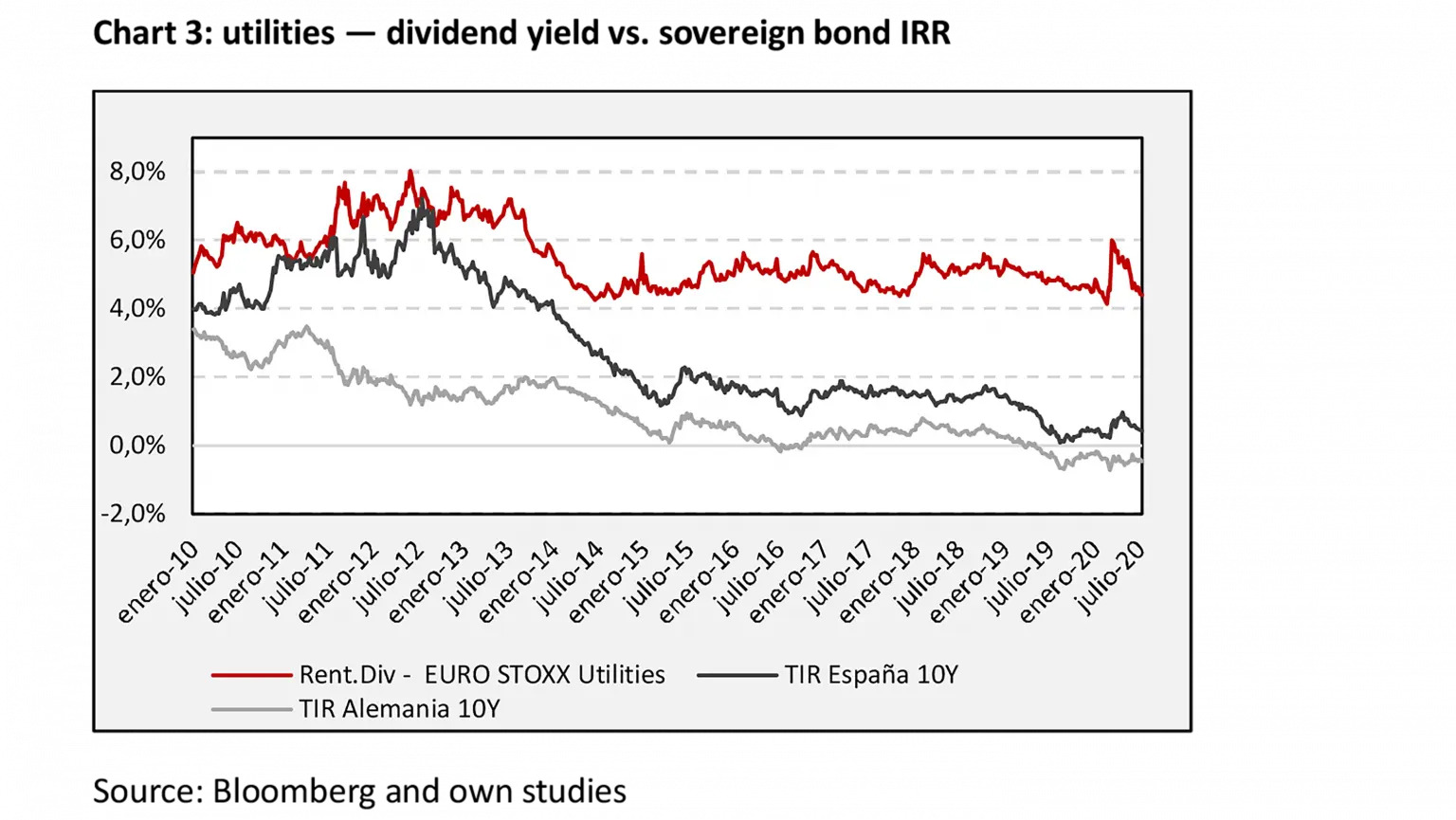

More obvious is the sector’s appeal to investors seeking to obtain a return through regular income, thus minimizing risk in the current interest rate environment. The differential of the sector’s dividend yield and the risk-free asset yield, or yield gap, has reached peak levels over the last decade. In this sense, there would be value in regulated operators in the energy infrastructure sector that have non-volume-dependent business models, with stable regulation, and who can continue growing their base of regulated assets for at least the next decade in order to gradually increase shareholder remuneration, which is already at attractive levels.

The current crisis has transported us into an uncertain world that will undoubtedly continue to provide many opportunities for equity investors. Although we don’t know when or how economic activity will recover, it’s unlikely that the underlying trends that were evolving prior to the pandemic will be permanently disrupted. On the basis of these premises, we can find value in the Utilities sector, which has gained greater appeal as an asset to have in a portfolio, both because of its defensive nature and high shareholder remuneration, and for its close link with the energy transition, which is outlined as the epicenter of economic reconstruction plans in Europe.