ECONOMY | 04.30.2025

MAPFRE Economics lowers global growth forecast to 2.7% due to tariff disputes

- MAPFRE’s research arm estimates that global economic progress will be 3% for next year, with inflation of 3.4% and 2.9% for 2025 and 2026, respectively.

- Economic deterioration will be more intense in the United States, while in Europe it is expected to be more moderate. The effect in Latin America would be disparate.

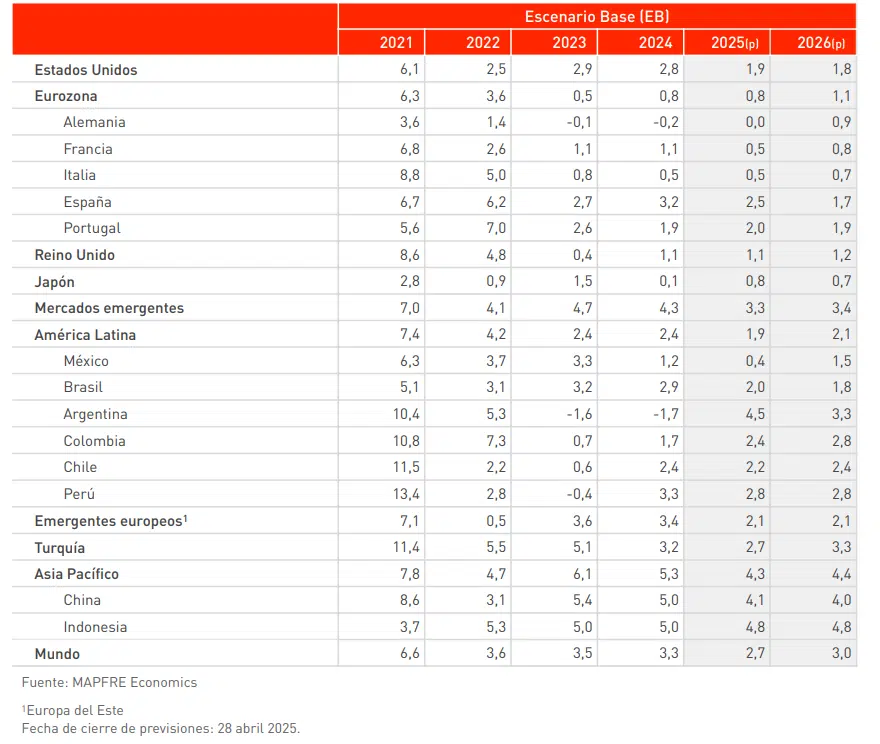

MAPFRE Economics, MAPFRE’s economic research service, published today the update of its Economic and Industry Outlook report, in which it forecasts growth of 2.7% for the global economy for 2025, four tenths of a point lower than the figure projected at the beginning of the year, and 3% for 2026. Inflation forecasts are 3.4% for 2025 (one tenth of a point lower) and 2.9% for 2026.

The scenario contemplated by MAPFRE Economics continues to envisage a global slowdown controlled by central banks. However, the emergence of new risks in the international scenario coming on the back of U.S. tariff policy has implied factoring in a degree of increased prudence and the contemplation of a possible decoupling toward less coordinated movements at a global level. The main macroeconomic variables will continue to be exposed to the effects of trade disputes, meaning their impact will depend on the policies defined in the coming months.

The Economic and Industry Outlook Report, published by Fundación MAPFRE, predicts more intense effects of this new scenario for the United States, with a sharper slowdown and higher price pressure that will hinder the Federal Reserve’s ability to intervene. Growth would therefore come in at 1.9% for 2025 and 1.8% in 2026, compared to the 2.5% and 2% initially forecast. Inflation would be 3% this year, one tenth of a point higher, while the forecast for the coming year remains at 2.6%.

Across the eurozone, however, MAPFRE Economics predicts less severe macroeconomic impairment and a more controlled inflation scenario. When the impact of the fiscal stimuli announced, especially in Germany, are considered, the outlook for the continent is less negative, with GDP growth estimated at 0.8% this year and 1.1% in 2026, (previously 1.1% and 1.4%, respectively). Inflation looks set to stand at 2.1% in 2025 and 1.8% in 2026.

As far as emerging countries are concerned, the growth forecasts stand at 3.3% and 3.5% for both 2025 and 2026. Prices are on course to rise by 4.2% in the current year and 3.6% next year. The different regions show notable movements in their economies due to the impact of U.S. tariff policies.

In Latin America, the implications of trade tensions are mixed, as, although they would point to lower external demand for the most dependent U.S. partners, namely Mexico, these same countries could also benefit from both commercial redirection and the attraction of capital inflows. This situation could give rise to a monetary policy with fewer changes than initially anticipated and offer a relatively stable framework. Estimated economic growth is 1.9% for this year and 2.1% for next year, with inflation of 8.8% and 8%, respectively.

In Asia, however, the trade dispute appears to be markedly more pronounced and the measures announced thus far less conciliatory, particularly in China, leading to a sharper reduction in forecasts for the region. Asia Pacific as a whole would grow by 4.3% in 2025 and 4.4% in 2026, with inflation of 0.4% and 1%, respectively. China, which was previously expected to enjoy growth of 4.3% in 2025, should now see growth of 4%, while the original economic forecast of 4% for 2026 is maintained, with inflation set to come in at 0.2% and 0.8%, respectively.

Base and Stressed Scenarios: Gross Domestic Product

(annual growth, %)

The insurance sector holds firm against tariffs

Lower economic activity worldwide would also have an impact on insurance activity, so the positive outlook forecast at the beginning of the year has cooled to a degree. However, despite geopolitical uncertainty, economic growth and interest rates will continue to drive the development of the global insurance industry.

MAPFRE Economics expects a 4.3% increase in Life insurance premiums and a 3.9% rise in Non-Life insurance volume. Earnings prospects continue to look healthy, due to a moderate inflation environment and downward interest rate curves, but at positive levels in terms of premiums. High interest rates mean financial income will continue to contribute significantly to profits, thanks to industry investments and the savings-linked Life insurance business.