CORPORATE | 26.07.2021

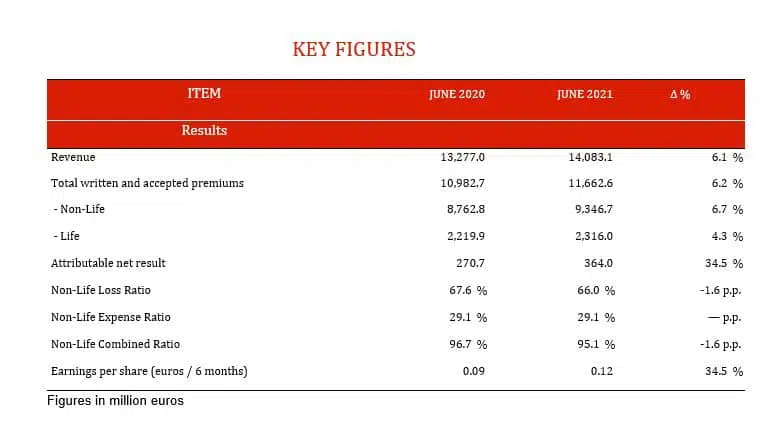

MAPFRE’s earnings rise by 34.5 percent to 364 million euros in the first six months of the year

Keys aspects of the first half

- The Group records revenues of just under 14.1 billion euros (+6.1 percent) and premiums grow by 6.2 percent to 11.7 billion euros.

- Very positive performance in the Group’s main markets and the reinsurance business.

- Spain remains the Group’s driving force, with premium growth of 7 percent and earnings of 204 million euros.

- Despite the great difficulties being experienced in the region, practically all Latin American countries closed the first six months with a positive result.

- Since the beginning of the pandemic, MAPFRE has paid out over 588 million euros in COVID-related claims. Of these payments, 266 million have been made in 2021 and chiefly in LATAM.

- The combined ratio improves by 1.6 points to stand at 95.1 percent.

- The Group’s solvency position stands at a 201 percent, at the midpoint of the range established by the Board.

MAPFRE’s attributable earnings for the first six months of this year were 364 million euros, which represents a growth of 34.5 percent over the same period of the previous year, after accounting for claims related to COVID-19 in excess of 266 million euros, most of which were related to the Life business (152 million euros).

“These results demonstrate the Group’s strength and its ability to adapt to changing environments such as the one we’re facing at present. This is made possible thanks to the strength of our diversified business model, a leading position in the main markets, as well as solid capital strength, enabling us to face the future with optimism,” highlighted Fernando Mata, MAPFRE CFO and Member of the Board.

The Group’s premiums grew by 6.2 percent in the first six months of the year, reaching almost 11.7 billion euros. At constant exchange rates, premium growth would have exceeded 11 percent, after several years of canceling loss-making businesses as part of the Group’s profitable growth strategy, and accompanied by an excellent combined ratio, which has improved 1.6 percentage points compared to June 2020 to stand at 95.1 percent.

Group equity at the close of June 2021 was 8.5 billion euros and total assets were 71.1 billion euros.

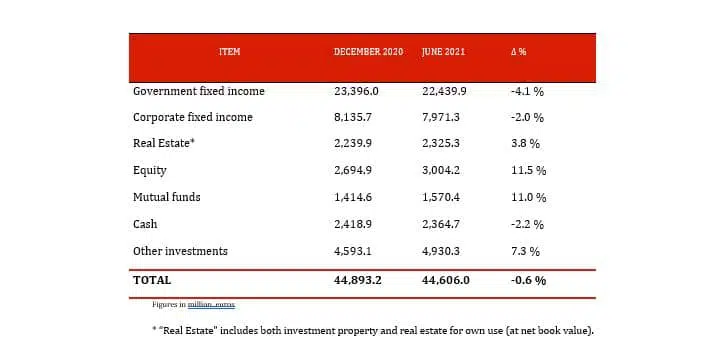

MAPFRE’s investments at the close of the first half of this year amounted to 44.6 billion euros, broken down as follows:

The Solvency II ratio stood at 201 percent in March 2021, reflecting the strength and resilience of the balance sheet and active investment management.

1.- Insurance unit

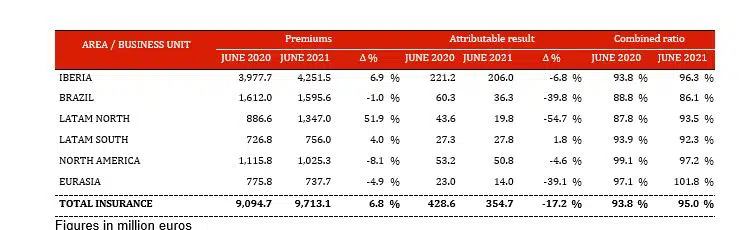

Insurance Unit premiums at the close of the first half of this year came to 9.71 billion euros (+6.8 percent). The result from this unit is also considered very positive despite the fact that it is being compared against a semester of intense paralysis in activity in the main economies of the Group due to the massive COVID-related confinements.

Iberia

In the IBERIA Regional Area (Spain and Portugal), premiums grew by almost 7 percent to almost 4.3 billion euros, with the solid performance of the Life business standing out (+12.9 percent). In Spain, premiums grew by 7 percent to just under 4.2 billion euros (compared to an increase of 5.5 percent for the sector). Spain also accounted for the biggest contribution to total Group earnings, delivering 204 million euros, a very significant amount despite the fact that it is being compared against a six-month period of virtual economic paralysis due to the lockdown that was in force.

In the Automobile business, MAPFRE again gained market share despite stagnation in the sector. Premiums rose 2.7 percent to over 1.1 billion euros, with almost 6.15 million vehicles insured (+4.7 percent) and a combined ratio of 93.1 percent.

In General P&C, premiums grew by 5.1 percent to just under 1.3 billion euros, with the solid performances in the Homeowners (+2.6 percent), Communities (+6.1 percent) and Companies (+8.7 percent) insurance lines standing out, while Health and Accident premiums rose 9.3 percent to 722 million euros.

Also noteworthy was the solid performance of the SANTANDER MAPFRE business, which generated premiums amounting to almost 25 million euros at the close of June this year.

MAPFRE VIDA performed very well, growing by 11.6 percent to deliver premium volume in excess of 1 billion euros, thanks to the improvement of Life Savings (+18.6 percent), on the back of the good performance of the unit-linked business.

Pension funds were up 6.3 percent to 6.1 billion euros at the close of June, while mutual funds grew by 11.9 percent to 4.3 billion euros.

Brazil:

In Brazil, premium volume was 1.6 billion euros (-1 percent). In local currency terms however, premium growth was over 15 percent. General P&C contributed 822 million euros, while the Life and Automobile businesses produced 551 million euros and 222 million euros respectively. It is also important to emphasize that the combined ratio in Brazil improved 2.8 percentage points to 86.1 percent.

LATAM North:

In the LATAM North Regional Area, premiums increased by 51.9 percent to almost 1.4 billion euros. This increase is explained by the renewal of the Pemex two-year policy in the amount of 469 million euros. It is worthy of note that virtually all countries in the region closed the first six months with a positive result.

LATAM South:

The LATAM South Regional Area closed the first half of the year with premium growth of 4 percent, delivering 756 million euros, accompanied by a 1.6 percentage point improvement in the combined ratio, which stood at 92.3 percent. Also noteworthy was the growth in local currency in Argentina (+60.8 percent), Colombia (+33.1 percent) and Peru (+14.4 percent). All countries in the region recorded positive results for the first half of the year, contributing to the growth in earnings in this regional area, which were up by 1.8 percent to 28 million euros.

North America:

Premium volume in the North America Regional Area topped 1 billion euros (-8.1 percent). This decline is explained by the depreciation of the dollar (7.6 percent), the effects of the profitable growth policy and the withdrawal from loss-making businesses, as well as the impact of mobility restrictions as a result of the pandemic. The combined ratio improved by almost two percentage points to 97.2 percent. In the United States, premiums amounted to 829 million euros (-7.5 percent), while in Puerto Rico, premium volume was 196 million euros (-10.6 percent).

EURASIA:

Premiums for the EURASIA Regional Area stood at 738 million euros (-4.9 percent) at the close of the first half of the year, mainly as a result of the depreciation of the Turkish lira (-25.2 percent). The contribution from Germany, with premiums of 223 million euros (+3.7 percent) was notable, thanks to a highly effective sales campaign and an excellent renewal ratio. Malta also performed well, contributing 210 million euros (+25.9 percent), thanks to the increase in the Life Savings business which grew by 33 percent. Lastly, Turkey contributed 153 million euros, (-15.7 percent).

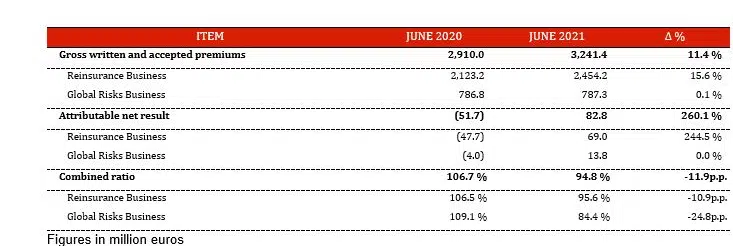

2.- Reinsurance and global risks units

The reinsurance and global risks business units, both integrated within MAPFRE RE, grew by 11.4 percent, surpassing 3.2 billion euros to the end of June, and delivering earnings of close to 83 million euros, compared to losses of 52 million in June of 2020. The combined ratio was almost 12 percentage points better, standing at 94.8 percent.

ASISTENCIA

Finally, revenues at the Asistencia Unit were 284 million euros (-26.4 percent), impacted by the significant reduction in travel insurance business volume, which also affected earnings (-2 million euros) and due to the divestments made in the restructuring process of the Unit, which is being transformed and digitized to return to profitability, as evidenced in the second quarter of the year. It is important to note the improvement (0.7 percentage points) in the combined ratio, which at the close of June was 99.7 percent.

More information about the Alternative Performance Measures (APMs) used in the report, which are financial measures not defined or specified in the applicable financial reporting framework, along with their definition and method of calculation, can be found on our website.