CORPORATE | 05.21.2024

MAPFRE’s solvency ratio stands at 199.6% at 2023 year end

The solvency position remains stable and within the established target range.

MAPFRE has informed the General Directorate for Insurance and Pension Funds (DGSFP) of the MAPFRE Group solvency position calculation corresponding to year end 2023.

The calculation does not include the transitional measures set out in the sector legislation upon the entry into force of the Solvency II supervisory regime, which temporarily allow for recognizing a lower amount in the own technical provisions of the insurance entities, which implies an increase in eligible own funds.

MAPFRE S.A. has been using this transitional measure since January 1, 2016, gradually reducing its application over an agreed period of 16 years. However, the DGSFP issued a resolution limiting the application of the transitional measure.

For this reason, MAPFRE filed a contentious-administrative appeal requesting the provisional suspension of the resolution, as it makes it difficult for MAPFRE to compete in equal conditions with other European insurance groups.

Subsequently, the DGSFP informed MAPFRE VIDA, notwithstanding what may be agreed by the contentious-administrative court when the decision is issued, that the company must present information without applying the transitional measure. In line with this criteria, the figures published value the transitional measures at zero.

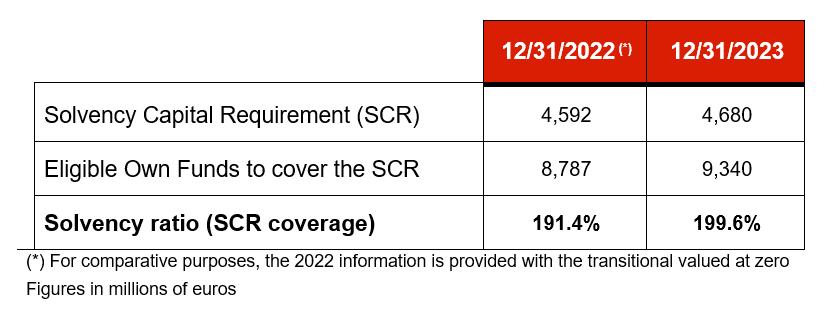

As per the above, the annual solvency position, with the transitional measure for technical provisions valued at zero, is as follows:

MAPFRE S.A.’s Solvency II ratio stood at 199.6% at December 31, 2023. If the transitional measure were applied, it would lead to a 403.3 million euro increase in eligible own funds and an 8.6 percentage point increase in the solvency ratio, from 199.6% to 208.2% at December 2023.

In either case, the solvency ratio remains highly stable and solid, backed by high diversification and strict investment and ALM policies.

The solvency position remains within the tolerance range established by MAPFRE S.A. (target solvency ratio without transitionals equivalent to 191%, with an upper/lower tolerance range of 25 percentage points).