CORPORATE | 07.20.2022

MAPFRE leads the sector in the Latin American market and enters Europe’s top ten list

The sector made a big recovery in 2021, with 12% business growth in Latin America and 9.1% for the largest insurance groups in Europe.

The insurance industry showed solid growth during 2021, both in Latin America and Europe, although it still has not recovered to pre-2019 levels. Life was the most affected line of business, which has caused shifts in the raking, mainly in Latin America. So much so, that according to the report “Ranking of insurance groups in Latin American in 2021,” prepared by MAPFRE Economics, MAPFRE now leads the Latin American market for the first time, with 8.32 billion dollars and a 5.5% market share. “It should be noted that MAPFRE Group’s excellent growth is due, in part, to the 16.8% growth in Mexico in 2021 because of the renewal in the second quarter of an important two-year policy in the amount of 563 million dollars,” explain the Economic Research experts. “The evolution of the life business is the main factor that explains these movements in the ranking, and therefore, there could once again be changes at the top of the ranking in 2022 as this segment continues to recover,” they add.

With respect to the ranking as a whole, the 25 largest insurance groups included in the ranking reported revenue of 93.39 billion dollars, with 8.64 billion more dollars in premiums in 2021, an increase of 10.2% compared to the prior year. If this sample is reduced to the 10 largest groups, annual growth between 2020 and 2021 comes in at 10.8%.

In total, the Latin American insurance market in 2021 had a premium volume of 149.9 billion USD, which is 12.0% (16 billion USD) higher than the previous year, with 12.5% growth in the Non-Life segment and 11.3% growth in the Life segment. However, this figure still falls short of the 153.1 billion USD reached in the regional market before the start of the pandemic.

In Non-Life, there were no changes in the first six spots in the ranking, and MAPFRE yet again took first place, earning almost 2 billion dollars more than the next finishers, Innovacar and Triple-S, respectively. In Life, the top spots went to Brasilprev, CNP Assurances, and Bradesco, in that order.

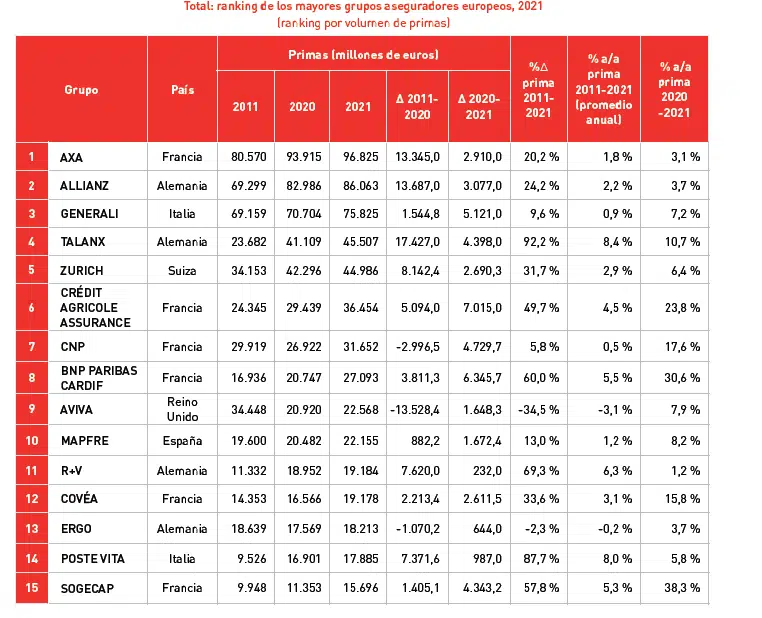

In Europe, the recovery of the economy and financial markets in 2021 has had a positive effect on the 15 largest European insurance groups, which increased their premium revenue by 9.1% in 2021, reaching 579.28 billion euros (around 594.12 billion dollars at the current exchange rate). All of the groups had premium growth, particularly French bancassurance companies Sogecap (38.3%), BNP Paribas Cardif (30.6%), Crédit Agricole Assurance (23.8%), and CNP Assurances (17.6%).

Axa, Allianz and Generali continue to lead this ranking, accounting for 45% of the aggregate premiums of all the groups that make up the ranking. It should be noted that the 2021 edition of this ranking excluded Prudential, whose premium volume would have put it in eleventh place in the classification. As noted last year, it was excluded because in October 2019 the group successfully spun off its British and European business from the rest of its international operations, resulting in two independent companies, Prudential and M&G.

MAPFRE moves up a spot to land in tenth place, with a premium volume of 22.15 billion euros, 8.2% more than last year. According to MAPFRE Economics, this increase is due to the favorable evolution of the business in the regions of Iberia, Latin America (where practically all countries saw growth), and in the reinsurance business.

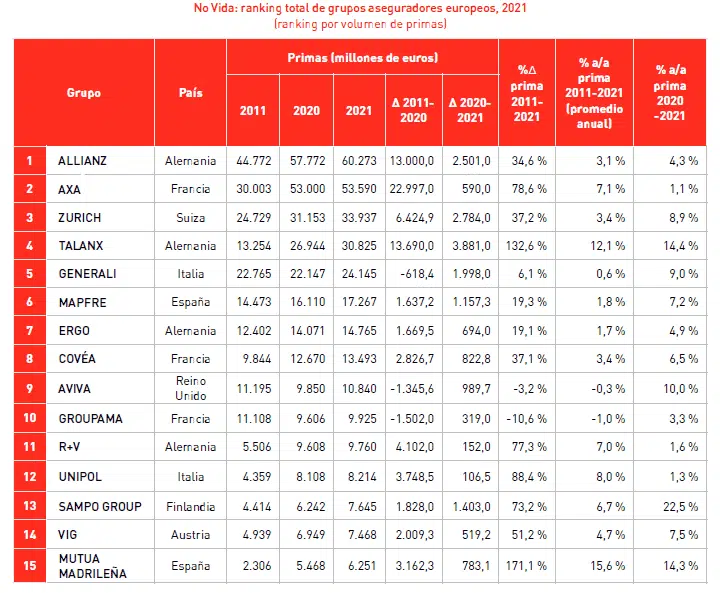

The 15 groups that are part of the 2021 Non-Life ranking had premium revenue of 308.4 billion euros, 6.5% more than the prior year. Allianz continues to lead this ranking, with a premium volume of 60.27 billion euros, an increase of 4.3%. In this case, MAPFRE came in sixth, with 17.27 billion euros in premiums.