CORPORATE | 02.08.2017

MAPFRE earns 775 millions euros in 2016, an increase of 9.4 percent

HIGHLIGHTS OF THE YEAR

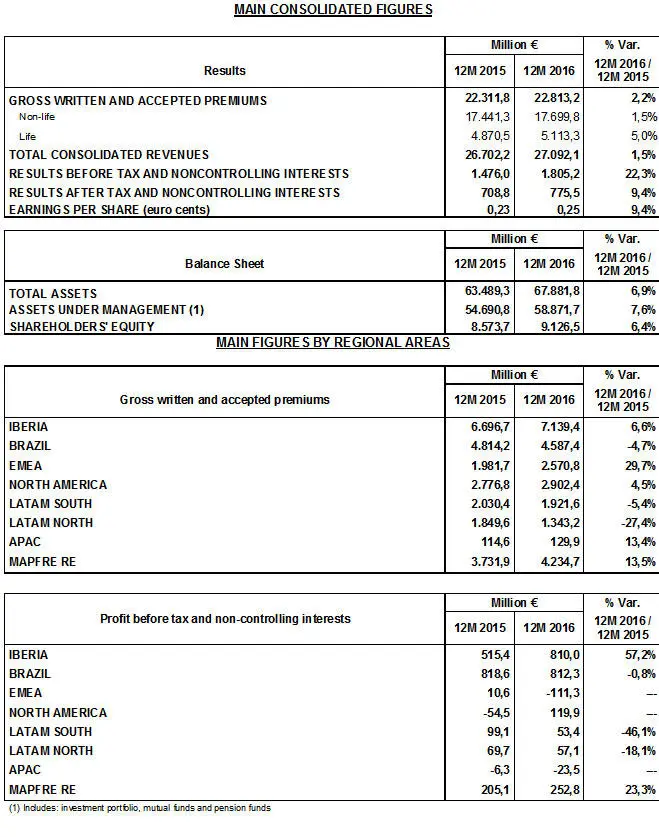

- MAPFRE’s revenue increases 1.5 percent to 27,092 million euros, and premiums exceed 22,813 million, a 2.2 percent increase.

- Excluding extraordinary items for both 2015 and 2016, net earnings would have grown by 41 percent.

- The Group’s combined ratio improves by more than one point, to 97.4 percent, while in Spain the improvement is more marked, at 95 percent.

- Strong business growth in Spain (+7.1 percent) and in the United States (+6.2 percent).

- An excellent year for MAPFRE RE, increasing profits by 22 percent.

- The Solvency II ratio stands at 200 percent, with 93 percent of maximum quality capital (TIER 1).

- MAPFRE will pay its shareholders 14.5 euro cents per share against the 2016 results, 11.5 percent more than the previous year.

- The Board of Directors proposes to the Annual General Meeting the appointment of Francisco José Marco Orenes as executive director of MAPFRE S.A.

MAPFRE’s net profit for 2016 increased by 9.4 percent to 775 million euros, in a year marked by good performances in its three main markets (Spain, Brazil and the United States) and the magnificent results of MAPFRE RE. It is worth pointing out that, excluding extraordinary items for both periods (2016 and 2015), MAPFRE’s net profit would have grown by 41 percent. The Group’s revenue amounted to 27,092 million euros, representing a 1.5 percent increase over the previous year, while premiums increased by 2.2 percent to 22,813 million euros.

At the close of 2016, equity stood at 11,444 million euros, a 10 percent increase on the previous year, due to good market performance and the positive development of the main currencies (the Brazilian real and the US dollar). Moreover, shareholders’ equity increased by 6.4 percent to 9,127 million euros, and total assets grew by 7 percent, standing at 67,882 million euros at year-end.

It is also important to highlight the performance of the combined ratio, which decreased by 1.2 points in 2016 to 97.4 percent.

“2016 was a very positive year for MAPFRE. Our strategy, based on profitable growth, has allowed us to increase profits by almost 10 percent and secure our position in the main markets,” said Antonio Huertas, Chairman and CEO of MAPFRE.

1.- Business performance:

In 2016, the Insurance Unit generated premiums of 18,727 million, an increase of 1.7 percent over the previous year.

→ The Iberia Regional Area (Spain and Portugal), which contributes 28.7 percent of the Group’s total premiums, increased premium revenue by 6.6 percent to 7,139 million euros. In Spain, premiums totaled 6,962 million euros, up 7.1 percent. The automobile business closed the year with growth of 2.6 percent, at 2,165 million euros, and approximately 5.5 million insured vehicles. The multi-peril business performance also stands out, growing by 6.1 percent (practically double that of the sector), and exceeding 1,000 million euros. The health insurance business produced premium volume of 494 million euros, up 7.7 percent on the previous year, 2.6 points better than the market growth. It is important to highlight the performance of the combined ratio, which improved 2.6 points to 95 percent, thanks to a rigorous underwriting and risk selection policy, especially in the automobile and multi-peril lines.

In addition, the MAPFRE VIDA business grew by 18.1 percent, producing premium volume of 2,155 million euros in a low interest rate environment that characterized the entire year. The growth in single premium insurance is especially noteworthy, increasing by 60.3 percent to 1,205 million euros. The mutual funds business rose 30 percent (742 million euros) to more than 3,208 million euros, while the value of pension funds stood at 4,684 million euros.

→ The Brazil Regional Area premiums stood at 4,587 million euros, down 4.7 percent, affected by the country’s economic situation and the depreciation of its currency. The agricultural business and the multi-peril business recorded growth of 13 percent and 9 percent respectively. This Regional Area contributes 18.5 percent of Group premiums. MAPFRE’s strength in Brazil has allowed profits to remain stable, even in an adverse economic climate.

→ The LATAM South Regional Area recorded premium volume of 1,922 million euros (-5.4 percent) in 2016. The growth in local currency in Peru (+7.2 percent) was noteworthy, with significant increases in the multi-peril and health businesses, as well as in Colombia (+1.9 percent), with the solid performance of the automobile business standing out. Argentina, meanwhile, registered an increase in local currency premiums of 37.8 percent, to 333 million. LATAM South contributes 7.7 percent of MAPFRE’s total premiums.

→ The LATAM North Regional Area’s premiums amounted to 1,343 million euros (-27.4 percent). This decrease was caused by the cancellation of loss-making contracts and the absence of multiyear underwriting, as was the case with a contract in 2015, principally in Mexico. The rest of the countries in the Regional Area experienced growth in local currency terms. This Regional Area contributes 5.4 percent of MAPFRE’s premiums.

→ The North America Regional Area posted premium volume for 2016 of 2,902 million euros, which represents an increase of 4.5 percent. The performance of the United States business should be highlighted, with growth of 6.2 percent (+7.2 percent in local currency), reaching 2,539 million euros, with a very significant improvement in claim levels, which fell by almost 6 points to 77.5 percent. This Regional Area contributes 11.7 percent of Group premiums.

→ The EMEA Regional Area premiums grew 29.7 percent to over 2,571 million euros, with growth in virtually every market. Turkey’s performance was noteworthy, with premiums amounting to 890 million euros, an increase of 18.2 percent, while Malta experienced growth of 23.4 percent to 335 million euros. Premiums in Germany stood at 321 million euros, and in Italy they totaled 558 million euros. 2016 was the first full year in which the direct business of these countries was consolidated in the MAPFRE accounts. This Regional Area represents 10.4 percent of the Group’s total premiums.

→ The APAC Regional Area, which accounts for 0.5 percent of the Group’s total premiums, increased premiums in 2016 by 13.4 percent, reaching 130 million euros.

The Reinsurance Unit’s premiums rose 13.5 percent in the past year, reaching 4,235 million euros. Special mention should be made of new contracts in the APAC, North America and Iberia Regional Areas. The net result of this business increased by 22 percent, to 186 million euros. MAPFRE RE contributed 17.1 percent of the Group’s total premiums and 20.1 percent of the attributable profit.

In addition, the Global Risks Unit recorded premiums of 1,212 million euros in 2016, up 3.2 percent, and revenue from the Assistance, Services and Specialty Risks Unit stood at 1,156 million euros (-4.4 percent).

2.- Dividend:

The Board of Directors has agreed to propose to the Annual General Meeting a final dividend against the results for the 2016 fiscal year of 8.5 euros cents gross per share. Therefore, the total dividend against the results for the year will amount to 14.5 euro cents per share, giving a return of 5.03 percent at current share prices. This means that MAPFRE will pay its shareholders 447 million euros against the 2016 results, up 11.5 percent on the previous year, increasing the payout from 56.5 percent to 57.6 percent over the last twelve months.

3.- Appointments:

At its meeting on February 7, the Board of Directors of MAPFRE agreed to propose to the Annual General Meeting the appointment of Francisco José Marco Orenes as executive director of the Board of Directors of MAPFRE S.A.

Additionally, Andrés Jiménez Herradón will cease to be a member of this board, with effect from February 22, having elapsed five years since his cessation as executive director of MAPFRE S.A.

The Board has also decided to name Rafael Márquez Osorio as a new member of the Audit Committee, replacing Andrés Jiménez Herradón, with effect from the same date.

Madrid, February 8, 2017. For more information, please contact MAPFRE Corporate Communication (Tel. +34 91 581 83 66; +34 91 581 91 68; +34 91 581 87 14), email: javier.fernandez@mapfre.com; juanfrances@mapfre.com; joaquinhernandez@mapfre.com.

The Alternative Performance Measures (MAR) used in in this report, which correspond to those financial measures that are used but not defined or explained in the applicable financial information framework, can be consulted at the following webpage: https://www.mapfre.com/corporate/institutional-investors/investors/financial-information/alternative-performance-measures.jsp.