CORPORATE | 30.06.2021

MAPFRE remains the sixth-largest European Non-Life insurance company in Europe

- The company is one of ten major European groups that managed to improve their solvency ratios despite the pandemic

- The premium volume of the insurance business in Europe fell by 4.9% in 2020

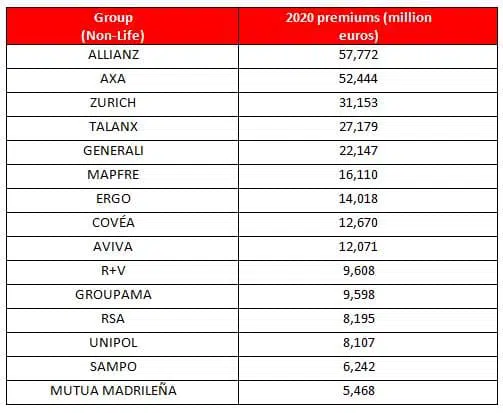

According to the latest edition of the annual ranking created by MAPFRE Economics, MAPFRE is among the 15 leading European insurance companies. In particular, in 2020, it held on to both eleventh place in the overall business ranking and sixth place among Non-Life insurers.

AXA remains in first place with 93.92 billion euros in premium volume, down 5.9% on the previous year. The premium volume of the 15 largest European insurance groups decreased by 4.9% in 2020 to 519.51 billion euros. However, the aggregate premium volume of these groups in the Non-Life segment increased slightly by 0.7% compared to 2019, which is positive given the complex circumstances in which activity took place.

The Life segment was particularly affected by the crisis caused by the pandemic, as well as by the continuation of the low interest rate environment. As a result, the 15 largest European insurance groups in this business segment—headed by Generali, AXA and Prudential—recorded a decline of -11.0% in premium revenue.

Resilience to the pandemic

Despite the strong business impact of the COVID-19 crisis, which also led to a 19.8% drop in the net result, which fell to 27.86 billion euros, the sector’s resilience in terms of solvency is noteworthy. In fact, 10 of the 15 groups mentioned above recorded significant improvements in this area by the end of 2020; as is the case with MAPFRE, whose ratio rose from 186.8% to 192.9%. On March 31, the ratio improved by another eight points to around 200%, the midpoint of its reference framework and twice the capital required by the regulator.

European insurers’ main response to the pandemic has been ensuring the health and safety of their employees, while also striving for business continuity and meeting their contractual obligations, thereby providing clients with adequate customer service and advice. “Lockdowns and social distancing measures have challenged insurers’ business continuity policies, accelerating the digitization processes already underway and leading to a transformation that now seems unstoppable,” MAPFRE Economics says in the report. “And let’s not forget the exceptional measures implemented, the mobilization of resources to dynamize the economy through direct donations to society and measures to help the policyholders, especially small- and medium-sized enterprises and self-employed workers. These measures have, in many cases, been supplemented by other support initiatives,” MAPFRE Economics concludes. MAPFRE, for example, has allocated more than 200 million to help self-employed people and SMEs. Fundación MAPFRE donated 45 million euros directly to public and private institutions for emergencies and humanitarian aid spanning almost 30 countries.

You can read the full report here.