Results September 2020

MAPFRE’s consolidated revenue in the third quarter of 2020 amounted to 19.1 billion euros, equivalent to an 11.9 percent decrease, and the attributable result stood at 450 million euros, representing a 2.7 percent fall with respect to the previous year.

Revenue September 2020

Premiums September 2020

Non-Life premiums went down 8.3 percent, marked primarily by lower issuing in the Auto and General P&C lines, from the effect in the latter segment of the PEMEX policy that was underwritten in 2019. Written Auto premiums fell 16.7 percent, primarily as a result of lower issuing in Brazil, the United States, Italy, Spain and Turkey.

By Non-Life business type, General P&C is the most important line, with 4.3 billion euros in premiums. Auto holds second place, with over 4.2 billion euros, and Health and Accident is in third place with 1.3 billion euros in premiums.

Life premiums fell 23.8 percent. Of these, Life-Protection fell 13.6 percent, primarily from the decline in this business and the currency effect in Brazil. Life-Savings premiums fell 36.4 percent, primarily from the fall in issuing in Spain in a complicated economic environment for the sale of these products.

Combined ratio September 2020

Net result September 2020

Balance sheet

Balance sheet to September 2020

Total assets reached 68.8 billion euros at September 30, 2020 and fell 5.1 percent compared to the close of the previous year. These changes include the relevant depreciation of the main currencies in Latin America and the Turkish lira.

The Group’s shareholders’ equity has been primarily impacted by the effects of the COVID-19 crisis, as well as by the aforementioned strong currency depreciation.

Assets Under Management

Solvency II

The Solvency II ratio for MAPFRE Group stood at 183.8 percent at June 2020, compared to 186.8 percent at the close of December 2019. Despite the sharp fall in stock markets and the volatility in general in financial investments, the ratio maintained great solidity and stability, backed by high levels of diversification and strict investment and ALM policies.

- High quality capital base: 86% of eligible own funds are Tier 1.

- Fully loaded Solvency II ratio: 170.6% (excluding impact of transitional measures on technical provisions and equity).

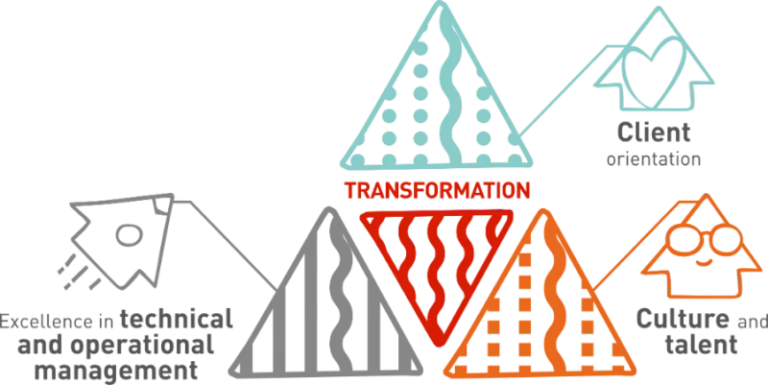

Strategic Plan 2019-2021

Client orientation

Excellence in technical and operational management

Culture and talent

Relevant events

Standard & Poor’s maintains MAPFRE’s rating with a stable outlook

MAPFRE AM Good Governance tops its category

MAPFRE launches CUPÓN ACTIVO, a new Unit Linked tied to the Eurostoxx Select Dividend 30 index

Fitch maintains MAPFRE’s insurer financial strength rating

MAPFRE’s Solvency II ratio stands at 184% at the close of the first half of the year

MAPFRE reinforces management teams in its principal markets

MAPFRE and Abante join forces with Macquarie to launch a 200-million-euro infrastructure fund

MAPFRE and Sudameris Bank join forces in Paraguay to promote their bancassurance business expansion

MAPFRE launches RENTA DIVIDENDO EUROPA, a new Unit Linked tied to the EuroStoxx 50

Santander and MAPFRE to jointly distribute Non-Life insurance in Portugal

MAPFRE AM and GSI launch a social impact fund with a first goal of 50 million to finance companies

Dividends and Shareholders

MAPFRE continues creating value for its shareholders

The MAPFRE S.A. Board, at its meeting held on October 30, agreed to pay an interim dividend against 2020 results of 0.05 euros gross per share. This dividend will be paid on December 22. With this payment, the Company will have dedicated a total of 416 million euros toward shareholders in 2020.

On June 25, the final dividend of 0.0858 euros gross per share was paid, after having proportionately applied the amount corresponding to treasury stock to the remaining shares.