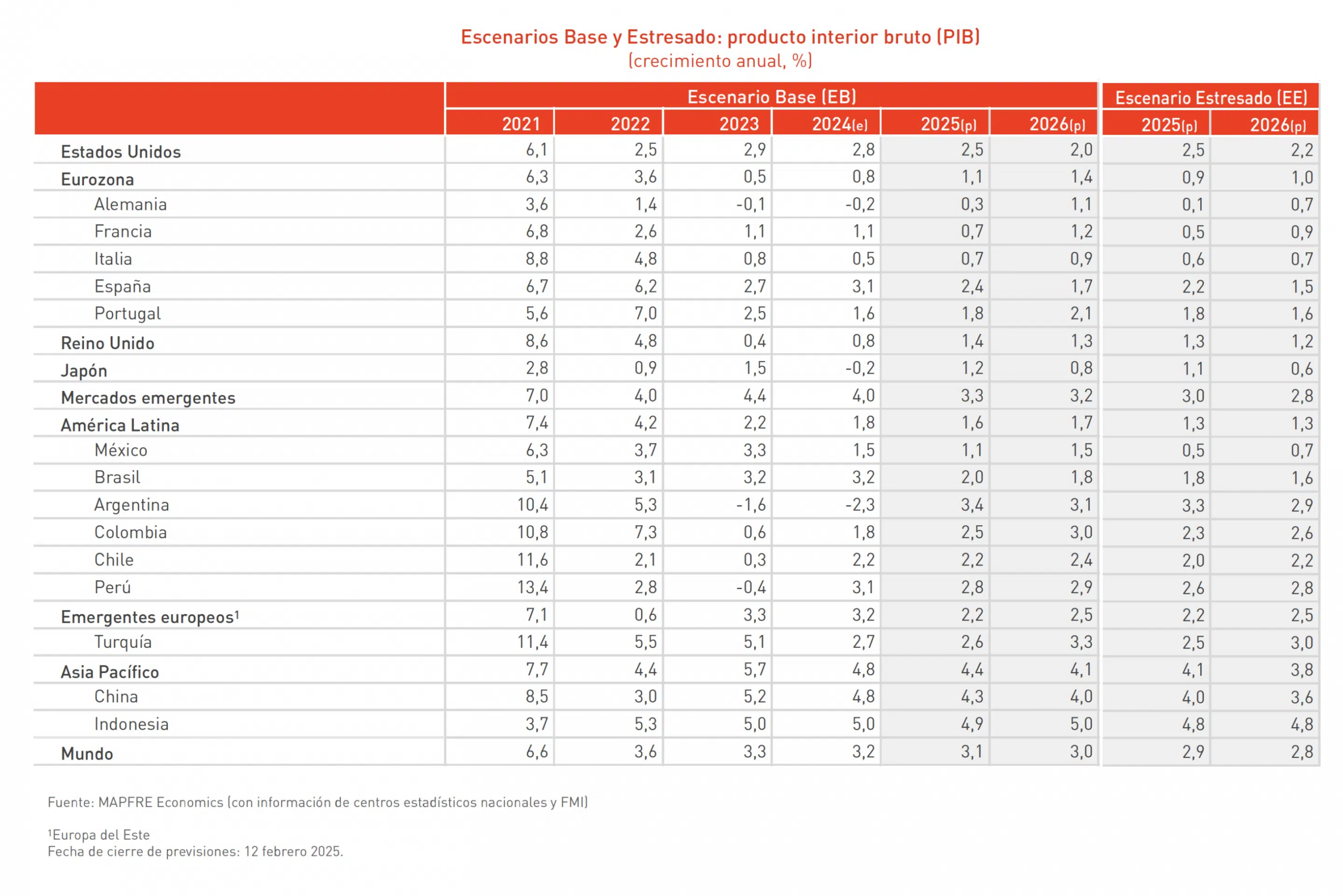

Mapfre Economics, Mapfre’s research arm, has once again raised its global growth forecast to 3.1% in 2025 (adding one-tenth of a percentage point) and 3% next year. These projections are outlined in the report Economic and Industry Outlook 2025, published by Fundación Mapfre. Inflation is expected to reach 3.5% in 2025 before easing to 3% in 2026.

The most likely scenario points to continued economic momentum, driven by positive expectations from late 2024, strong employment performance, real wage growth, lower interest rates, and a slightly more restrictive fiscal policy, which is still expected to remain in a net deficit.

For the United States, Mapfre Economics forecasts growth of 2.5% in 2025 and 2% next year. The U.S. economy is expected to continue to expand, supported by a stable labor market, strong consumer spending, and steady investment trends, despite trade tensions and geopolitical uncertainty.

The Eurozone is expected to continue its weak economic performance, largely shaped “by unresolved structural challenges and uncertain trade conditions.” As a result, Mapfre Economics forecasts EU GDP growth of 1.1% in 2025 and 1.4% in 2026, with inflation at 2.3% in 2025 and 1.7% in 2026.

In emerging economies, the research arm forecasts moderate growth, with GDP expected to rise by 3.3% in 2025 and 3.2% in 2026. Inflation in these markets is projected to reach 4.5% in 2025 and 3.8% in 2026. Meanwhile, the Asia-Pacific region should grow by 4.4% this year and 4.1% next year, with inflation at 0.9% in 2025 and 1.4% in 2026. China is projected to grow by 4.3% in 2025 and 4.0% in 2026, demonstrating resilience despite weakness in the real estate sector and uncertainty over the impact of U.S. tariffs. Inflation is expected to remain low, ending 2025 at 0.7% and 2026 at 1.3%.

Latin America is projected to grow its GDP by 1.6% this year and 1.7% next year, with the region’s performance heavily influenced by its relationship with the United States, which could heighten its overall vulnerability. Mapfre Economics projects a mixed but positive economic performance, with average inflation across Latin American countries reaching 8.6% in 2025 and 8% in 2026.

Impact on the insurance industry

Easier financing conditions, moderating inflation, and a recovery in credit across most major economies are expected to boost overall economic activity and, in particular, drive growth in the insurance industry.

Despite ongoing geopolitical uncertainty, economic expansion and favorable interest rates should support the global development of the insurance industry across both Life and Non-Life segments. Additionally, improved financial performance in investment portfolios is expected to enhance profitability prospects. In the Eurozone, however, growth is likely to be more subdued, with weakness in some of the region’s larger economies offsetting gains in peripheral countries, particularly Spain.