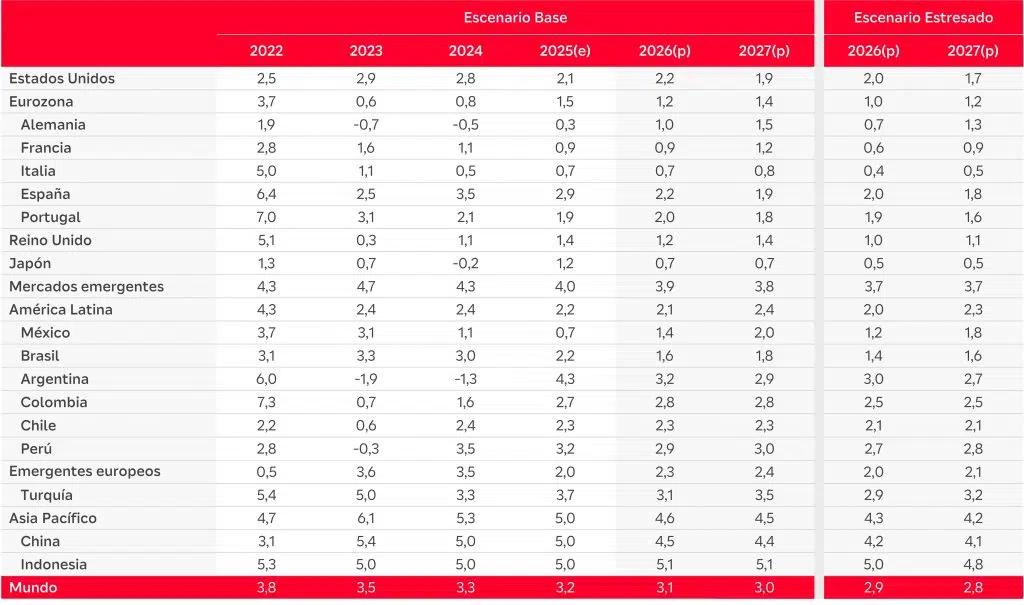

The growth of the global economy will be 3.1% in 2026 and 3% in 2027, according to the report ‘Economic and Sectoral Outlook 2026,’ prepared by Mapfre Economics and published by Fundación Mapfre, featuring forecasts for selected economies and for the insurance industry.

“The year 2026 is shaping up as a period of fragile transition toward the potential growth of the global economy. The environment will be characterized by moderate growth and persistent disinflation, under policies with limited room for maneuver,” Mapfre Economics notes in the report, which highlights geopolitics as a central axis reshaping the economic cycle and redefining the reaction functions of monetary and fiscal policy.

The United States is expected to grow by 2.2% this year and 1.9% next year, although Mapfre Economics highlights the deterioration of its fiscal trajectory and its potential impact on the cost of financing as a risk for the economy in the short term. The Eurozone will also grow, although at a more moderate pace: 1.2% in 2026 and 1.4% in 2027.

Latin America will tend to balance its economic growth with disinflation, with an improvement in its GDP of 2.1% this year and 2.4% next year, while Asia Pacific will grow by 4.6% and 4.5%, respectively. In the case of China, growth will be 4.5% in 2026 and 4.4% in 2027.

Impact on the insurance industry

Mapfre Economics indicates in the report that the period 2026–2027 consolidates a moderate, sustainable, and less volatile growth scenario for insurance demand. The Non-Life segment will be supported by robust exposure and the stabilization of claims costs, while the Life segment will capitalize on the interest-rate environment and improving real incomes.

“This outlook confirms the ability of the insurance market to expand at a solid pace, supported by macroeconomic and financial stability,” it emphasizes.

Accordingly, the balanced trajectory observed in 2025 is expected to be maintained, with premium growth of 6.1% in the Life insurance segment and 5.4% in Non-Life. For 2027, forecasts place growth in the Life segment at 6.2% and in Non-Life at 5.3%.

You can access the full report here.