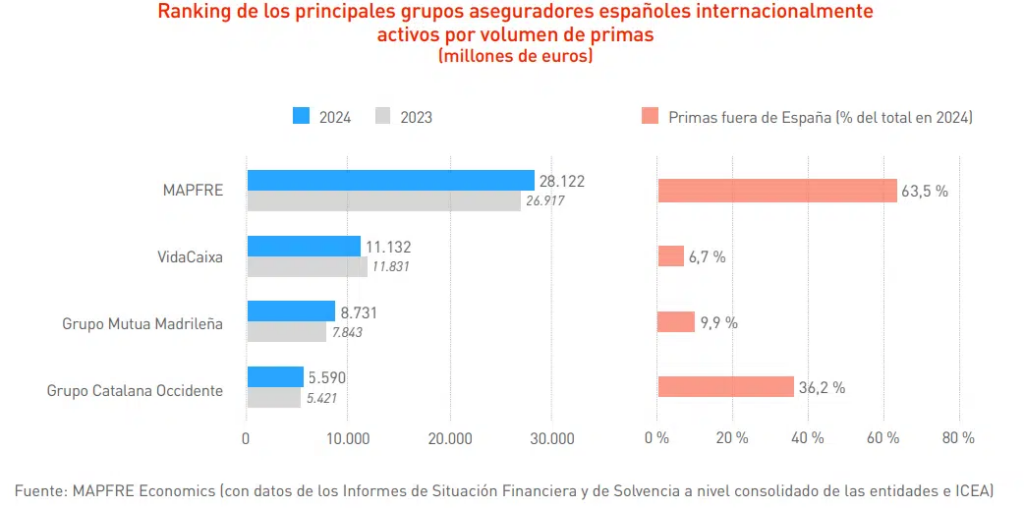

The Mapfre Group has consolidated its position as the largest Spanish insurance company worldwide, with premiums reaching 28.1 billion euros in 2024, 4.5% more than the previous year. These numbers reflect the good performance of Latin America and reinsurance, in addition to Spain, as revealed in Mapfre Economics’ latest report. Premiums from outside of Spain accounted for 63.5% of Mapfre’s total insurance revenue, reflecting a diversification of international business much higher than that shown by the other companies leading the ranking.

In the Spanish insurance industry as a whole, premiums fell by 1.6% in 2024, with a disparate performance by line of business. The Life insurance business fell by 13.7%, dragged down mainly by the 17% decline in Life-Savings insurance. This segment enjoyed a very good year in 2023, when it grew by 36% in total Life and 46.3% in Life-Savings, thanks to high interest rates and the rapid take-up of guaranteed profitability products. In 2024 more intense competition and European Central Bank interest rate cuts combined to weaken demand.

In Non-Life, premiums rose 7.8%, with all the main lines showing positive performance, driven by growth in the Spanish economy. The Homeowners segment stands out, with growth of 9.6%, as does the Motor business, which, although it was up 8.9% in premium volume, continues to suffer certain profitability problems.

The decline in Life insurance premiums caused insurance penetration (the relationship between premiums and the country’s GDP) to fall to 4.72%, 0.37 percentage points lower than in 2023.

In terms of profitability, the Spanish insurance industry performed well in 2024, with an increase in aggregate earnings of 16.5% to just under 6.4 billion euros and, with the latest data available to May, this year’s premium figures are positive, with Life business volume up by 16.5% year-on-year and Non-Life up by 8.3%. Mapfre Economics expects the insurance industry to close 2025 with a 12% increase in Life premiums and Non-Life premiums 6.3% better.

Spaniards spend an average of 1,531 euros on insurance

Premiums per capita, known as insurance density, were 1,531.2 euros in 2024, down by 39.2 euros on the previous year. By business line, the average expenditure on Non-Life insurance was 944.4 euros, while in Life it stood at 586.7 euros, of which 479 euros corresponded to Life-Savings. Insurance depth (the weight of Life premiums compared to the total) in Spain was 38.3%, which is still lower than that of other developed markets.

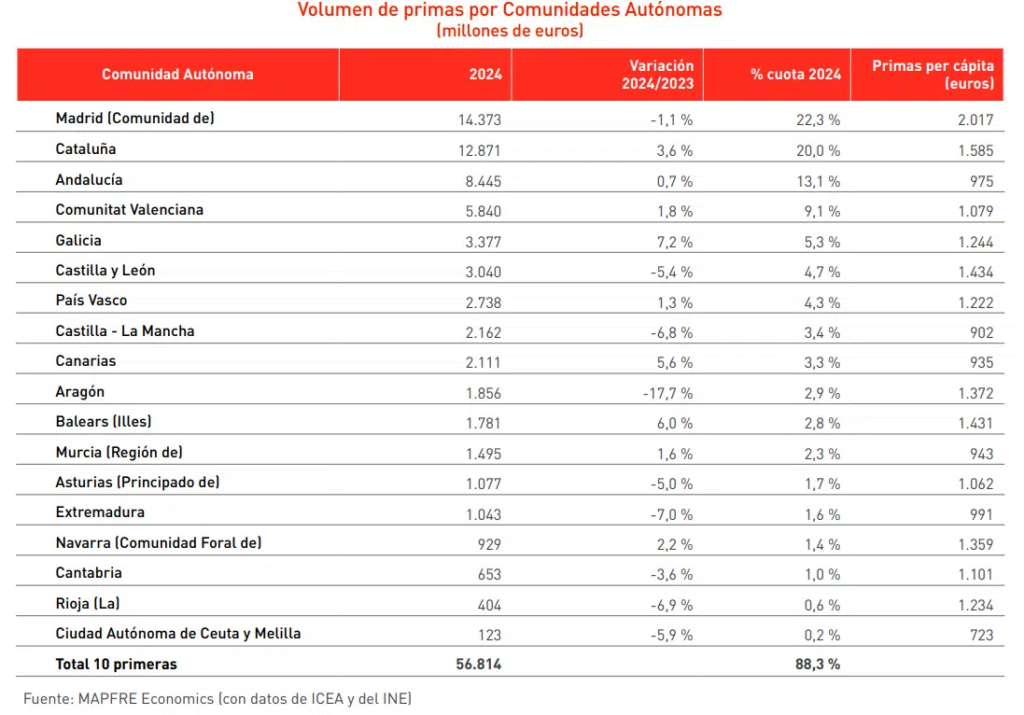

By Autonomous Community, the best insurance growth was seen in Galicia, up 7.2%, the Balearic Islands, up 6%, the Canary Islands, up 5.6%, and Catalonia, up 3.6%. The poorest performing regions in terms of year-on-year growth were Aragon (-17.7%), Extremadura (-7.0%), La Rioja (-6.9%) and Castilla-La Mancha (-6.8%). Madrid, Catalonia, Andalusia and the Community of Valencia account for the largest share of the insurance market, with 22.3%, 20%, 13.1% and 9.1%, respectively.

Madrid continued to register the highest spend per inhabitant on insurance, at 2,017 euros, followed by Catalans (1,585 euros per capita), residents of Castile and León (1,434 euros per capita) and the Balearic Islands (1,431 euros per capita).