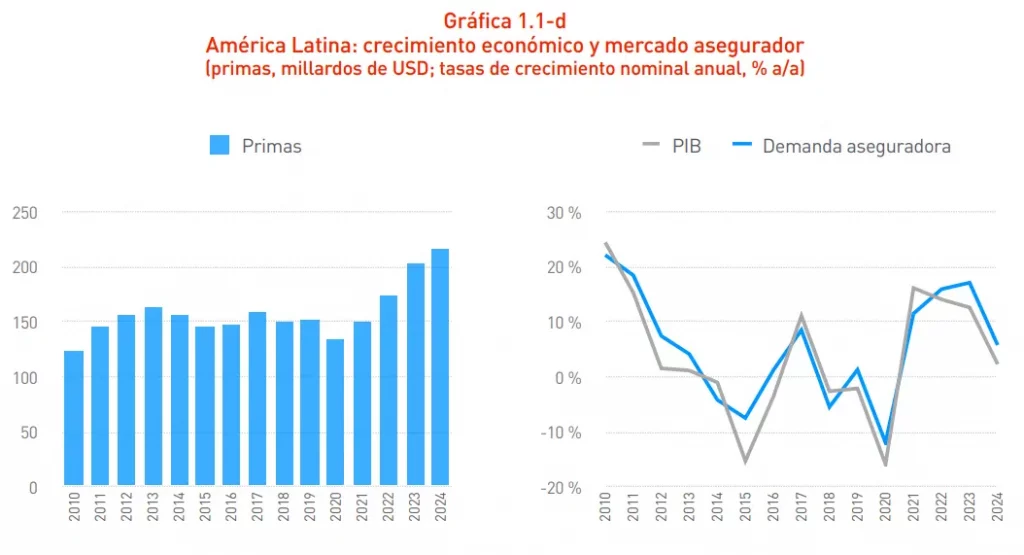

The Latin American insurance market expanded by 5.8% in 2024, reaching $215.1 billion (approximately €186.75 billion at current exchange rates), according to the latest report from Mapfre Economics, Mapfre’s research arm. Insurance premiums showed a moderation of the previous year’s upward trend, following a sharp rebound of 17.1% in 2023.

Among the factors behind this smaller increase in insurance activity in Latin America, where Mapfre remains the largest multinational insurance group, were the base effect (given that 2023 saw significant tariff updates due to inflation), weaker economic performance in key markets like Brazil and Mexico (which affected insurance demand, especially in the Non-Life segment), and exchange rate movements that hurt Latin American currencies in 2024, reducing the dollar value of premiums.

Still, Mapfre Economics described the result as “healthy growth despite a complex environment with limited economic expansion,” noting that growth in local currency terms significantly outpaced inflation. In real terms (local currencies, adjusted for inflation), the countries showing the strongest insurance sector growth were Uruguay (+25.8%), the Dominican Republic (+13.6%), and Mexico (+11.2%). The exception was Argentina, the only country where premiums fell in real terms (-13.1%).

By segment, Life insurance was the main driver of regional growth, increasing by 8.7% in dollar terms. This line of business benefited once again from a favorable, albeit more complex, environment for the development of savings and annuity products, with generally less restrictive interest rates that remained well above inflation, which was more contained than in prior years.

Within the Non-Life segment, the most dynamic lines were Personal Accident insurance, up 8.9%, and Health insurance, up 8.4%. Auto insurance, the largest line by market share (17.3%), grew by a more modest 2.6%, in line with the region’s sluggish economic growth. Fire and allied lines insurance posted a slightly higher increase of 4.1%.

In terms of profitability, the sector’s earnings reached $14.46 billion in 2024, a 7.4% decline from the previous year. Mapfre Economics noted, however, that 2023 had been an “exceptional year,” and that current profitability remains above pre-pandemic levels. Mexico, Colombia, and Peru recorded higher profits than the year before, while Brazil and Chile saw lower results compared to 2023.

Structural trends of the sector

The insurance penetration rate (premiums as a percentage of GDP) reached 3.2% in 2024, up 0.1 percentage points from the previous year. This indicator, which measures the sector’s weight within the broader economy, is particularly high in Puerto Rico (18.2%) because it includes government-funded health insurance for low-income residents. Following Puerto Rico, Chile (4.6%), Uruguay (3.6%), Brazil (3.3%), and Colombia (3.3%) showed the highest levels of insurance penetration.

Insurance density (per capita premiums) in Latin America stood at $340.70 (about €296) in 2024, up 5% from 2023. Most of this average insurance spending remains concentrated in Non-Life products, with $192.60 per capita.

Finally, Mapfre Economics updated its 2024 estimate of the Insurance Protection Gap (IPG), the difference between existing insurance coverage and the amount that would be economically necessary and socially beneficial, to $315.95 billion, 4.2% higher than in the previous year’s estimate. Life insurance accounted for 60.2% of the IPG, a smaller share than in more developed economies. As a result, the total potential insurance market in Latin America reached an estimated $531.1 billion (around €461 billion), about 2.5 times the current market size.

You can access the full report here.