Mapfre Economics, Mapfre’s research arm, has updated in its latest report the Global Insurance Potential Index, an indicator that measures countries’ capacity to reduce the Insurance Protection Gap (IPG)—defined as the difference between actual protection needs and the volume effectively insured.

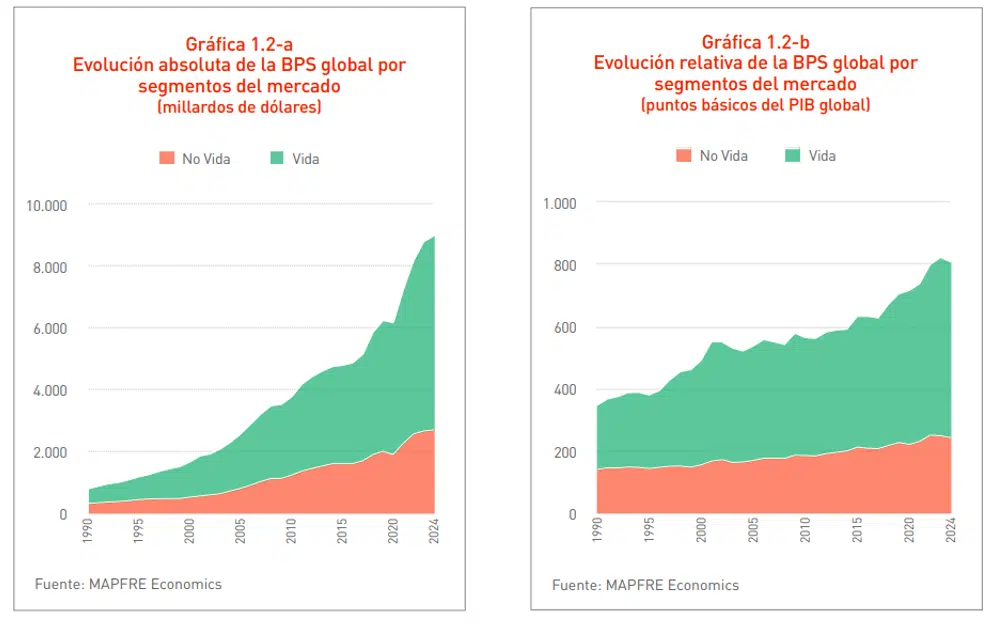

In 2024, the global insurance protection gap reached 9 trillion dollars, or 7.8 trillion euros at current exchange rates, up 2.1% from the previous year despite the continued expansion of insurance activity. This difference between actual coverage and the level considered socially and economically desirable represents 8.1% of global GDP.

Emerging economies account for 78.5% of the global IPG, underscoring their lower levels of insurance protection relative to developed markets, but also the significant growth potential for the insurance sector in these regions, according to Mapfre Economics. BRICS economies represent 40.4% of the global gap, while other emerging markets account for 38.1%.

By insurance segment, at year-end 2024, 69.9% of the global protection gap originated in the Life segment, compared with 30.1% in Non-Life.

A broader perspective reveals a structural trend toward a larger protection shortfall in Life than in Non-Life: in 1990, Life insurance accounted for 59.4% of the global protection gap and Non-Life for 40.6%, a difference of 10.5 percentage points in favor of Life.

When segments and regions are considered jointly, the historical pattern is mixed: in Life, the share of emerging markets in the global insurance gap declined from 78.9% in 1990 to 73.8% in 2024. In Non-Life, the trend moved in the opposite direction, rising from 85.4% to 89.4% over the same period. “This dynamic reflects greater consolidation of personal insurance coverage in developed economies, while property insurance continues to show a strong concentration in developing countries,” explains Manuel Aguilera, General Manager of Mapfre Economics.

Countries with the greatest insurance potential

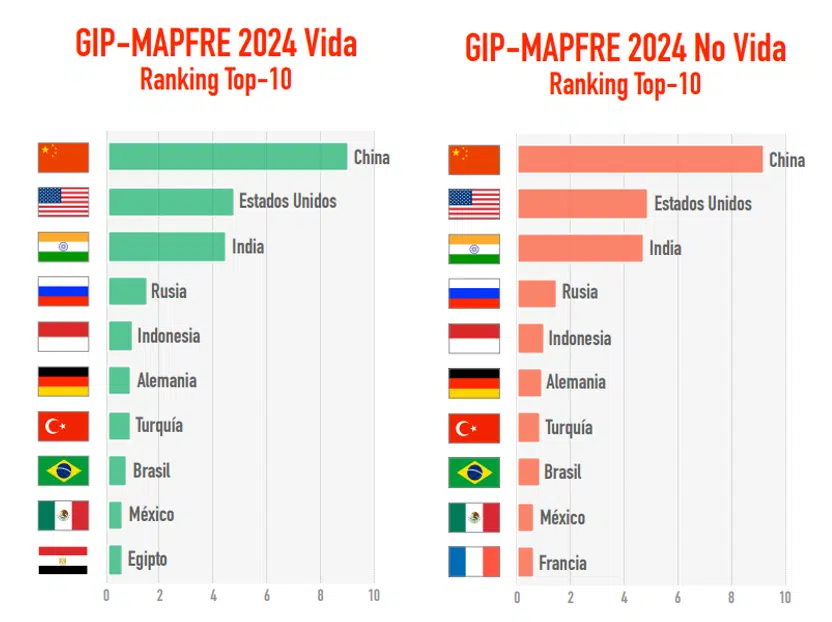

Mapfre Economics calculates the Global Insurance Potential Index (Mapfre-GIP) for 96 insurance markets. The index incorporates variables such as insurance penetration (premiums/GDP), the size of the economy and population, and the magnitude of each market’s insurance protection gap. The index provides a score that ranks each market according to its capacity to close the global insurance gap. Once again, China is the country with the greatest insurance potential, followed by the United States and India—both in the Life and Non-Life segments (in Non-Life, the United States moves ahead of India into second place).

Beyond this ranking, the Mapfre Economics report highlights economies that, while not occupying top positions today, have the size and growth dynamics to move into more prominent positions in the future. These include Egypt, Iran, Pakistan, Turkey, Nigeria, and Bangladesh.

Commenting on the roadmap for closing protection gaps, Manuel Aguilera, General Manager of Mapfre Economics, noted: “In developed markets, the maturity of the insurance sector limits the scope for further expansion, making it necessary to innovate in products and distribution channels to sustain growth. In emerging markets, the priority is to reduce the protection gap through public policies that promote financial inclusion, digitalization, and institutional strengthening.”