You are in:

- Start

- Interviews

- Arturo Semerari: President of ISMEA. The Italian Institute for Services to the Agricultural and Food Markets. Rome - Italy

Arturo Semerari: President of ISMEA. The Italian Institute for Services to the Agricultural and Food Markets. Rome - ItalyAGRÍCULTURAL

Arturo Semerari was born on 21 October 1959 in Taranto, in the Puglia region of southeast Italy. Coming from a farmers’ family, he had been concerned about the ups and downs of the agricultural sector from an early age. He graduated in Agricultural Engineering from the University of Padua, specialising in Agricultural Economics at the University of Milan. He held several posts in both the public and private sectors, in this case in the consultancy sector, before becoming President of ISMEA in 2002.

“Europe is the world’s biggest importer of agricultural products, surpassing even the United States”“It is important that money for agriculture should not be subsidising speculative activities, and one way of doing this is through agricultural insurance”. This is the view of the President of ISMEA1 who in this interview, tells us about the Italian system for protecting agricultural income and gives us an overview of the trends emerging in this field in the European Union.

Where are we right now in Europe as regards

agricultural insurance?

We are working on reforming the Common

Agricultural Policy, the CAP. This means that we

have to know what systems exist in the various

European countries, because right now, besides

having national laws, it is important that we

achieve a consensus for Europe and common

legislation for all the countries.

How far can we compare what Europe is

doing in relation to the movement of agricultural

products with other countries or areas

of the world?

Generally speaking, you have protectionist countries

like Japan, Switzerland and Norway. In the

European Union we also have a reputation for

protectionism, but in fact, this is not true. Europe

is the world’s biggest importer of agricultural

products, surpassing even the United States.

We import from Africa and Latin America with

the prices differential. However, the products involved

are not controlled in their countries of origin but by the multinationals, so ultimately, they

are the ones benefiting most from the business.

In Italy, land is very expensive because we have very little space and a large population. With these determining factors, farming is not noted for its profitability

What proportion of Italy’s gross domestic product

–GDP– does Italian agriculture make up?

Around 2%. But the food sector accounts for

16% of GDP and after engineering, it is the

second largest industrial sector.

Are agricultural multinationals interested in

investing in this field?

Not in Italy. One of the problems is that farmlands are being abandoned. In Italy, plots of

land are very expensive because we have very

little space and a large population – bigger

than Spain’s. We have many hills and mountains,

areas where nothing can be grown. With

these determining factors and the price of land,

farming is not noted for its profitability.

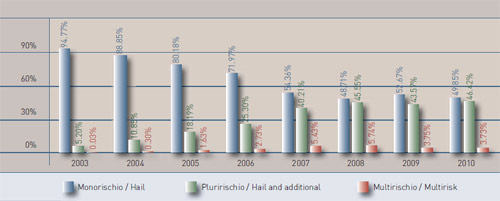

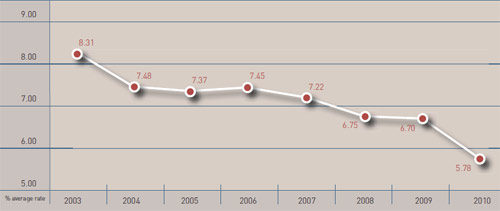

Subsidised agricultural insurance. Evolution of the market share by type of insurance product

| 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

|---|---|---|---|---|---|---|---|

| Rural multirisk policies included | |||||||

| 3,333,901 | 3,710,212 | 3,810,222 | 3,789,132 | 4,379,809 | 5,436,140 | 5,131,045 | 5,312,829 |

Subsidised agricultural insurance. Average market rate (crops)

Third presidential term with ISMEA

How did you get into insurance? And how did

you become the President of ISMEA?

Before the year 2000, ISMEA had embarked on

a series of reforms. The then Minister, who is

now Chairman of the European Commission

on Agriculture, appointed a Commissioner to

unite the various institutions that were to shape

the new ISMEA. Through my knowledge as a farmer, I could see that the Italian agricultural

insurance system was not good – it was inefficient.

In 1998 I worked as a consultant to the

Ministry of Public Administration, which was in

charge of several economic reforms, including

agrarian reform. I was the one responsible for

drafting the report on the reform of ISMEA, in

which I included the reasons for having agricultural

insurance and also the need to reform

credit. One consequence of all this was that I

was appointed President of ISMEA in 2002, a

position that I have held ever since. I am now

its President again for the third and final time.

What were ISMEA’s functions before and after

the reform?

Before the reform, ISMEA was an institution

devoted to performing studies for the Ministry

of Agriculture on agricultural, market, development

and shopping-basket issues amongst other things. After the reform, it began working

on agricultural insurance and credit. In the

insurance field, it acts as a public reinsurer in

Italy. It carries out studies for the Ministry and

defines the performance parameters, statistics

and various forms of insurance. In the credit

field it manages two guarantee funds, one for

banks working in the agricultural sector and

another for peasants and farmers wanting

guarantees.

ISMEA was an institution devoted to performing studies for the Ministry of Agriculture on agricultural and market issues. After the reform, it began working on agricultural insurance and credit

Are there any other functions besides these?

Yes, we manage a purchasing fund. We pay for

farms and then, the farmers make repayments

over a period of fifteen to thirty years.

Is the Common Agricultural Policy, the CAP,

well orchestrated in Europe?

The situation in Europe has been complicated

for many years. Apart from Spain, Italy or

France, politicians do not consider agriculture

to be economically useful for Europe, and this

is a problem, because we have a very powerful

agriculture, which also keeps people in rural

areas. It is a strategic sector, because agricultural

development provides raw materials,

something Europe has too little of to meet demand.

The reform we now have is not the right

one for Europe. After 2013, it may be possible to

carry out major reforms with a different vision.

Now is the time to consolidate the agricultural

budget beyond 2013. It is very important that

we should work for farmers who create business,

not for ones who speculate and have

no farms. How do we do that? With insurance

that protects farmers’ incomes and ensures

certain conditions for carrying out the activity.

The problem in Italy and Spain and elsewhere

is that farmers face many difficulties when

seeking finance from banks which do not understand

their working conditions and the risks

involved in their activity.

The problem in Italy and Spain is that farmers face many difficulties when seeking finance from banks which do not understand their working conditions and the risks involved in their activity

Even so, France has major financial institutions

linked to the agricultural sector, and

Spain has its rural savings banks.

Yes, that helps. France has Crédit Agricole,

and in Italy there are also some organisations

that support farmers, like the ones in

Spain.

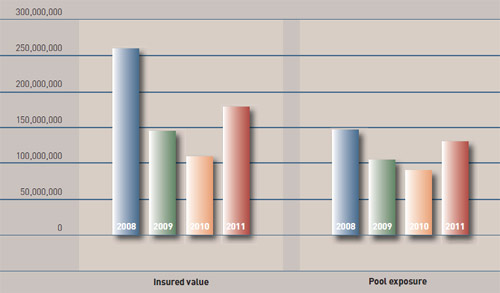

ISMEA Pool. Situation as at 30/09/2011 and comparative. Figures in EUR

| Year | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|

| Capacity | 207,300,000 | 197,300,000 | 185,000,000 | 168,500,000 |

| Insured value | 263,797,398 | 147,186,907 | 113,713,321 | 183,534,526 |

| Pool exposure | 149,441,455 | 108,040,274 | 93,672,869 | 134,681,254 |

A fringe benefit

Do Italian farmers value the benefits of

ISMEA’s work? Or do they demand more?

We do work for farmers’ benefits, but we do

not do so directly, because we work through

insurance companies and banks. We are

reinsurers and we offer guarantees to banks.

ISMEA’s work is known and recognised by

farmers, and in fact, we have granted many

guarantees in respect of loans to farmers – to

the tune of over 10 billion euros.

In Italy, is there any pool of insurers that

makes use of your financing and protection

capacity as a reinsurer?

Not in Italy. Insurance pools are prohibited as

they are understood in Spain. There is only one

insurance pool, or rather, a reinsurance pool,

which is of both a public (represented by ISMEA)

and private nature. It is licensed by the competition

supervisory authority and works with nine

types of insurance.

Could you explain a little more how it works?

Our pool is the reinsurer for agricultural insurances.

In 2004 it began working with ISMEA’s

insurance fund, and in 2008 that fund began

working with private insurers who know the

market. All this led to a new type of insurance,

tailored to the needs of the target groups – that

is to say, farmers. The first two years’ results

were not good. There were many losses due to

weather problems. 2009 and 2010 were not good

years either, due to the problem with financing

the solidarity fund. The premium subsidy budget

suffered permanent delays due to the impact of

the crisis. 2011 is about to be closed.

It is important that money for agriculture should not subsidise other –sometimes speculative– activities, and one way of achieving this is through agricultural insurance

Does ISMEA have any environmental protection

aspect, given that European subsidies are

pointing in that direction?

Not for the time being, although the trend in

Europe is indeed to support environmental protection.

It is important that money for agriculture

should not subsidise other –sometimes

speculative– activities, and one way of achieving

this is through agricultural insurance. The

role that farmers play is very important for a

sustainable environment. But we must help

farmers to work on farms and, indirectly, on the

environment. Even so, the tendency is to think

only about the environment, without appreciating

the role of the farmer.

How often do you have to deal with catastrophic

events, and which ones are most frequent?

Disasters happen every year. The effects of climate

change are huge. Hail, ice and rain are

the ones that affect us most.

How do you see Spain as far as agricultural

insurance is concerned?

Agroseguro is a fantastic system for covering

agricultural risks but, due to the nature of our

legislation, it is not possible to work that way

in Italy.

ISMEA

The Italian Institute for Services to the Agricultural

and Food Markets, ISMEA, is a

public body created when the Institute for

Studies, Research and Information on the

Agricultural Market2 was merged with the

Fund for the Promotion of Peasant Property3,

under the Legislative Decree of 29

October 1999.

The Italian Institute for Services to the Agricultural

and Food Markets, ISMEA, is a

public body created when the Institute for

Studies, Research and Information on the

Agricultural Market2 was merged with the

Fund for the Promotion of Peasant Property3,

under the Legislative Decree of 29

October 1999.

Through the companies that it controls, ISMEA offers information and research services and provides insurance and financial capacity, as well as guarantees, to agricultural enterprises. It also facilitates their relations with the insurance and banking sector, promoting competitiveness and reducing the risks inherent in their production and market activities.

ISMEA supports the consolidation of regions and their land through the expansion of farmland ownership and generational renewal in agriculture, based on specific aid approved by the European Commission.

(1) Istituto di Servizi per il Mercato Agricolo Alimentare.

(2) Istituto per Studi, Ricerche e Informazioni sul Mercato Agricolo.

(3) Cassa per la Formazione della Proprietà Contadina.

Farming land close to the city of Asis. Italy

Farming land close to the city of Asis. Italy Vineyards at Piedmont Region. Italy

Vineyards at Piedmont Region. Italy